Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Unplanned solar plant repairs to cost industry $16 billion over next 6 years

1 minute read

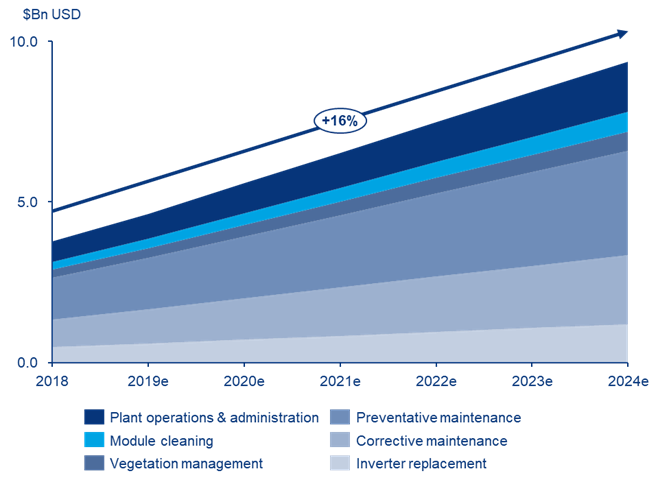

Annual solar plant operations and maintenance (O&M) costs will grow from nearly $4.5 billion in 2019 to just over $9 billion in 2024. This increase is due to future demand growth and current installed capacity. Unplanned repairs alone can cost owners up to $3,000/MW/year, based on an average-sized solar power system of 50MW, according to new research from Wood Mackenzie.

Global solar demand on the rise

After a modest decline in 2018, the global solar market will reach a new annual high of 114.5GW in 2019 – up 18% from the previous year. Annual installations will sit at 120-125 GW in the early 2020s as emerging markets begin to deliver results. Global cumulative solar PV installations are expected to grow from ~500GWdc in 2018 to 1,243 GWdc by 2024. China, India and the US concentrate more than 50% of global solar PV installations to 2024, making both APAC and North America the most attractive regions within the solar O&M segment.

Solar installations nearing inverter end of life will reach 21GW by the end of 2019, representing 3.4% of the global market. This increases to more than 14% of the total cumulative capacity over the following five years. By 2024, Wood Mackenzie expects the solar industry to have 176GW of projects with inverters older than ten years.

Despite being the most significant and major component of a solar project, replacement of a solar inverter represents only 12-13% of the average O&M cost of a ~50MW solar power system. By 2024, inverter replacement costs alone will reach nearly $1.2 billion out of a total O&M opportunity of $9.4 billion. Other areas that have a significant impact on costs are regular preventative maintenance and corrective repairs, representing 35% and 24% respectively.

Digital technology to optimise solar market

"Solar technology has greatly improved technician utilisation ratios over the last few years. Previously, one technician would be able to service 20MW of solar capacity. Global downward price pressures have driven the implementation of automated solutions and digital platforms, making it possible for technicians to service from 40MW-60MW of solar capacity – more than doubling their efficiency in some cases.

“As asset owners and operators continue to invest in advanced analytics and O&M specific software, and move from more time-consuming methods of spreadsheet-based analytics, operational costs will be reduced and higher data quality achieved," said Leila Garcia da Fonseca, Wood Mackenzie Principal Analyst.

Getting all systems to speak same language will be challenging

Solar plant management is often erroneously assumed to be simplistic when compared to other generation technologies.

“Everything looks beautiful on paper until questions arise about how beneficial these systems can be after the plant asset managers realise they aren’t able to communicate with the existing data structure. This is especially true in older solar projects where components are not sophisticated enough to handle multiple communication protocols. Therefore, there is little benefit to implementing costly, state-of-the-art advanced analytics platforms on older equipment.

“Although a significant portion of solar PV projects have a monitoring system implemented, few are synced in real-time with diagnostics tools in place. Even fewer conduct basic periodical performance assessments. Ideally, asset owners would have all operations running autonomously and linked to an Enterprise Resource Planning System (ERP). However, an end-to-end digital platform is not yet a reality. Asset operators might deploy some of the digital solutions available but have yet to use this advanced of a digital ecosystem,” added Ms. Garcia da Fonseca.

Is investment in a digital platform worth it?

The future is undoubtedly digital. Nevertheless, not all facilities and asset owners are ready to implement digital solutions.

“It doesn’t make sense for owners of projects close to end-of-life to deploy an expensive and intelligent platform. It wouldn’t make sense technically, nor commercially, as the data acquisition system might not support all digital system requirements. The economics just don’t add up.

“In order for big data adoption to ramp up, two things need to happen. Asset owners must realise the benefits a digital platform can bring to their asset management tasks. Additionally, results from systems with established advanced analytics must be more widespread among the industry,” concluded Ms. Garcia da Fonseca.