Get Ed Crooks' Energy Pulse in your inbox every week

Uncertainty casts a shadow over US LNG

Politics and legal actions are clouding the outlook for US exports. The election could clear some of the uncertainty, but not all of it

13 minute read

Ed Crooks

Senior Vice President, Thought Leadership Executive, Americas

Ed Crooks

Senior Vice President, Thought Leadership Executive, Americas

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

The Energy Gang’s review of the year in energy

-

Opinion

Predictions for energy and natural resources in 2025

-

Opinion

Bonus episode from COP29: Getting real about methane emissions

-

Opinion

US LNG a test case for the Trump administration’s ambitions

-

Opinion

What happened at COP29?

-

Opinion

The Trump administration's AI strategy points to strong growth in US power

“Elections have consequences.” That was what President Barack Obama famously told Republican members of Congress after his inauguration in 2009, as he attempted to drive through his economic agenda in the depths of the financial crisis. Elections certainly have consequences for energy policy, and the US elections on 5 November will be no exception. The two parties present starkly different visions for the future of the industry.

However, the significance of federal policy for US energy is often overestimated. A second Trump administration would cut regulatory burdens on the oil and gas industry and open more areas for development, boosting production at the margin. But the primary determinants of US hydrocarbon production are the revenues and capital allocation strategies of the Majors and E&P companies, which are unlikely to be affected much by what happens in Washington.

Former President Donald Trump has criticised the 2022 Inflation Reduction Act (IRA), which expanded and extended tax credits for low-carbon energy, and this week aimed his fire at solar power. “It’s all steel and glass and wires. It looks like hell. And you see rabbits get caught in it,” he said. “It’s just terrible.” But repealing the key provisions of the IRA would need action by Congress, where the votes needed to eliminate the tax credits are unlikely to be forthcoming.

One area where the presidential election could make an immediate difference is the LNG industry. The Natural Gas Act of 1938 puts exports of gas, including LNG, directly under the administration’s control. Anyone who wants to export (or import) gas needs an authorisation from the Department of Energy (DoE) declaring that the sales would be in the public interest of the US.

In January, under pressure from environmental campaigners, the administration announced a “temporary pause” on awarding authorisations for exports to countries that do not have a free trade agreement (FTA) with the US. Those non-FTA countries include most big LNG markets, such as China and EU members.

Former President Trump has said he would end that pause and restart approvals immediately on taking office. Vice President Kamala Harris’s position if she wins the election is less clear, potentially pointing to delays for LNG export projects that do not have the authorisations they need.

It seems highly likely that the pause will be lifted. But new requirements could be imposed on projects that would make securing an authorisation a slower and more complex process.

The explanation for the pause given back in January was that the Department of Energy needed to re-do the economic and environmental analyses that inform its decisions on whether or not gas export projects are in the public interest. Those analyses were last completed in 2018 and 2019. The department said it wanted updates using the most recent information on subjects such as the greenhouse gas (GHG) emissions from the LNG value chain.

This week Andrew Light, the US assistant secretary of energy for international affairs, told reporters at Singapore International Energy Week that the new economic and environmental analyses would soon be published for public comment.

Although no details of the analyses have yet been published, the DoE has given some indications of the issues that they will address. In August, it gave permission for the Altamira FLNG1 project in Mexico to export US gas to countries without an FTA. Its order highlighted issues that could potentially have led to an authorisation being withheld, including the project’s consequences for prices and for greenhouse gas (GHG) emissions.

The DoE concluded that none of those considerations was sufficiently pressing for it to block non-FTA export authorisation for Altamira FLNG1. But that authorisation was granted for just five years, when the project’s backer New Fortress Energy had sought one lasting until 2050. For future decisions, projects could be forced to jump higher hurdles to show that they would not have adverse economic and environmental impacts.

The DoE’s environmental assessment for Altamira FLNG1 argued that if the project did not go ahead, gas would instead be exported from somewhere else to meet demand. It concluded: “DoE finds it not unreasonable to assume that GHG emissions would be broadly similar [if other projects went ahead instead], and, given the global nature of climate change, would have similar incremental impacts.”

Climate campaigners want the DoE to reject that kind of thinking. They say the analysis should take a broader perspective than the GHG emissions from any individual project, and to look instead at cumulative impacts from the entire sector.

They also want the DoE to use different numbers when calculating impacts. The administration’s decision to pause authorisations was reportedly influenced by an academic paper from Cornell University’s Robert Howarth, which concluded in its final version that the full-cycle greenhouse gas emissions from US LNG are 33% higher than for coal.

That analysis has come in for intense criticism. Other studies, including ones from the DoE published in 2014 and 2019, have concluded that switching from coal to US LNG for power generation would likely cut GHG emissions. If the DoE decides to reject its own earlier analysis and accept Professor Howarth’s calculations, it would imply a much more challenging public interest test for LNG projects to secure export authorisations in the future.

If former President Trump is re-elected, all of these considerations are likely to be irrelevant. Gas export projects will be assumed to be in the public interest, and the DoE authorisation will be a rubber stamp. But if Vice President Harris wins, the DoE’s statements will be minutely scrutinised for indications of what conditions LNG projects will need to meet.

The future of US LNG argued out in court

At the same time as the administration has been taking a harder line on US LNG exports, the DC Circuit appeals court, one of the country’s most important, has also been pushing back against the industry.

Back in 2021, the court ordered the Federal Energy Regulatory Commission (FERC) to re-do the environmental analysis that underpinned its decisions to authorise two projects: NextDecade’s Rio Grande LNG and Glenfarne Energy Transition’s Texas LNG.

FERC complied, delivering new analysis that still supported approvals for the projects. But in August of this year, a panel of judges on the DC Circuit court rejected the new analysis, saying FERC had still not adequately investigated the projects’ environmental impacts. FERC announced last month that it would now prepare supplemental environmental impact assessments for Rio Grande LNG and its associated pipeline, and for Texas LNG.

This week, Rio Grande LNG filed a petition for an “en banc” review of the case by all the judges on the court, arguing that the panel’s decision conflicts with precedent and other court decisions, and “causes needless unjustified devastation”. The decision, it adds “serves only to… chill investment in complex energy infrastructure at a time when American energy independence, and the need to provide a reliable source of LNG to our allies, is a pressing foreign-policy and national-security interest.”

While the legal arguments continue, the cases create an additional source of uncertainty over the outlook for US LNG exports.

Wood Mackenzie view

This week Wood Mackenzie held its annual conference on ‘Gas, LNG and the Future of Energy’ in London. The consensus there, as summed up by Simon Flowers, our chairman and chief analyst, was that the pause in LNG export authorisations would ultimately prove to be something between “a blip” and “a speed bump” for the US industry.

Global demand for gas in general and LNG in particular is still growing, and there are very few countries able to deliver the increased supply to meet that demand. North America has a vast resource base and a well-developed upstream industry that can produce gas at low cost, positioning it as a supplier to the world. The compelling economics mean that US LNG exports – which are already on a steep near-term growth path – are likely to grow in the long term, too, whatever temporary political obstacles may crop up.

That said, the administration’s policy does have the ability to disrupt future US LNG exports for a while. Mark Bononi, Wood Mackenzie’s principal analyst for global gas and LNG asset research, has calculated that proposed US LNG projects with a total capacity of almost 90 million tons per year (mtpa) still need non-FTA export authorisations. That is roughly equivalent to the entire US LNG export capacity operational at the start of this year. Projects that have secured non-FTA export authorisations but need extensions if they cannot start shipments by the end of 2026, account for almost another 90 mtpa.

If a future Harris administration does insist on more stringent environmental conditions for LNG projects for approval, that could hold some US supply back from the market starting around 2028. This would put upward pressure on global prices.

One key test case to watch will be Woodside Louisiana LNG, the project formerly known as Driftwood LNG, which Woodside acquired when its US$1.2 billion deal for Tellurian closed earlier this month. Woodside is targeting final investment decision (FID) on a portion of the project for the first quarter of next year, allowing exports to begin by the first half of 2029. A second FID for an additional portion of the project could follow around mid-year in 2025.

However, Woodside will need an extension to the project’s authorisation for non-FTA exports for it to go ahead. The authorisation was initially awarded in 2017, with a deadline for first exports of May 2026, which is now impossible to meet.

There are some favourable indications for the project’s ability to secure that extension. Back in February, when it was still called Driftwood and owned by Tellurian, the project was granted a three-year extension of its construction permit from FERC, giving it until April 2029. Construction is under way at the site, and the DoE said in 2023 that was one of its key criteria for granting an extension. But it remains unclear exactly how the DoE will reconcile that policy on extensions with the more recently announced pause on new authorisations.

If the authorisation is extended quickly and Woodside is able to take FID early next year, that would be a sign that a Harris administration is supportive of new investment and further growth in US LNG exports. If Woodside is made to wait, or to crawl through new hoops – such as demonstrating the project’s contribution to cutting global GHG emissions, for example – it would show that US LNG exports can expect to face greater political challenges than in the past.

One other consideration is that even if former President Trump is re-elected, the shadow of uncertainty that has been creeping over the US LNG industry will not be dispelled completely. If environmental campaigners find that policy and regulation are set against them, then litigation would probably increase. Legal challenges like the action against Rio Grande LNG and Texas LNG could be the most effective way for campaigners to slow the industry’s growth.

In brief

Two important announcements have come from the US lithium industry this week, marking significant steps forward in its attempt to build a supply chain for battery raw materials that does not rely on China. First, the US Geological Survey announced that it had identified large reserves of between 5 and 19 million tons of lithium held in brines in the Smackover Formation in southwestern Arkansas. If commercially recoverable, the lithium would be enough to meet projected 2030 world demand for EV batteries nine times over.

Second, the Biden administration awarded its first approval for a US lithium mine, giving the go-ahead to a project that could supply enough of the metal for nearly 370,000 electric vehicles a year. Construction at Ioneer’s Rhyolite Ridge Lithium-Boron mine in Nevada is scheduled to start next year, with first production in 2028. The US Bureau of Land Management said the mine was essential to advancing the clean energy transition and powering the economy of the future. Further, the site could be developed while maintaining important protections for local plants and wildlife.

A court has given the US government an additional five months to draw up new regulations for protecting endangered species in the Gulf of Mexico, lifting the threat of a shutdown of oil and gas operations in the region in December. In August, a federal judge in Maryland ruled that the current regulatory framework set out by the National Marine Fisheries Service (NMFS), known as the Biological Opinion or BiOp, underestimated the risk and harms of oil spills to protected species, and would be vacated in December. Companies working in the US Gulf of Mexico are free to operate without risk of fines or sanctions for incidental harm to endangered species, providing they work within the BiOp. If the BiOp is vacated, operators will be exposed to legal risks, and some have said they would be forced to stop all activity in the Gulf of Mexico. Now the NMFS has been given until 21 May 2025 to produce a new BiOp that will address the court’s concerns.

Wood Mackenzie’s Miles Sasser, a senior research analyst, said: “The timeframe is still tight, and uncertainty remains, but this was the industry’s desired outcome in the short term as other legal routes brought their own timeline risks and potential disruptions.”

The US Treasury has published final details of eligibility for the 45X Advanced Manufacturing Production Credit. The credit is intended to encourage US companies to onshore production of energy technologies, including solar and wind components, batteries and critical minerals. The big surprise in the final rules was a change from the initially proposed version to allow critical minerals mining operations to be eligible.

Other views

Getting China back on track – Simon Flowers and others

Gastech 2024: Our top three takeaways – Bob Kubis, Kateryna Filippenko and Eugene Kim

What we learned from conversations with power and renewables investors in 2024 – Prashant Khorana

What could further trade actions mean for the US solar supply chain? – Michelle Davis

Global competitiveness of renewable LCOE continues to accelerate

Europe’s electric vehicle woes are a lesson for EVs everywhere – Kate Aronoff

Would Trump throw EV machinery into reverse? Not easily – Kyle Stock

UNEP: New climate pledges need ‘quantum leap’ in ambition to deliver Paris goals – Zeke Hausfather

Utilities’ hidden clean energy tax is at the heart of our energy challenges – Ari Peskoe

Quote of the week

“We saw during the first [peace] summit that there could be a decision on energy security. In other words: we do not attack their energy infrastructures, they don’t attack ours. Could this lead to the end of the war’s hot phase? I think so.”

Volodymyr Zelenskyy, president of Ukraine, told journalists in Kyiv that an end to attacks on power plants and oil facilities could be a first step towards ending the war with Russia.

Chart of the week

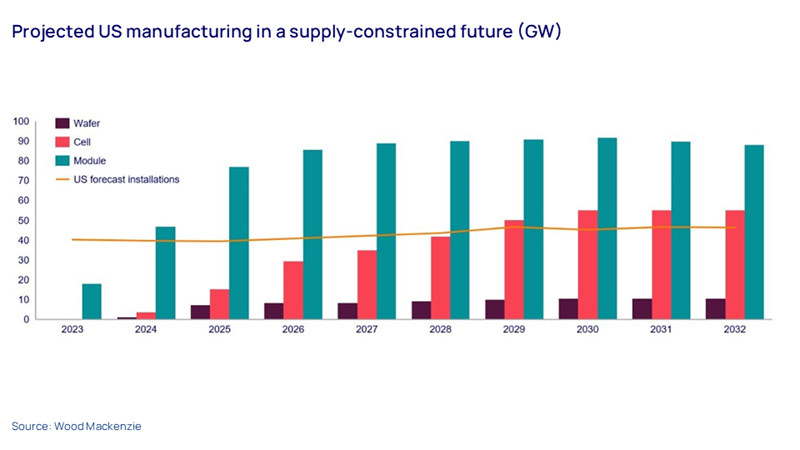

This comes from a new note by Wood Mackenzie’s head of global solar Michelle Davis, titled: What could further trade actions mean for the US solar supply chain? It shows projections for US installations of solar power and manufacturing capacity in the supply chain in a world in which imports are constrained by increased trade barriers. The bars represent manufacturing capacity, and the gold line shows demand for modules. You can see that in this world, module manufacturing capacity grows rapidly, exceeding installations by next year, and remains high into the 2030s. Cell production capacity lags behind, but also exceeds domestic installations by the end of the decade.

However, solar installations are lower in this world with less imported equipment. Davis comments: “If the US enacts more protectionist measures that ultimately limit solar imports, it will likely increase domestic solar supply chain growth. But it will also cause market havoc, increase equipment prices and potentially delay, if not jeopardize, solar project viability.”

Take a look at the full report for a lot more detail and context.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.