Risk appetite returns as global upstream investment picks up

Deepwater oil projects back in fashion – is LNG next?

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Why upstream companies might break their capital discipline rules

-

The Edge

Walking Japan’s energy tightrope

-

The Edge

No country for oil men (and women)

-

The Edge

Battery energy storage comes of age

-

The Edge

CCUS’s breakthrough year

-

The Edge

Five themes shaping the energy world in 2025

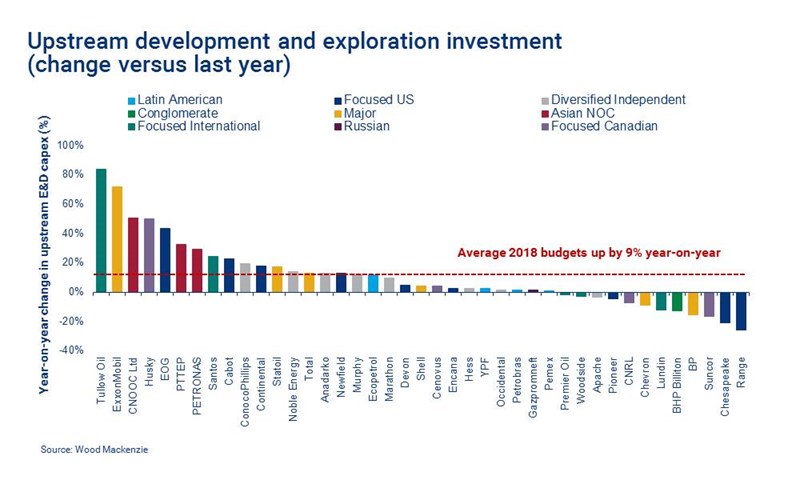

Investment is making a comeback.

Much of the action, as ever, is in the US Lower 48, with operators responding to higher prices by upping 2018 budgets by 15-20%. But there’s stuff happening, too, in the big wide world beyond onshore USA.

Our upstream team, led by senior analysts Jessica Brewer and Angus Rodger, shows that there’s something of a broad-based global recovery in investment underway.

Conventional operators' budgets will rise by around 5% in 2018 another – a big ramp-up in final investment decisions last year sowed the seeds.

‘Class of 2017’ had 32 new projects, with reserves of 12 billion boe, split 50:50 oil to gas, versus 14 in 2016 and just 9 in 2015. There’s momentum building, but there are nuances to this recovery as the industry treads warily in this tricky commodity and financial climate.

First, projects are getting ever smaller.

Spend per project sanctioned in 2017 averages US$2.7 billion and reserves per project averaged 376 million bbls, both the lowest in a decade. Operators are achieving hurdle rates by narrowing project scope and by focusing on brownfield projects or those near infrastructure. Norway’s return to international competitiveness with 8 FIDs in 2017 and average project reserves of 187 million boe is a case in point.

The big question is whether the industry is spending enough. Total volumes of oil reserves in sanctioned projects averaged less than 5 billion bbls over the last three years.

In effect, that's a 29% ‘replacement rate’ of annual non-OPEC production of 16 billion bbls outside the US Lower 48 another – less than half the rate for the six years prior to the downturn.

The world has changed, of course, with the arrival of tight oil; fewer conventional projects may be needed in the coming years. But the decline at the very least highlights the challenge for IOCs and NOCs which lack exposure to Permian growth to sustain a conventional-oriented business.

Second, there are signs of risk appetite resurfacing.

The industry has been risk-averse since 2014. Capital designated for the 12 billion boe of reserves sanctioned in 2016 was channelled into just a few geographies, mainly to onshore projects and big domestic gas developments with low oil price sensitivity and very stable cash flow profiles.

Similar volumes of reserves were sanctioned in 2017, but the target of investment was very different. There was a much wider range of geographies, a shift back into deepwater projects, and oil has become a much higher proportion of the mix.

The halving of global deepwater development costs in three years to an average of just US$8/boe is a key factor.

The world-class reservoirs of the giant Libra (Brazil) and Liza (Guyana) projects is another – these two phased developments have some of the lowest NPV,15 breakevens among new projects and are competitive with US tight oil. Latin America is back on the greenfield investment map after a two-year absence.

Commitment to new investment varies widely among companies, depending where they are in the investment cycle and balance sheet strength.

ExxonMobil is at the aggressive end in 2018, entering a new phase of organic investment expected to stretch well into next decade. Few IOCs or NOCs have a hopper with such breadth and depth, so it may be too early to herald the start of a new cycle.

And what will be different in 2018? We reckon we’ll see more of this measured approach to risk.

NPV,15 breakeven costs for our suite of pre-FIDs in the mix for sanction this year average US$44/bbl, 15% below the ‘Class of 2017’. This should fuel upward of 30 FIDs again, and bring yet more diversity of project type and resource theme.

LNG markets have tightened on strong demand. With no major greenfield FIDs since Icthys in 2012, there’s an outside chance this could be the year a big project gets the go-ahead. That really would signal a new cycle is underway.