Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

The plastics industry must go under the knife for a more sustainable future

Tough action required to future-proof industry and safeguard further capital investment

1 minute read

Stemming the flow of plastics into the environment will need ‘more than a nip and tuck approach’ if the world is to reach peak plastic and meet the net zero challenge, says Wood Mackenzie, a Verisk business (Nasdaq: VRSK).

After 50 years of carefree consumption, urgent transformation is needed to negate large-scale greenhouse gases (GHG) being emitted annually by the sector into the global atmosphere. In 2021, the plastics industry will produce 1.2 gigatonnes (GT) of carbon dioxide equivalent (CO2eq). At the same time, emissions from the industry are set to rise by 90% over the next three decades as demand for plastic products increases.

Andrew Brown, head of polymer demand at Wood Mackenzie, said: “Plastic has been a complete gamechanger over the past 50 years. It has become a vital part of everyday life and is now pivotal to the energy transition.

“However, the balance has shifted too far towards low-cost, disposable plastics, which cause environmental damage at every stage in their life cycle, and it needs more than a nip and tuck approach to address this.”

Items from polyester clothes to plastic bottles and supermarket shrink-wrap are most publicly recognised as villains of the plastics industry, with the average human currently consuming approximately 50kg of plastic annually. However, new research released today by Wood Mackenzie explores the need to create a plastics value chain with more sustainable practices across production, waste collection, recycling and lower-carbon, renewable feedstocks.

The methodology uses a scenario to identify where the industry can act to reduce its environmental footprint while continuing to deliver essential products and services supported by the plastics economy.

The results show that the industry can deliver a “peak plastic” future, in which demand growth moderates and consumption of fossil fuel feedstocks declines. The model shows:

- Carbon emissions returning to around 1 GT by 2050, peaking at 1.45 GT in 2035, compared to emissions of nearly 2 GT in 2050 in the base case scenario; and a total saving of 8 GT over the next 30 years under peak plastic.

- Mismanaged waste down by 45% versus the base case, saving 1 billion tonnes of plastic waste going into the environment, open burning or unsanitary dumps over the next three decades.

However, without any offsets, the scenario shows the sector producing 1 GT of emissions in 2050, while tens of millions of tonnes of poorly managed waste would continue to flow into the environment.

Wood Mackenzie suggests positive results can be delivered with a regime of diversifying traditional fossil fuel feedstocks, minimising the carbon footprint of plastic production and investment in cleaning up the waste chain. The consequence of failing to do so could jeopardise future capital investment for businesses and risk social license to operate.

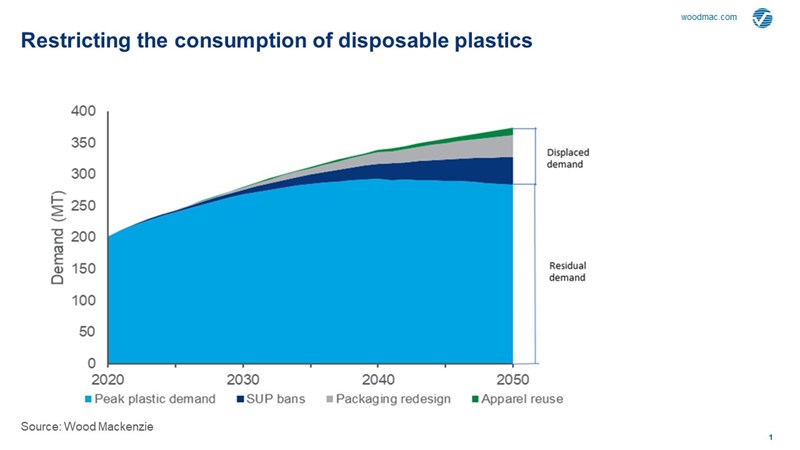

Brown said: “An important first step to improving the sector’s footprint is to restrict our appetite for the convenience of disposable plastics in fast-moving sectors of the economy. Under our peak plastic scenario, business models that seek to eliminate plastic, substitute it for other materials, or develop innovative re-use models displace 90 million tonnes (MT) of polymers in packaging, apparel, retail and hospitality in 2050, corresponding to 13% of all plastic demand and a quarter of plastics demand in these sectors.”

Seeking renewable inputs to meet the remaining demand remains a challenge. The ongoing extraction of fossil fuels – which account for 85% of plastic feedstocks today - contributes to GHG emissions and a linear business model that results in a stock of plastic waste abandoned to the environment.

Sandheep Sebastian, senior data scientist, said: “There are a host of greener feedstock options being considered which have superior environmental profiles.

“These include making plastics from bio-feedstocks, from waste and by combining captured carbon with low-carbon hydrogen.

“But most fundamentally, producing plastic from waste through mechanical and chemical recycling simultaneously addresses both carbon emissions and plastic waste.”

He added: “While restricting fossil fuel materials will not lead to a healthier industry overnight, it has the potential to be transformative in the medium term. In our peak plastic scenario, renewable feedstocks account for 25% of base chemical production by 2050 – up from less than 2% today – with oil demand into the petrochemical sector going into decline from 2035.

“However, substantial investment and research and development is required to build up scale in these alternative feedstocks.”

The research also looked at what the 30 largest plastic producing companies have committed to do to address their environmental footprints. The biggest areas of focus are on shifting to lower-carbon energy inputs and driving operational efficiencies. Only four out of the 30 mentioned Scope 3 (the emissions in their supply chain, particularly associated with what happens to the plastic they have produced) in their carbon commitments.

Head of intermediates and applications, Guy Bailey, said: “While leading petrochemical companies should be applauded for taking steps to address the impact of their products, current commitments are – in aggregate – insufficient to the scale of the problem, and lacking in detail for how they will be implemented.

“Companies that fail to address governments’ climate and recycling targets risk pariah status amongst investors and the consumer brands that use their plastic. However, organisations that take the lead and act now will come out of this ahead of the pack with a more stable and sustainable future.”