Can private value chains boost polyolefin recycling?

Major players are best placed to form partnerships across industries and bridge the yawning supply gap.

3 minute read

Husam Taha

Principal Analyst, Plastics Sustainability

Husam Taha

Principal Analyst, Plastics Sustainability

Latest articles by Husam

-

Opinion

Plastic demand could reduce by up to 30% in an accelerated energy transition scenario

-

Opinion

The roadmap to recycling polyolefins

-

Opinion

Can private value chains boost polyolefin recycling?

Sustainability and circularity are key to the future of the plastics industry, yet according to our data, only about 30% of polyolefins reaching the market today are recyclable. With demand for more environmentally friendly products rising rapidly, improving recyclability is a pressing issue.

We recently published an in-depth insight into the potential role of private value chains in boosting polyolefin recycling. Fill in the form to download a complimentary copy of the report, which is based on data and analysis from our Recycled Polyolefins Service, and read on for some key takeaways.

Despite strong demand for recycled plastic, most polyolefins being produced are non-recyclable

Industries across the plastics value chain are keen to decarbonise their operations by using products with a lower carbon footprint. Yet linear design practices in product development and waste management result in seven out of every ten tonnes of polyolefins produced ending up in landfill or being incinerated. Aside from the environmental impact, the lack of suitable material for recycling is one of the main reasons why the polyolefin market is so supply-constrained.

Design for recycling must consider the whole value chain

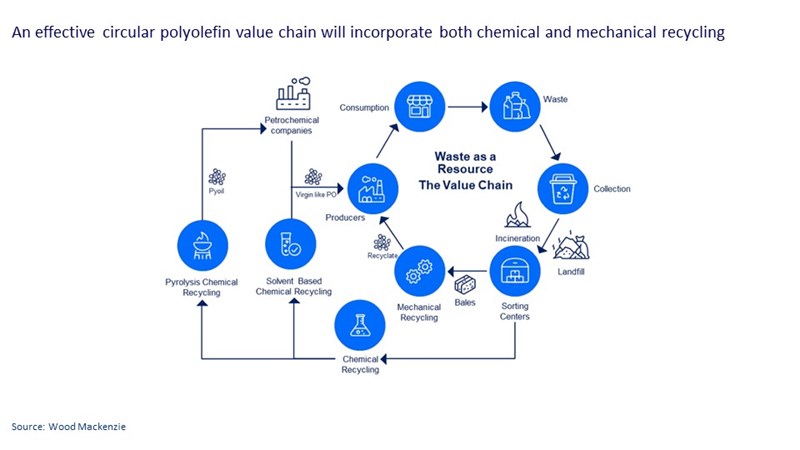

An effective circular polyolefins value chain stretches from design and manufacture through consumption, waste, collection, sorting and recycling, to the creation of new resources ready for reuse. To facilitate the transition to a circular economy, decarbonisation efforts need to begin at the design stage.

Legislation and cross-industry collaboration will be needed to drive the development of materials that are collectable, sortable and recyclable. Once this is in place, the value chain will have to ensure suitable investments to drive the market towards sustainability.

Chemical recycling will be needed to complement mechanical recycling

To meet mounting demand for recycled materials, chemical recycling will need to complement mechanical recycling. Clear legislation will be needed to clarify the role each process should play and avoid a market in which technologies compete over feedstock. Investment into new technologies and simplifying bureaucratic red tape around the adoption of new processes and recycling methods will accelerate uptake.

By 2028, we estimate operating chemical recycling capacity will be nearly four times higher than it is today. Chemical recycling can take the form of pyrolysis or solvent-based recycling. Pyrolysis results in polyolefins being turned into varying proportions of oil, gases and solids, which can then be used as feedstocks in the production of fuels, chemicals, and new polymers. Yield is determined by the quality of the input material used, and consistency is key.

Big players are focused on securing stable supply of sustainably produced materials

To hit net zero targets, massive investments are needed to develop and integrate collection, sorting, mechanical and chemical recycling infrastructure into every industry’s product and process design. Major players with bigger carbon footprints have the strongest incentive to lead the transition to sustainably produced plastic.

To ensure access to sufficient recyclable material, firms will have to either own or be able to steer the supply chain they rely on. Given the supply-constrained market, key players are racing to develop the necessary infrastructure to ensure access to recyclable plastic. Strategic partnerships between players from different industries will be essential to derisk the high cost of investment

The above factors will lead to the emergence of private value chains, with cross-industry partners aiming to ensure the volume and quality of feedstock available to them. At the same time, companies will adopt de-globalised operational strategies to cope with an increasingly expensive and complex transition.

Ensuring broad market participation will be essential to boost supply

As early adopters of new technologies and solutions, private value chains will be crucial in derisking investments and helping to drive the transition to a circular plastics economy. However, in the long term, participation will be needed from across the market to boost the supply and circularity of materials and applications across all industries in the value chain. The more players that can participate, the less supply-constrained the market will be.

Finally, it’s worth bearing in mind that in today’s world, both producers and consumers alike are responsible and have a part to play in the transition to a more sustainable future. Producers need to make available commercially viable, recyclable and reusable solutions with a low carbon footprint. But at the same time, consumers need to live more sustainably, reducing their use of plastic products and reusing refilling and repairing plastic items wherever possible.

Don’t forget to fill out the form at the top of the page to access your complimentary copy of the report, which includes detailed business case evaluations of the major players in the market.