Waste to wealth Unlocking circular value chains

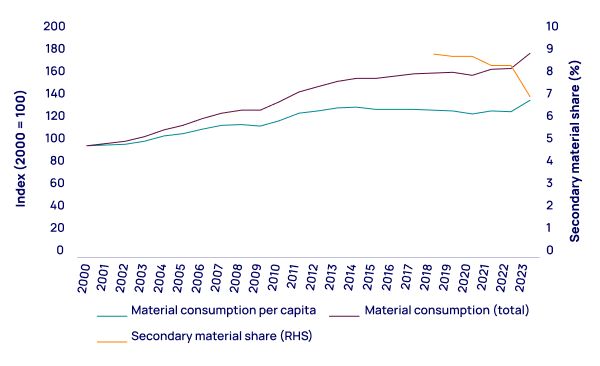

The circular economy ‒ reusing materials and reducing waste ‒ is a critical strategy for delivering a lower-emission, more sustainable future. It’s the goal of countless regulatory initiatives, not least the United Nations Plastic Treaty currently under negotiation, and has been adopted as a key part of the business vernacular. However, despite this rising tide of corporate commitments and regulatory targets, the global economy remains wedded to an extractive, rather than circular, model.

Businesses have been slow to fully embrace circularity for multiple reasons, not least economics. There is money to be made from circularity, but allocating margins fairly across fragmented value chains is difficult. As the biggest beasts in the value chain – with the greatest capital and capability ‒ there is a compelling responsibility on commodity-producing companies to take a lead. However, corporate targets today remain stubbornly focused on individual companies, rather than on measures that would enable the entire circular value chain to thrive.

Companies need to explore different ways of building relationships across industries for circularity to flourish. In this report, we focus on three key initiatives across different industries – electronics, plastics and biofuels ‒ where companies have come together in precisely this manner, pointing a way forward for other sectors too. Through joined-up thinking, a pathway to increased circularity remains open.

Stuck in a loop: barriers to progress

A circular value chain is only as strong as its weakest link. If one company has no incentive to participate, the whole value chain can break down. In established, commoditised markets (such as gasoline), value allocation is coordinated by the price signal. However, in nascent, pre-commoditised markets typical of circular value chains (such as biofuels), transparency is lacking, presenting commercial challenges to businesses trying to make progress on circularity, among them:

- International oil companies (IOCs), technology companies and waste management firms all operate with different capital bases, risk appetites and cashflow needs, complicating expectations about what ‘fair value’ looks like.

- Without a clear route to value, waste-processing companies and new technologies will not be induced to bring supply to the market.

Moreover, there are operational challenges for companies adopting circular business models. For starters, new systems need to be put in place to track material flows and staff will need to be trained to act in ways that promote the value chain as a whole. Sales and procurement teams, for example, need to operate differently when success depends on the whole value chain rather than just their own business.

These challenges, though, can be overcome as long as the system can generate sufficient cash. We see three broad circular product models where that can happen.

First, products where supply from waste costs less than virgin production. These are typically markets with the highest rates of secondary material usage and the closest to commoditised markets. Collecting plastic bottles to make fibres is a good example, with a global recycling rate of 56%.

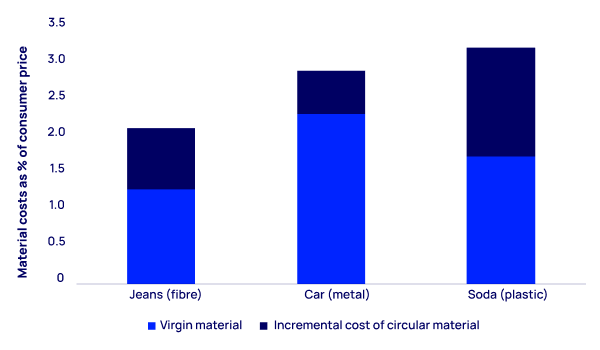

Second, products where the cost of the processed waste supply is at a premium to virgin production. But that premium can be easily absorbed in the price paid by the end consumer because of the fractional impact of material cost on the price of the final product.

Third, products that come at a cost premium that cannot be absorbed by the consumer. Fuels are the classic example. Here, the margin must be supported by policy ‒ usually through demand mandates – but this can be substantial. While a typical refinery could generate a net margin of 2-5%, the equivalent for renewable diesel, for instance, has been 20-35% in recent years.

Leading the charge: the flagbearers of circular value chains

With the market unable to provide the essential coordination function that allocates this margin across the value chain, other mechanisms need to come into play to promote the growth of a more circular economy.

There are three main types of value-chain relationships ‒ beyond the contracting typical of commoditised markets ‒ that can provide this coordinating function. These typically involve trade-offs between the level of cost and effort for the firm and the degree of control and certainty they generate, with more upfront investment tending to lead to greater control.

There is no ‘correct’ approach that can be uniformly applied – this must be weighed on a case-by-case basis, taking into account investment appetite and the level of control required. But where companies consciously adopt the appropriate framework, the prospects for progress are significantly strengthened:

- Partnerships: looser arrangements where firms come together to embrace shared objectives that maintain independence and flexibility.

- Joint ventures: jointly owned entities for strategic projects needing market or value-chain knowledge that is hard for a firm to acquire internally.

- Vertical integration: acquiring suppliers or distributors for greater control over the supply chain, ideal for ensuring control of a project.

The stuttering progress towards circularity at the macro level suggests that these practices are not being widely adopted. However, initiatives already in play show that these approaches are possible across different value chains and that their application can pave the way for a more circular, sustainable economy.

Electronics: partnering for e-waste solutions

The past quarter-century has seen exponential growth in electronically enabled goods. With this has come a significant increase in demand for the metals necessary to underpin this electronic revolution, as well as a similar increase in the amount of e-waste (electronic device waste) generated. Boosting circularity offers a way of addressing both problems by adding value to the waste, thus preventing it from going into inappropriate forms of waste-processing (landfill or incineration) and reclaiming the materials for the sector.

However, with electronic goods found in every sector and every country, the challenge of collecting and processing this waste stream is an extremely complex one that no company can hope to address on its own. The Circular Electronics Partnership (CEP) was set up to deal with precisely this problem. A global collaboration between major electronics producers, CEP brings together 40 companies from across the value chain. With many companies and sectors represented, a commercial undertaking would have been too complex to make work from a governance and competitive practice perspective. A partnership format facilitates coordination by developing a common lexicon for the industry to use, including standards, reporting metrics and design guides.

The CEP has begun the process by identifying obstacles to circularity and building roadmaps to achieve targeted circularity goals by 2030. In aligning terminology and reporting across the sector, the electronics industry is far better positioned to move towards a more circular future than if stakeholders were pursuing individual targets.

Plastics: the power of joint ventures in the value chain

The problem of plastic waste is well documented, with more than 100 million tonnes of it finding its way into waste facilities or the environment each year and significant amounts of carbon being emitted across its lifecycle. The question is how to do it. Global polymer producer LyondellBasell (LYB) may offer some solutions.

LYB has some of the industry’s most ambitious targets for boosting circularity in plastics, targeting 2 million tonnes of recycled plastic production in 2030 – an increase of 1,500% from 2023. The firm has recognised that it does not have the internal capability to achieve this lofty objective on its own and that it needs to work with other companies to secure high-quality feedstocks and stable supply chains and volumes.

The firm’s initial investments were in a joint-venture project with Suez, the French-based international waste management company. The two companies formed Quality Circular Polymers (QCP) combining the respective strengths of LYB in plastics production and marketing with Suez’s waste collecting and sorting. Both firms recognised that a joint-venture undertaking would match their strategic strengths to address a fast-growing area of the market. The initial partnership was for a 35-kilotonne per annum (ktpa) mechanical recycling facility – subsequently expanded by 60% ‒ providing a third of LYB’s current recycling capacity and allowing Suez to share in the valorisation of the waste stream.

Boosting recycling offers a means of reducing fossil-fuel extraction and adding value to a waste stream to prevent its leakage into the environment.

LYB’s enthusiasm for joint ventures as a means of aligning external expertise with its core competencies to help it reach its ambitious 2030 targets has seen subsequent investments in waste management and technology companies as it seeks to build capacity 60-fold.

Fuelling the future through vertical integration

Biofuels – fuels derived from non-fossilised organic matter and its processed derivatives ‒ will play a key role in the journey to net zero, providing carbon-neutral molecules to power hard-to-abate transport sectors. Eni is a leading biofuel producer with ambitious plans to expand from 1.7 million tonnes per annum (mtpa) of biorefining capacity in 2023 to 5 mtpa by 2030, during which time global production is forecast to expand by one-third.

A key challenge to the growth of the sector comes from the need to secure reliable access to sustainable biofeedstocks, which are severely constrained. To derisk the availability of feedstocks in future, Eni has invested in vertical integration into the agricultural sector in Africa. Recognising that its capital and expertise could be used to benefit farmers in the region, Eni has helped source land that does not compete with food production and provides security of income to farmers through its long-term feedstock needs.

In return for this upfront capital investment, Eni will fulfil 20% of its feedstock needs, providing a material hedge against future volatility and boosting the market through ‘greenfield’ investment.

Adding value to value chains

What marks these three case studies as examples to emulate is not that they provide a template. Joint ventures are not ‘the solution’ to recycling, not all refiners should invest in farming and e-waste will require more than the CEP arrangement to drive circular outcomes in the future.

What they show is that adopting the right forms of value-chain relationship – driven by the needs of the company and the value chain – can serve to introduce coordination, laying the foundation for circular value chains to grow together.

Missed Horizons Live?

On the Horizons Live webinar our authors discussed the key themes of the report and tackled questions from the audience. Missed it?

Explore our latest thinking in Horizons

Loading...