Get in touch

-

Sonia KerrSonia.kerr@woodmac.com

+44 330 174 7267 -

Kevin Baxterkevin.baxter@woodmac.com

+44 408 809922 -

Vivien LebbonVivien.lebbon@woodmac.com

+44 330 174 7486 -

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Despite demand fluctuations, the global wind turbine supply chain is racing towards a $600 billion cumulative opportunity by the end of 2028.

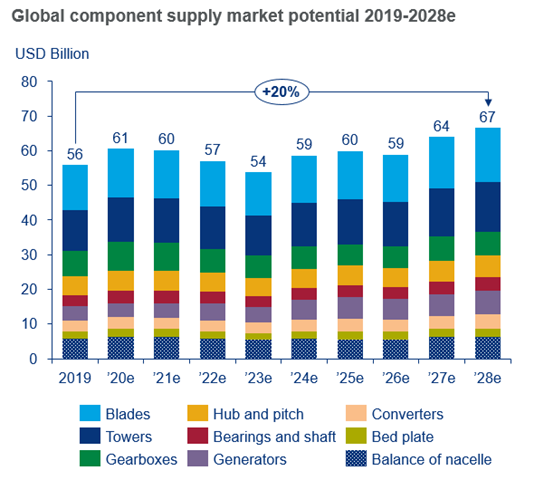

According to new analysis from Wood Mackenzie, annual average wind turbine supply is forecast to hit $60 billion between 2020 and 2028 - reflecting an increase of 8% compared to 2019.

Higher average turbine prices and a 20% growth in offshore demand reflect a 37% uptick in supply chain potential, representing a cumulative value of $222 billion by 2028. Strategic capital components, such as blades and towers, present a $25 billion cumulative opportunity by themselves.

Despite a healthy outlook for the wind turbine supply chain over the next decade, the coronavirus presents near-term hurdles for the industry.

More than 44GW of combined peak wind demand in the US and China is expected to strain the wind supply chain in 2020. Additionally, a shortage of several critical components has been further exacerbated by the coronavirus crisis.

“A rush in installation activity has caused a shortage of blades and bearings. The coronavirus has jeopardised approximately 10-15% of production volumes in China, Spain and Italy. However, Chinese companies resumed production in early March, resulting in a downgrade of only 3GW for 2020 installations.

"Just over $6 billion worth of turbines and component supply production is already jeopardised in Q1 2020. The coronavirus impact could worsen this if facilities continue to face delays in resuming production.

“Turbine OEMs and suppliers can mitigate the impact by increasing manufacturing during the latter part of the year and relocating supply to other markets, such as India and Mexico,” said Shashi Barla, Wood Mackenzie Principal Analyst.

US PTC phaseout post-2020 will spur demand for nearly 5,000 wind towers in 2020, compelling turbine OEMs to increase tower imports into the US despite anti-dumping duties.

US tower imports from Canada, Indonesia, South Korea and Vietnam surpassed a combined total of $900 million over the past six years.

"The US Department of Commerce slapped preliminary anti-dumping rates on these four countries in 2020, ranging from 5.04% to 65.96%, to create a level playing field for domestic tower suppliers.

"A surge in demand will force turbine OEMs to continue imports into the US, incurring additional import duty costs between $60-90 million in 2020. Turbine OEMs will be forced to absorb the additional costs and renegotiate contracts with asset owners,” added Barla.