Get Ed Crooks' Energy Pulse in your inbox every week

The spread of the coronavirus shakes the world

As the COVID-19 virus spreads to 52 countries, fears of its economic impact have sent stock markets and oil prices tumbling

10 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Rising electricity demand in Texas: the canary in the coalmine for the rest of the US?

-

Opinion

Deals show the enduring appeal of US gas

-

Opinion

2024 is a year of elections. What will they mean for clean energy?

-

Opinion

Home energy storage booms in the US

-

Opinion

China’s solar growth sends module prices plummeting

-

Opinion

Everyone is worrying about rising demand for electricity. Do Microsoft and Google have an answer?

A week ago, the World Health Organisation reported that there had been about 77,000 cases of COVID-19, the disease caused by the new coronavirus, in 27 countries. On February 28, the WHO said the number of cases was up to 83,650, in 52 countries. There are encouraging signs that in China the virus is being brought under control, but it is spreading around the world. Tedros Ghebreyesus, head of the WHO, has said the outbreak is at a “decisive point”.

The rapid spread of COVID-19 beyond China has contributed to escalating alarm about its impact on the world economy. China has issued a record number of force majeure exemptions, allowing exporters to breach supply obligations, and the effects are rippling out to other countries, particularly in Asia. Stock markets have fallen sharply this week, as Goldman Sachs warned that it expected no earnings growth from US companies.

Oil and other commodity markets have also been hit. Brent crude has dropped about 15% over the past week, and was trading below $51 per barrel on Friday morning, while West Texas Intermediate was about $45. Expectations of oil demand in 2020 are being revised sharply lower.

Even very serious global disease outbreaks, such as the global influenza pandemic of 1918-19, have proved to have only a temporary economic impact, and so far there are no compelling reasons to expect COVID-19 to be any different. There is, however, significant uncertainty about how quickly it can be brought under control. Already the impact on oil demand in China and around the world now looks likely to be significantly larger than initial estimates had suggested. The global outlook for demand now depends on the severity of the measures other nations have to take to bring the virus under control.

One key issue for the market is the outcome of the meetings of OPEC and its allies in the OPEC+ group, scheduled for next week, March 5-6, in Vienna. The Financial Times reported that Saudi Arabia was going to push for the OPEC+ group to agree an additional cut in production totaling 1 million barrels per day. That is significantly more than the 600,000 b/d reduction recommended by a technical meeting of officials earlier in the month, when the coronavirus was still largely confined to China.

Ann-Louise Hittle, Wood Mackenzie’s head of macro oils, said the pressure on OPEC+ countries’ revenues from low prices should encourage them to reach an agreement, and additional reductions in supply would help stabilise the market. However, she added, that stability could be threated if the impact of COVID-19 continues well into the second quarter, hitting demand and impeding the expected recovery from the lows seen in February.

The last new oil sands mining project in Canada is scrapped

Disputes over the future of Canada’s oil and gas industry have become increasingly acrimonious in recent months, as environmental and Indigenous activists have blocked railways across the country to protest against the proposed Coastal GasLink pipeline in British Columbia.

Many in neighboring Alberta have blamed Justin Trudeau’s federal government for failing to do enough to support its oil and gas industry. A group of conservative politicians has launched the Buffalo Declaration, warning that “Canada is in crisis”, and calling for constitutional reform, greater autonomy for Alberta, and a better deal on the transfer payments that it contributes to other provinces.

The flames were fanned this week when Teck Resources, the Vancouver-based mining company, scrapped a plan for a new C$20 billion oil sands mine in Alberta. Don Lindsay, Teck’s chief executive, sent a letter to Canadian environment and climate minister Jonathan Wilkinson on Sunday, withdrawing the company’s Frontier project from the regulatory approval process, because the development had “no constructive path forward”. Lindsay argued that “investors and customers are increasingly looking for jurisdictions to have a framework in place that reconciles resource development and climate change,” and Canada lacked that framework. The federal cabinet had been expected to make a decision this week on whether to approve the project.

Lindsay added that Teck believed in the necessity of addressing the threat of climate change and was a strong supporter of the Trudeau government’s carbon tax, which is facing legal challenges that will be decided by Canada’s Supreme Court. Teck this month set a goal of carbon neutrality by 2050. However, Lindsay added: “The promise of Canada’s potential will not be realised until governments can reach agreement around how climate policy considerations will be addressed in the context of future responsible energy sector development.”

Jason Kenney, Alberta’s premier, described the project’s cancellation as “devastating news” for the Canadian economy, and for Albertans and indigenous people in particular. He blamed the decision on “federal regulatory uncertainty and the current lawless opposition to resource development”.

Wood Mackenzie analysts said Teck “did everything right” to try to win support for the Frontier project, including signing participation agreements with 14 First Nation and Metis communities. But even so, the federal government sat on the final approval for months.

There were other factors that influenced the decision, says Mark Oberstoetter, Wood Mackenzie’s director of Canadian upstream oil and gas. At a cost of C$20 billion, Frontier would have needed a Brent crude price of $84 per barrel to break even, an ambitious assumption at a time when the futures price for December 2024 is about $55. Wood Mackenzie had not built the production from Frontier into its forecasts. Future production growth in the oil sands can be expected come from steam-assisted gravity drainage projects and expansions to existing mines, not new greenfield developments like Frontier, which was the last such proposal still being worked on.

Even so, Wood Mackenzie analysts say, the impact of the succession of legal challenges, regulatory delays and environmental protests on oil and gas projects in Canada has been significant in raising costs and eroding returns. The industry’s response is “to move capital out of Canada to regions with less perceived risk.”

BP reviews its membership of industry groups

Following its announcement of its ambition to have “net zero” carbon emissions by 2050, BP is withdrawing from three US oil and gas industry groups: the American Fuel and Petrochemical Manufacturers, the Western Energy Alliance, and the Western States Petroleum Association. Bernard Looney, BP’s new chief executive, said the company had reviewed its membership of 30 key trade associations to see if they were aligned with its emissions and climate goals, and “if our views and those of an association cannot be reconciled then we will withdraw our membership.”

BP is keeping its membership of the American Petroleum Institute, at least for now. The report from its review noted that although the company still had some disagreements with the API, the group had taken “significant steps in 2019 to revise its climate position”. The report added: “The new position and corresponding climate policy principles have shifted a great deal and the association is now more closely aligned [with BP].”

Mike Sommers, the API’s president, told the Financial Times: “I'm confident that we're going to be able to continue to represent this industry, including Total, including BP, including Shell, including Equinor, for many, many years to come.” However, he acknowledged that there were some differences between the group’s position and some of its larger members in particular, over issues including federal regulation of methane leakage. ExxonMobil, along with some of the European oil majors, has expressed public support for methane regulations.

In brief

Rio Tinto, the mining group, has followed BP in setting an ambition to be a “net zero” emissions company by 2050. It has pledged $1 billion to be invested in climate-related projects, although Wood Mackenzie’s Julian Kettle pointed out that for a company of Rio’s size, a billion dollars is not an enormous amount.

The plan to build a third runway for London’s Heathrow airport has been rejected by the Court of Appeal for England and Wales, on the grounds that the UK government had not adequately taken into account the Paris agreement on climate change when it backed the expansion project in a National Policy Statement in 2018.

Wind power has overtaken hydro to become the most-used source of renewable electricity generation in the US, according to the government’s Energy Information Administration.

Drax, the largest power plant in the UK, will stop burning coal next year, four years ahead of the government’s deadline. It was once the largest coal-fired power plant in western Europe, but since 2013 it has been shifting to burning wood pellets.

Queensland has announced plans for a large-scale green hydrogen plant, in one of the heartlands of Australia’s coal and gas industries. The A$1.61 billion facility is intended to use electricity from renewable sources to produce hydrogen, with some available for export and some used to produce ammonia. The plant will be built in stages, ultimately reaching an electrolysis capacity of 3 gigawatts. A similar project is being studied in Western Australia

Meanwhile, the UK is about to start testing hydrogen-powered trains.

Los Angeles has confirmed it is placing the US’s largest ever single order for electric buses. It is buying 155, mostly from BYD. Meanwhile in Shenzhen, BYD’s home city, all 16,000 of the buses are electric.

Ride-hailing services such as Uber and Lyft that use gasoline or diesel vehicles appear to lead to increased greenhouse gas emissions, according to a study published by the Union of Concerned Scientists.

Vietnam is still planning to build more coal-fired power plants, but is thinking about scaling back its ambitions as solar energy becomes increasingly cost-effective.

France is working on a deep repository for nuclear waste that it expects will take about 150 years to fill. The project has been compared to the tombs of the Egyptian pharaohs.

And finally: the geology of the earth still holds plenty of phenomena that we still do not fully understand. But while we still haven’t fully explained our own planet, scientists are starting to uncover a whole new set of mysteries about the bizarre geology of Mars. A paper in Nature this week presenting some of the initial findings from the first ten months of the InSight lander on the surface of Mars has thrown up a series of intriguing puzzles, including “a local magnetic field that is ten-times stronger than orbital estimates”.

Other views

Simon Flowers — Have we passed ‘peak growth’ for tight oil?

Gavin Thompson — How the coronavirus highlights the perils of the US-China trade war

Romana Adamcikova — UK North Sea decommissioning: the £17 billion challenge

Ian King — Blockades hit blue-collar workers first. So much for sticking it to the powerful

Nick Butler — We need a world institution for climate and energy

John Kemp — Learning to live with coronavirus in our midst

Seaver Wang – How the fossil fuel industry could help drive decarbonisation

Quote of the week

“Over this coming decade, as the impacts of climate change bite harder and the calls for action grow louder, the credibility of this sector will be tested. To pass that test, the industry needs to show demonstrable, rapid change, now… In how it engages with the debate, yes, but – most of all – in what it does and the products it sells.” – Steve Holliday, a former Exxon executive and former CEO of National Grid, now president of the Energy Institute, speaking at the IP Week conference. He talked about his worry that ambitious goals and objectives for 2050 “tempts us into a mistaken belief that we can put off action until later”.

Chart of the week

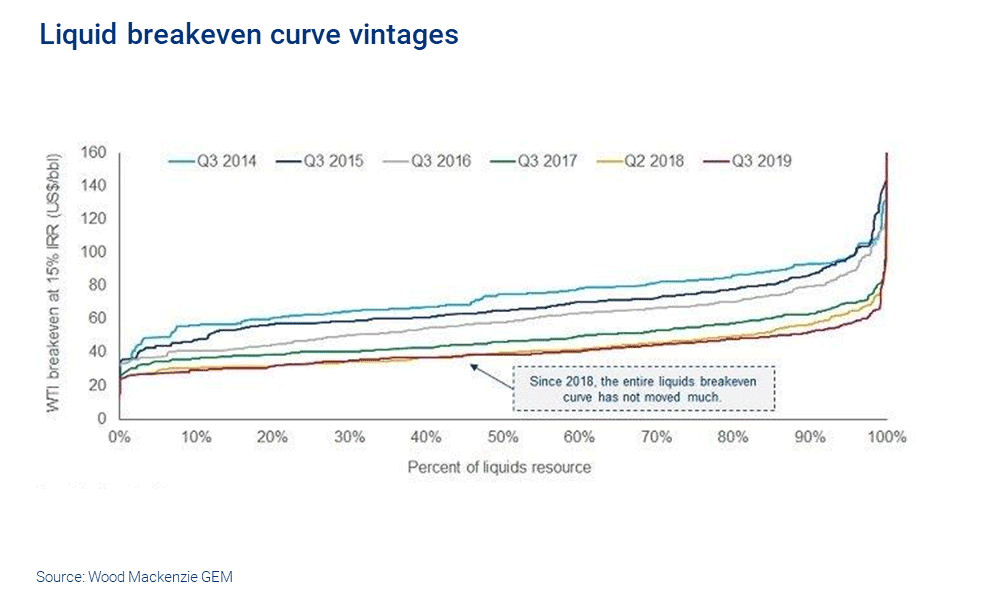

This chart, used in recent presentations by WoodMac analysts, is one of the most important images of the year. It shows a series of breakeven curves for US liquids onshore in the Lower 48 states, plotting the West Texas Intermediate crude prices needed for percentages of the total resource base to earn a 15% return. Since 2014, the curves have been steadily dropping each year, as productivity gains and reductions in development costs brought breakeven prices lower. But by the second half of last year, however, that steady reduction had stalled: the economics of US tight oil stopped improving. Without further savings, it will be difficult for the cost curve to fall further, says Wood Mackenzie’s Ben Shattuck.

How to get Energy Pulse

Energy Pulse is Ed Crooks' weekly column, published by Wood Mackenzie every Friday. Here's how to get Energy Pulse:

- Follow us on social media @WoodMackenzie on Twitter or Wood Mackenzie on LinkedIn

- Fill in the form at the top of this page and we'll send you an email when the latest issue goes live

- Bookmark this page to have access to the full archive of Energy Pulse