Sign up today to get the best of our expert insight in your inbox.

How gas could displace renewables in meeting surging US data centre demand

Solar, wind and storage developers’ confidence is waning with the threat to the IRA

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

Opinion

The narrowing trans-Atlantic divide on the energy transition

-

The Edge

Tariffs - implications for the oil and gas sector

-

The Edge

Big Mining pivots to copper for growth

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

How gas could displace renewables in meeting surging US data centre demand

Chris Seiple

Vice Chairman, Energy Transition and Power & Renewables

Chris Seiple

Vice Chairman, Energy Transition and Power & Renewables

Chris brings more than 30 years of global power industry experience to his role.

Latest articles by Chris

-

Opinion

The 2025 US power market outlook

-

Opinion

eBook | Lens Power and Renewables: illuminating risks, uncovering opportunities

-

The Edge

How gas could displace renewables in meeting surging US data centre demand

-

Opinion

Uncertainty dominates the 2025 US power outlook

-

Opinion

Uncertainty dominates the 2025 US power outlook

-

The Edge

Five themes shaping the energy world in 2025

US power demand is embarking on a major new phase of growth sparked by a manufacturing renaissance, increasing electrification and the boom in data centres. The data centre sector is moving fast, with 2025 investment likely to double 2023’s levels and drive much of the 2% annual power demand growth we expect through the end of this decade. With a massive backlog of solar, wind and storage under development, the renewable industry stands poised to capitalise on this demand growth, satisfying the owners’ preference for 24/7 green power.

At least that’s what we thought a few months ago. The Trump administration’s threat to dismantle the Inflation Reduction Act (IRA) of 2022 throws that assumption into doubt. I spoke to Chris Seiple, Vice Chair, Power and Renewables, to learn more.

Is the IRA delivering for the US cleantech industry?

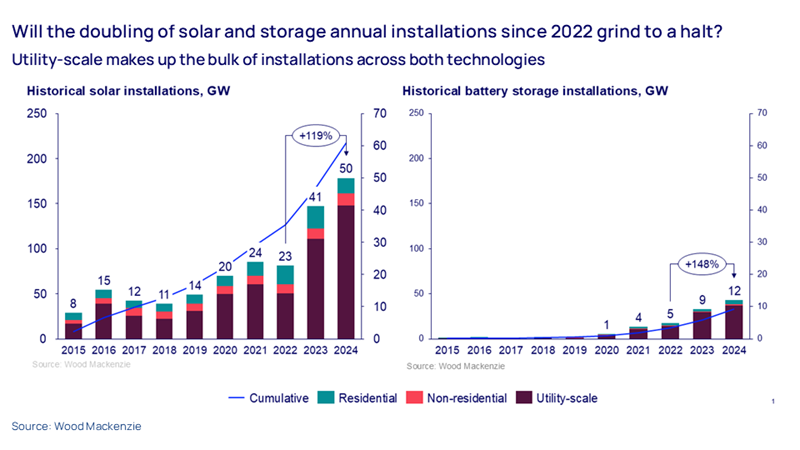

Big time. Investment in renewable power and battery storage is going gangbusters. After averaging 22 GW a year at the start of this decade, solar capacity installations more than doubled to 50 GW in 2024 because of the IRA incentives. And it’s much the same for battery storage installations, which have jumped 148% since 2022 to 12 GW.

Moreover, a key policy goal of the Biden administration was that the IRA would rejuvenate domestic supply chains. Spurred by the IRA’s 45X advanced manufacturing production credit, solar module manufacturing is taking off, with capacity climbing from 7 GW in 2022 to 40 GW in just two years.

Has the mood of investors changed with the new administration?

Completely – many in the industry are experiencing whiplash. There’s still a lot of momentum with many developers accelerating projects to take advantage of ‘safe harbour’ rules – locking in the benefits of the IRA. The legislation gave investors a positive signal to invest – arguably the first ever – with long-term support for low-carbon projects.

That exuberance has now given way to a massive mood change as developers and utilities absorb the ideological messaging of a new administration that overtly favours energy dominance in oil and gas over low-carbon power.

Nearly a year ago, former officials from Trump’s first administration told us that if Republicans gained control of all branches of the federal government, then no one could assume the IRA was safe simply because much of the spending would be in Republican districts. In response to those conversations, we put together a severe downside scenario for renewables, which is now looking increasingly likely.

Does it make sense to stifle low-carbon power investment?

No, for the simple reason that it’s the shovel-ready, low-cost capacity that can most quickly meet much of the rise in power demand. Data centres are large-load customers that want 24/7 green power. A combination of solar, onshore wind and battery storage should contribute a big proportion of the additional supply.

What’s the alternative if new renewables projects dry up?

Coal plant retirements will be deferred but that won’t be enough to meet demand growth. Nuclear and geothermal are longer-term solutions. That leaves gas in the driving seat, so to speak, and by some distance. Existing gas plants will be the biggest beneficiaries as they are best placed to capture some of the new demand growth from their excess capacity during some hours.

But that won’t be anywhere near sufficient. New gas capacity will still be needed. The problem is that new-build gas plants face looming logistics and cost challenges. We recently managed a turbine solicitation for a customer and learned that if you don’t already have a turbine manufacturing slot, the earliest you will get a new combined-cycle power plant online – assuming everything goes perfectly – is Q4 2029. And the squeeze on the supply chain is leading to a run up in the cost of building a new CCGT plant with costs reportedly rising to over US$2000/kw, up nearly 40% from a few years ago.

Will additional gas capacity for the power sector push US gas prices up?

Highly likely. We had already increased our forecasts in November 2024 by 10% to 15% for the near and medium term and currently have Henry Hub reaching US$4.50/mmbtu by 2035. A combination of faster roll-out of gas plant and the anticipated LNG project final investment decisions will put upward pressure on US prices – and, by implication, global LNG prices.

What about higher power prices?

We have argued that power supply will be unable to keep up with the boom in demand from data centres, leading to higher wholesale power prices. The increased cost of building gas-fired power plants and unwinding the IRA will add even more fuel to the fire. We estimate the sharply higher costs of building a gas combined-cycle plant will increase the levelised cost of electricity by 20%, or US$20 per MWh.

Important as affordability is for the US Government, there are even more important goals – delivering the supply to meet electricity demand growth and ensuring national security and economic growth. Unwinding the IRA will disrupt existing business plans for generation capacity that have been under development for several years and were poised to come online most quickly to meet demand growth. To meet the expected demand growth, it will now be all hands on deck for all generation technologies.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.