与我们分析师联系

Why is China the early adopter of CTO/MTO

Kelly Cui, Olefins Senior Consultant, explains China’s abundant coal reserves and how it’s being used to meet domestic olefins demand.

1 minute read

Kelly Cui

Principal Analyst, Petrochemicals

Kelly Cui

Principal Analyst, Petrochemicals

Kelly is an expert in the coal-to-olefins (CTO) and methanol-to-olefins (MTO) sector.

Latest articles by Kelly

-

Opinion

Which global steam crackers are at most risk of closure?

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

-

Opinion

Why crude-to-chemicals is the obvious way forward

-

Opinion

Coronavirus to disrupt China’s chemicals sector more than SARS

-

Opinion

Can China’s CTO and MTO industries survive the threat of massive steam cracker investment?

-

Editorial

Why is China the early adopter of CTO/MTO

As written previously, China has historically seen rapid rises in both ethylene supply and demand growth. Between 2010 and 2016, annual demand growth was robust at 7%, and continues to develop much faster than supply. To meet this increasing demand, China has started to use its own abundant coal reserves and domestic and imported methanol resources for CTO/MTO to reduce its dependency on imports of olefins and derivatives.

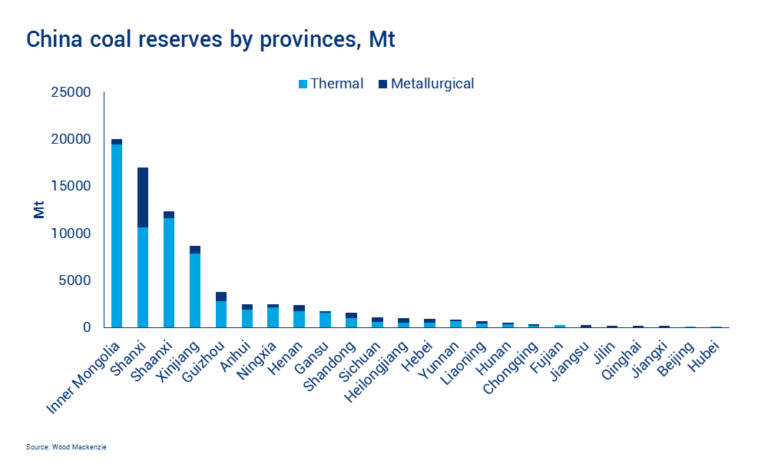

Wood Mackenzie's forecasts of commercial production from identified companies and projects in China between 2017 and 2035 provide total marketable coal reserves of 78 billion tonnes. Thermal coal, the feedstock in the coal-to-olefins (CTO) process, accounts for 84% of this total marketable reserve.

Due to the distribution of coal resources in China, the majority of thermal coal production lies in the Northern provinces – Inner Mongolia, Shanxi and Shaanxi are the top three producers. In 2016, these three provinces combined to contribute over 60% of domestic supply.

Energy security is vital in China’s energy strategy. Poor oil resources and rocketing oil demand means China imports 60% of their oil. As natural gas supply and demand faces a similar situation, China’s leadership is keen to improve the country’s energy self-sufficiency, which has led to it encouraging the development of the coal-to-chemicals industry. Coal-to-liquids, coal-to-gas, coal-to-olefins are now the key components of the coal to energy and chemicals sectors. PCI Wood Mackenzie assessed that the coal-to-chemicals sector consumed 249 Mt of coal in 2016.

The emissions vs. energy security conundrum

As a leader of the Paris climate agreement, China announced its carbon emissions will peak before 2030, and its carbon emissions per GDP will be cut by 60% to 65% between 2005 and 2030. With coal being an obvious contributor to carbon emissions, China is looking to restructure its energy mix to low-carbon, clean or renewable energy. As such, the Energy 13th Five-Year Plan aims to reduce coal’s share in total energy demand from 64% in 2015 to a max of 58% in 2020, while increasing the share of renewables and natural gas in the energy mix.

How will China balance their carbon-cutting with energy security objectives? Despite strengthened policies on coal regulation, China has not stopped approving coal-conversion projects. Part of the problem can be solved with increased measures on ‘sanmei’ – a lower quality variety of raw coal burnt using technology incapable of reducing its polluting effects. Sanmei is mostly used by those with small industrial boilers or for heating their homes. While this group only accounts for 20% of total coal demand, their use of sanmei contributes almost 80% of pollution caused by coal in China.