Global upstream update: oil supply questions and portfolio resets

Geopolitical risk meets ambitious growth targets, while M&A trends point to buyers needing certainty and upside

3 minute read

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

Opinion

Is oil price volatility a threat to upstream production, investment and supply chains?

-

Opinion

Global upstream update: UK fiscal changes and an Asia-Pacific licence bonanza

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

The Edge

Why upstream companies might break their capital discipline rules

-

Featured

Upstream oil & gas regions 2025 outlook

Robert Clarke

Vice President, Upstream Research

Robert Clarke

Vice President, Upstream Research

Robert leads our US onshore research, with a particular focus on the evolution of the tight oil sector.

Latest articles by Robert

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

Global upstream update: oil supply questions and portfolio resets

-

The Edge

Three factors driving US liquids production to new heights

-

Opinion

What's new in global upstream

-

Opinion

Chesapeake-Southwestern Energy deal: ten key takeaways

-

Opinion

The making of a Megamajor – ExxonMobil acquires Pioneer Natural Resources

In our latest Global Upstream Update, we explore the latest industry developments, reflect on their broader energy market impact, and consider what could happen next.

Fill in the form to download this report, or read on for an overview of the four key themes we highlight this edition.

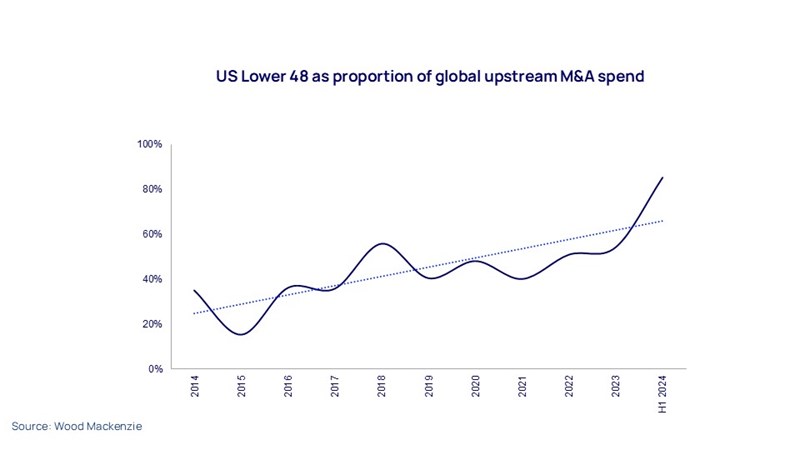

1. Global M&A continues to be dominated by the US Lower 48

US Lower 48 merger and acquisition (M&A) activity remains boldly unique, dominating the global deal landscape. So far this year, cumulative spend is roughly six times higher than all other regions combined. Additionally, deal count is 63% higher than the entire 2023 Lower 48 total.

Even without a huge transaction like the ExxonMobil-Pioneer acquisition (valued at US$65 billion), the sum of all the smaller deals in 2024 is quickly adding up. Total Lower 48 spend of US$100 billion by year-end isn’t out of the question.

However, there has been some volatility in equity markets over the past months, which has stalled public-to-public mergers. Market participants need patience though. The drivers to build, greater scale, and add inventory still persist.

Another M&A factor to consider is regulations. Most of the largest deals have now cleared Federal Trade Commission (FTC) hurdles. Watch changing macro fundamentals too; they could push would-be buyers to move.

2. In North Africa, Libya's output is perpetually at risk of outage

Libya’s unresolved political problems pose a continued risk to supply. The Tripoli-based government’s removal of the Central Bank governor recently threatened 1 million barrels per day (b/d). Large offshore gas fields remain unaffected, as do gas exports to Italy.

European companies like Eni and TotalEnergies are most exposed to production outages. But, large production volumes provide Libya with strong cash flow, despite high government take, underpinning the country’s staying power. Incentives for Libya to keep production flowing total US$9 billion of annual government revenue.

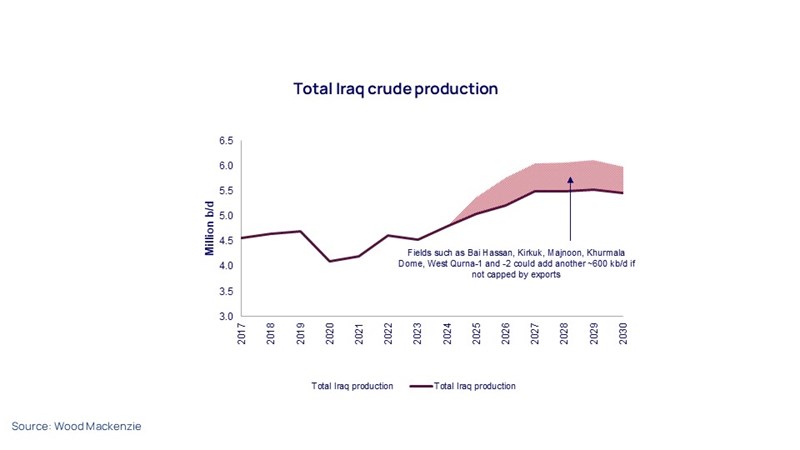

3. Middle East: Iraq’s volume targets are ambitious

One of Iraq’s key upstream strengths is its world class petroleum basins. The country has a huge reserve of low-cost resources, with over 150 billion barrels of crude oil, and 110 trillion cubic feet of gas. A diverse corporate landscape adds more positives.

Iraq’s political stability has improved, with a stronger cabinet pushing bolder new energy policies. The country is targeting a 6 million b/d capacity by 2028 - up from 4.5 million b/d in 2023, The region relies on oil revenues for over 90% of its state budget.

However, a strained relationship between the Federal Government and the Kurdistan Regional Government remains a threat. Likewise, security, and above ground risks are severe in some areas, and harsh fiscal terms have led to some major companies exiting. The country’s oil growth is also limited by infrastructure and water issues.

Europe: major companies leaving the Southern North Sea

Shell, ExxonMobil and others have decided to exit the Southern North Sea. This is placing mature gas assets in the right hands for investment and growth, notwithstanding the issues in the UK created by its deeply flawed Energy Profits Levy (EPL).

Viaro Energy has picked up assets that include the Selene exploration well, which is currently being drilled to target, 320 bcf of prospective resources.

Additionally, Canadian independent company, Tenaz Energy acquired NAM’s Dutch offshore portfolio for an estimated US$262 million. The deal makes Tenaz the second largest operator in the Dutch North Sea, despite not having operated in Europe before.

Tenaz has ambitious plans to revitalise the assets with workovers and infill drilling after years of underinvestment. When the deal completes, Tenaz will start a US$120 million investment programme to invigorate the ageing assets.

Download the full report

For more information, analysis and charts on the global upstream industry, and to receive our upcoming predictions for 2025, please fill in the form at the top of the page.