Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Russia-Ukraine war could slow global economic growth to 2.5% this year

World economy could become more regionalised

1 minute read

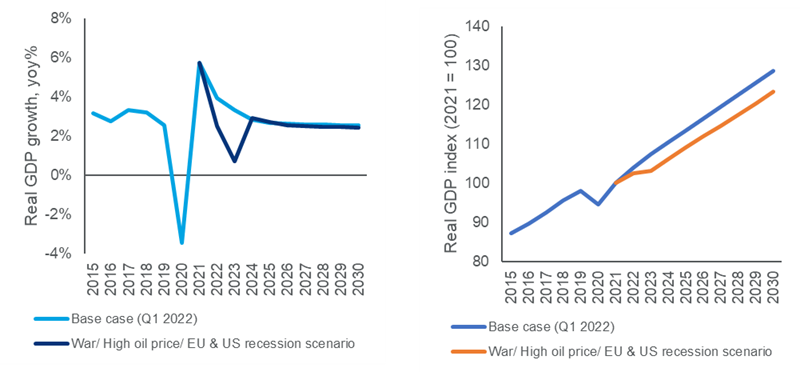

Global economic growth could slow to 2.5% year-on-year in 2022 and 0.7% in 2023 due to the Russia-Ukraine war, says Wood Mackenzie, a Verisk business (Nasdaq:VRSK).

The company has produced a downside scenario for the global economy assuming large spill-over effects from the Russia-Ukraine conflict through transmission channels and markets, some interruption of energy and commodity flows, an energy price shock causing recessions in the EU and US and pro-cyclical policy missteps exacerbating matters.

Research director Peter Martin said: “Energy and commodity prices could fall as the global economic downturn takes hold and the EU and US recessions bottom out after four to six quarters when consumption hits its nadir. The lag in reaching the bottom of the economic cycle sees the global economy take a bigger hit, relative to the base case, in 2023 compared to 2022. This means global economic growth could slow to 2.5% this year and 0.7% next year.”

In the scenario, Russia partially defaults on sovereign debt worth US$480 billion with contagion effects for the European banking system. However, this pales in comparison to the Euro crisis in 2011/12 and banks are now better capitalised to weather losses.

Conversely, a sharp rise in energy and food prices hurts industry, destroys demand and erodes consumer purchasing power. Global business confidence deteriorates and investment contracts. Wages are frozen before unemployment eventually rises and consumption falls further. Concerned about inflation, major central banks persist with monetary policy tightening into the recession and fiscal support is inadequate.

Martin said: “For Russia, the total economic impact will be a function of the duration and ultimate stringency of the sanctions, which will not be lifted until a resolution to the conflict is reached. We think a 15% decline in Russia’s GDP this year is possible. Over the medium term, however, Russia’s economy will be forced to rebalance and restructure.”

While western allies have since imposed the most stringent sanctions Russia has ever faced, it is worth noting that the country’s official reserve asset cushion is significant with international foreign exchange and gold reserves totalling US$640 billion in February, equivalent to 40% of GDP in 2021. But as much as half of Russia’s reserve assets are inaccessible by virtue of sanctions on overseas holdings. Assets held domestically can be utilised, including US$130 billion in gold reserves.

Martin said: “It is possible that deep recessions in Russia and Ukraine this year could have only a modest impact on the global economy as they account for less than 2% of global GDP. The direct impact on other countries will depend on trade and financial links and their reliance on Russian commodities.

“More importantly, the global economy could be looking at more permanent changes. If the Covid-19 pandemic highlighted a need to shorten supply chains, the war in Ukraine underscores the importance to have reliable trading partners. These forces could lead to a lasting realignment of global trade. The global economy becomes more regionalised — shorter supply chains with ‘reliable’ partners. It is not the end of globalisation, but global trade could reorganise into two or more distinct blocs.

“In the short term, regionalisation could reduce efficiency, increase transaction costs and prolong higher inflation. It could also weigh on productivity growth over the longer term. If so, our downside scenario would see the global economy suffer a sustained loss of output.”