Will Shell exit Pulau Bukom?

The firm is undertaking a strategic review of its weakest integrated refinery-petrochemical site

2 minute read

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

Opinion

Oil and refined products in 2025: a commodity trader’s guide

-

Opinion

Global refinery closure outlook to 2035

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

Opinion

International Energy Week 2025: our key takeaways for oil & gas

-

Opinion

7 questions about Trump tariffs and their impact on the North American oil market answered

-

Featured

Oils & chemicals 2025 outlook

Darryl Xu

Principal Analyst, APAC Chemicals

Darryl Xu

Principal Analyst, APAC Chemicals

Darryl specialises in aromatics, and manages our global paraxylene and benzene/styrene research in Asia.

Latest articles by Darryl

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

-

Opinion

Will Shell exit Pulau Bukom?

-

Opinion

Plastic circularity: how much will recycled plastics displace oil-based feedstock?

-

Opinion

Petrochemical feedstocks: three global trends to watch

Jason Anderson Raj

Principal Consultant, EMEA Chemicals Consulting

Jason Anderson Raj

Principal Consultant, EMEA Chemicals Consulting

Jason is currently responsible for Asia and Middle East market and the development of the EO/EG Asset Benchmarking Tool.

Latest articles by Jason

View Jason Anderson Raj's full profileAs the energy transition accelerates over the next decade, oil demand growth is expected to falter. In a more competitive, less profitable refining market, refiners need to high grade their portfolios to enhance both their margins and their overall carbon competitiveness. This will inevitably involve exiting assets that are competitively weak, high emissions or both.

Our analysis indicates that Shell’s Pulau Bukom refinery-petrochemical site in Singapore is a prime candidate for such a strategic review. In our report Shell to exit Pulau Bukom? We explore the likely fate of the facility, using data and insight from Wood Mackenzie’s proprietary PetroPlan simulation and Refinery Evaluation Model for Chemicals (REM-Chems). Read on for a summary of our view and fill in the form to download a complimentary copy of the report.

Why Shell may decide to sell?

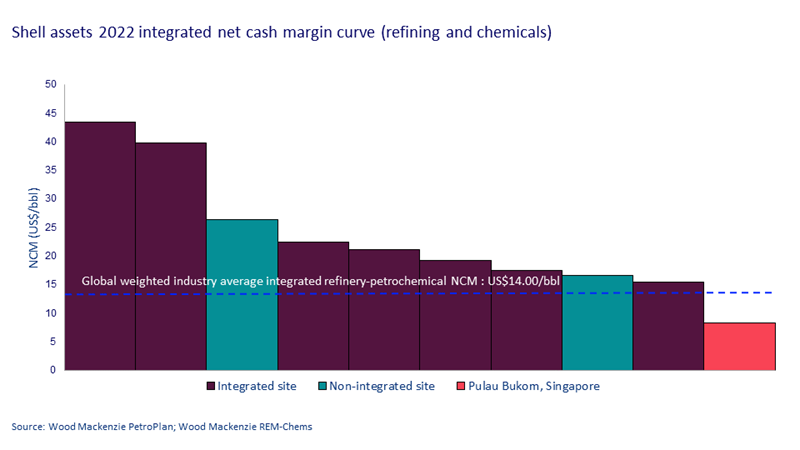

Analysis of Shell’s net cash margin (NCM) profile shows that Pulau Bukom is by far the weakest integrated refinery-petrochemical site in Shell’s portfolio. NCM for the facility was less than US$10 per barrel in 2022, against a global weighted industry average of US$14 per barrel (see chart below).

This is a structural position, with the facility performing poorly despite 2022 being a strong year for refining. As you can see, Shell’s other integrated refinery-petrochemical assets all exceed industry average margins – some by a considerable amount (the firm’s best performing integrated site returned an NCM of over US$40 per barrel in 2022). The chemical assets occupy a middle of the road competitive position.

To make matters worse, carbon taxes in Singapore are projected to increase substantially in the coming years, which will have a further detrimental impact on the site’s profitability. Shell have already cut crude distillation unit (CDU) capacity at the site and reconfigured the refinery to increase its chemicals yield– this has reduced the site’s carbon emissions by 45% compared to a 2018 pre-pandemic baseline.

Further optimisation is possible, such as shifting yields further towards specialty chemicals and developing solar power capabilities to increase its consumption of renewables. These could enable the site to hit its 50% carbon emissions reduction target by 2030 and limit the tax burden as carbon prices rise.

Why there may be strong buyer interest?

If Shell decides Pulau Bukom no longer fits with its portfolio, we expect there to be plenty of potential buyers For Middle East NOCs, the facility offers a way to secure guaranteed crude oil offtake while increasing supply chain flexibility. Meanwhile, the strong bilateral relationship between China and Singapore means Chinese conglomerates are likely to see Pulau Bukom as a quick and easy means of geographical diversification.

Don’t forget to fill in the form at the top of the page to download your complimentary copy of the report. This includes analysis of Pulau Bukom’s ethylene, ethylene oxide and ethylene glycol performance, along with a more in-depth exploration of potential buyer interest in the asset.