Size matters: which International E&Ps are best positioned to ride out industry consolidation?

We analyse 16 of the largest international operators to assess their resilience and sustainability

2 minute read

Andrew Harwood

Vice President Research, Upstream & Carbon Management, Corporate

Andrew Harwood

Vice President Research, Upstream & Carbon Management, Corporate

Andrew is responsible for our corporate coverage in Asia Pacific.

View Andrew Harwood's full profileZoë Sutherland

Principal Analyst

Zoë Sutherland

Principal Analyst

Zoë is a principal analyst with more than 15 years of industry experience.

View Zoë Sutherland's full profileScott Walker

Senior Research Analyst, Corporate Research

Scott Walker

Senior Research Analyst, Corporate Research

Scott has nearly a decade of experience across M&A and corporate analysis in the upstream oil and gas sector.

View Scott Walker's full profileA renewed appetite for oil and gas investment has put international E&P strategies back in focus, as investors scrutinize upstream portfolios for near-term resilience and long-term sustainability.

Recent merger activity between ExxonMobil-Pioneer, Chevron-Hess, and a rumoured Santos-Woodside Energy match-up, has also sparked speculation around who might be the next big consolidation target.

Our recently published insight Benchmarking the International E&Ps looks beyond the Majors, the National Oil Companies and the US-focused tight oil sector to benchmark 16 of the largest International E&Ps.

Sourcing our Corporate Strategy & Analytics Service (CSAS), we assess these players for financial strength, portfolio outlook and energy transition strategies. Fill out the form to download a complimentary extractor read on for a brief overview of the report’s key findings.

A diverse range of independent operators

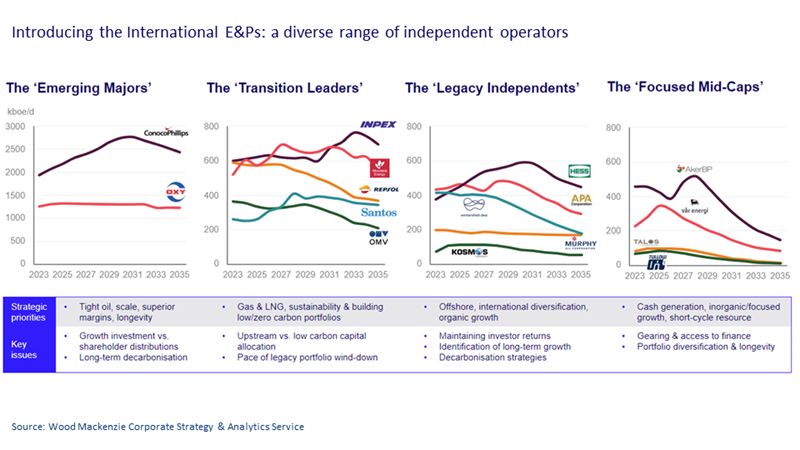

The 16 largest international E&Ps are a diverse group differentiated by factors including scale, financial strength, portfolio focus and transition strategies. We categorise these players into four groups:

- The ‘Emerging Majors’ have prioritised tight oil and scale to develop superior margins and longevity

- The ‘Transition leaders’ are building gas & LNG weighted portfolios in support of longer-term sustainability

- The ‘Legacy Independents’ remain wedded to their international exploration focus areas, but may struggle to maintain growth long-term

- The ‘Focused Mid-Caps’ have less diverse portfolio’s and are focused on near-term cash generation, inorganic growth and short-cycle resources

Financial strength varies widely across the group. Gearing ratios are down from 51% in 2020 to an average of 36% in H1 2023, with individual companies ranging from -3% to +133%. Debt repayment has slowed in 2023 as target gearing ratios are achieved, supported by strong commodity prices; but a select few still have work to do to strengthen the balance sheet and improve financial resilience.

Scale and diversification can also support resilience and long-term sustainability. Diverse portfolios, across geographies and resource themes, can mitigate rising geopolitical and transition risks. But smaller players, weighted to a single basin, resource type or project find it harder to spread risk.

Deepwater, LNG and tight oil remain advantaged resource themes that support portfolio scale, margins and longevity; however, across the 16 companies we assess, only Repsol and ConocoPhillips have exposure to all three. Repsol and ConocoPhillips also compare favourably on geographical diversification; in contrast, Aker BP and Var Energi remain highly concentrated on the maturing North Sea sector.

Corporate consolidation and M&A will be central to building scale and diversification. The pace of consolidation across this peer group is expected to accelerate in the coming years. Those with strong financials and exposure to long-dated, advantaged resource are compelling acquisition targets. For smaller (weaker) companies, the risks are acute, .

Low-carbon strategies remain a sideshow to the main activity of exploring for, developing and producing hydrocarbon resources. In this group. only Repsol, Oxy and OMVhave set Scope 3 targets for indirect emissions resulting from their activities.

For those businesses who are pursuing low-carbon approaches, carbon capture, utilisation and storage (CCUS) is the key focus. Oxy and Santos are both leaders in this field targeting large scale CCS to reduce their emissions. Only Repsol and INPEX are diversifying into renewable wind and solar power. Meanwhile, OMV stands out for its aim to exit upstream oil and gas completely by 2050.

Don’t forget to complete the form at the top of the page to download your complimentary extract from the report. This includes deeper analysis of each E&P across multiple factors, including resource themes, gas production, balance sheet strength, debt coverage, liquidity and scale.

Want to be the first to receive our latest oil and gas insights?

Sign up now to receive our upstream thought leadership straight to your inbox

Find out more