Sign up today to get the best of our expert insight in your inbox.

Why upstream companies might break their capital discipline rules

Pressure will intensify to invest more in a slow transition

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Tariffs - implications for the oil and gas sector

-

The Edge

Big Mining pivots to copper for growth

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

How gas could displace renewables in meeting surging US data centre demand

-

The Edge

Majors' capital allocation in a stuttering energy transition

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

Opinion

Is oil price volatility a threat to upstream production, investment and supply chains?

-

Opinion

Global upstream update: UK fiscal changes and an Asia-Pacific licence bonanza

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

The Edge

Why upstream companies might break their capital discipline rules

-

Featured

Upstream oil & gas regions 2025 outlook

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus leads our benchmark analysis of global Pre-FID delays, and deep water developments.

Latest articles by Angus

-

The Edge

Why upstream companies might break their capital discipline rules

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

How to make upstream licensing work

-

The Edge

What’s driving the upstream revival in Southeast Asia?

-

Opinion

A two-decade decline in exploration is driving the need for carbon neutral investment in Australia’s upstream sector

-

Opinion

Asia Pacific upstream: 5 things to look for in 2024

The possibility of oil and gas demand growing strongly into the next decade is one Wood Mackenzie has explored in our Delayed Energy Transition Scenario (DETS). Others across the industry have outlined a similar case for oil demand resilience, most recently Vitol the global energy trader.

Stronger-for-longer oil and gas demand would have huge implications for the upstream industry responsible for delivering the supply. Fraser McKay, Head of Upstream Analysis, and Angus Rodger, Vice President Upstream, co-authors of our January 2025 Horizons, share their thoughts with me.

First, in the DETS, upstream needs to deliver an additional 6 million b/d of oil on average (6% more than in our base case) through to 2050 as well as 3%, or 15 Bcfd, more gas

We have no doubt that the resources are there for the industry to tap, much of it in the basins and themes that currently dominate supply. The Middle East and North America will account for two-thirds of the additional supply. Half of the production will be from conventional plays, the rest spread across tight oil, deepwater, LNG and other resource themes.

Investment would initially focus on lower-cost advantaged resources. But as these are consumed, supply will increasingly have to come from higher-cost plays, with clear implications for oil and gas prices.

Second, the increased development activity required to deliver the incremental supply will put extreme pressure on the supply chain

A decade of belt-tightening has largely eliminated spare capacity, and the service sector is already stretched in places. Among many looming bottlenecks, deepwater is the one to watch. Day rates for top-end rigs have already doubled since 2021 while capacity utilisation will reach 90% in the next two years.

A service sector that’s taken a decade to stabilise finances and rebuild margins will not rush to build new capacity. Instead, service costs and margins will go up.

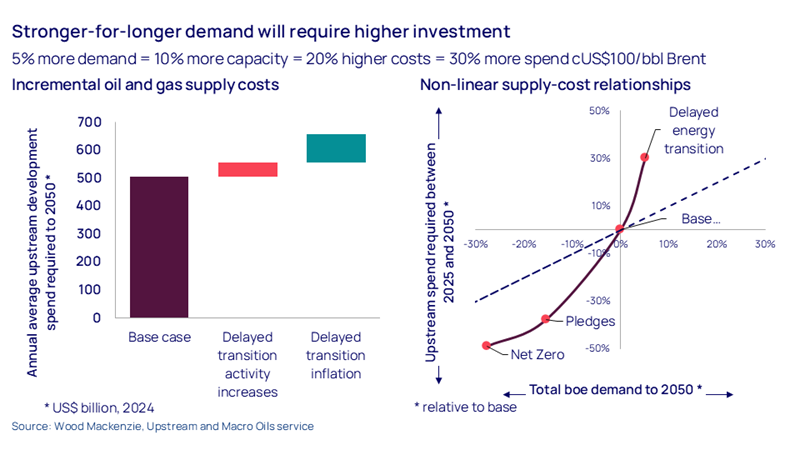

Third, we estimate global investment in upstream will have to increase by 30% to deliver the incremental supply, from US$500 billion a year currently to US$660 billion

Only one-third of the increase is related to higher activity, such as drilling and development. The rest is service sector cost inflation and the exploitation of higher-cost resources – even after allowing for some operational and efficiency improvements.

Fourth, oil prices will have to rise materially to incentivise this investment

Wood Mackenzie’s Oil Supply Model analyses supply and demand fundamentals, calculating a price based on the marginal cost of supply. The supply cost stack to meet future demand begins with fields in production and under development, layering on resource upgrades from existing fields, new projects from contingent resources and yet-to-find (exploration).

The model projects Brent averaging above US$100/bbl in real terms from the 2030s through to 2050, US$20/bbl above WoodMac’s long-term assumptions. Gas and LNG prices will also be higher, though the ask on supply is smaller and more easily absorbed.

Lastly, what are the implications for upstream strategy?

The initial feedback is that our analysis chimes with what many companies already carry as their base case. The industry has always questioned how quickly the world could move away from oil and gas to a low-carbon energy system. The DETS, though, would pose challenges for companies, from how to position strategically and judge the pace of committing to how to increase exposure and finance the investment in higher supply.

We do not expect a sudden uptick in spending from E&P companies. The belief that oil and gas demand will continue to rise may be strengthening but it’s far from guaranteed. Nor do many think the energy transition is over – electric vehicles will disrupt transportation and global gasoline consumption. It’s just going to take longer. Importantly, the industry won’t throw away the investor confidence that’s been hard won over the last decade through diligent capital discipline by shifting into growth mode. Nimbleness, financial resilience and portfolio flexibility will be key as companies navigate the changing pace of the transition.

But upstream companies will have to take more risk to deliver higher supply, developing new projects and stepping up resource capture through M&A and exploration. If it’s an opportunity for the sector, it’s also one for investors. Should our scenario turn into reality and oil prices stay firm into the next decade and beyond, the returns will justify higher risk.

Capital discipline will remain the overarching framework, with shareholders expecting at least 35% to 45% of operating cash flow to be returned as dividends and buybacks for the biggest players. The ratio can stay the same, but higher prices will generate more cash flow to allocate both to shareholders and investment. A big question is whether companies, in anticipation of tightening fundamentals, will be bold enough to ‘break the ‘rules’ and increase the proportion of investment ratio.

The stronger-for-longer thesis underpins our view that there’s more M&A to come as companies seek longer-duration exposure to firm oil and gas demand. The current deal M&A market is pricing in US$65 to US$70/bbl longer term, suggesting attractive value creation potential in acquiring assets under a slower transition scenario.

It’s also a great opportunity for organic investment. Companies that can find and develop low-cost resource, deliver the incremental barrels the world needs and ride the wave of higher prices in a stronger-for-longer demand scenario will be among the winners over the next decade.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.