Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

The oil industry nervously stands by: Tariff uncertainty and price volatility are threats to supply, investment and the service sector

The global oil industry has been bracing for a crisis since oil prices fell below US$60 per barrel (/bbl), a level unseen since 2021. Producers are preparing for potential further declines, with investment in the US Lower 48 tight oil sector particularly responsive.

3 minute read

Producers are preparing for potential further declines, with investment in the US Lower 48 tight oil sector particularly responsive. If prices plummet to US$50/bbl, up to 1.2 million barrels per day could be at risk by 2026. Wood Mackenzie’s report, "Is oil price volatility a threat to upstream production, investment and supply chains?" offers an in-depth analysis of the far-reaching consequences of ongoing market disruptions and geopolitical events on upstream production, investment and supply chains.

"The oil industry has ingrained institutional knowledge from the price crashes in 2015 and 2020 and is ready to act swiftly in a downturn. While the US administration targets both lower prices and ‘Drill, baby, drill’, we’re more likely to see ‘Delay, baby, delay’”, said Fraser McKay, Head of Upstream Analysis at Wood Mackenzie. “If operators and the supply chain anticipate a period of prolonged low prices, it would send shockwaves through the industry. This near-term uncertainty becomes an investment killer, precisely when the focus should be on potential long-term demand growth.”

An industry on edge

Wood Mackenzie's report paints a picture of an industry caught between increasing surety about longer-term demand for its products, but excess supply and uncertainty in the near term.

- Current prices hurt but don't wound: at US$65/bbl, margins are dented but not enough to force dramatic budget or development plan changes. Companies are likely to delay growth capex and discretionary spending to preserve financial leverage and shareholder distributions. This approach is possible due to increased portfolio and balance sheet flexibility built in since 2021.

- The supply chain is bracing for impact: the service sector is preparing for potentially reduced activity and downward pressure on costs. But tariffs could drive up the sector’s input costs, forcing service companies to choose between market share and margin erosion in well-supplied markets. Depending on how the situation evolves, tariffs could increase costs in the US by up to 6% onshore and 15% offshore.

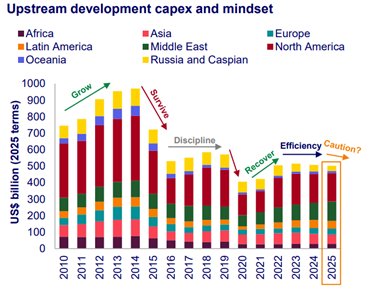

- Investment uncertainty: near-term oil demand and OPEC+ market strategy concerns have caused oil and gas company share prices to tumble. Capital allocation decisions are always harder when prices, costs and cash flow look volatile. Consequently, we anticipate a year-on-year decline in global upstream development spend for the first time since 2020.

Ryan Duman, Director of Americas Upstream at Wood Mackenzie adds, “US tight oil operators would be among the first to curb investment if prices slide further, given their inherent activity flexibility. But international projects are also feeling the pinch, with some already facing delays and budget revisions. More significant budgetary action would occur if oil settled below US$60/bbl for a month or longer. A drop towards or below US$50/bbl would prompt decisive action from most operators.”

Upstream spend likely to fall in 2025, for the first time since 2020

Source: Wood Mackenzie Lens Upstream’s asset-by-asset global database, all investment levels and changes shown in 2025 terms, previously modelled 2025 estimate shown.

McKay concludes, “2025 was already shaping up to be a cautious year for major oil projects, but the US’ tariffs have created a chain of consequences which will lead to decision paralysis for some, funding or cash flow concerns for others and for just a few, an opportunity to benefit from cost or scheduling arbitrage.” He continued “What is very clear, is that if prices were to fall towards US$50/bbl, companies would quickly cut investment budgets to protect shareholder distributions. The longer the industry holds its collective breath, the harder supplying demand in a delayed energy transition will be, setting the sector up for yet more volatility.”

Read the entire report here.

For further information please contact Wood Mackenzie’s media relations team.