Sign up today to get the best of our expert insight in your inbox.

How the energy crisis is a boon for hydrogen exporters

Green projects dominate investment

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

What next for East Med gas?

-

The Edge

Why upstream companies might break their capital discipline rules

-

The Edge

Walking Japan’s energy tightrope

-

The Edge

No country for oil men (and women)

-

The Edge

Battery energy storage comes of age

-

The Edge

CCUS’s breakthrough year

The world won’t get to net zero by 2050 without low-carbon hydrogen. This super-versatile energy carrier will have a critical role in decarbonising hard-to-abate, high-emissions sectors including power, steel and fertiliser. It can also be part of the solution for countries reliant on imported oil, gas and coal to bolster energy security.

Our Hydrogen Conference on 27 and 28 April in London will examine the big themes in detail. Among these is the US$1.4 trillion growth opportunity: how low-carbon hydrogen production, blue and green, scales up from almost zero today to 0.5 Bt, meeting 15% of the global primary energy mix by 2050. That’s what needs to happen in AET-1.5, our accelerated energy transition scenario to get the world on a 1.5 °C pathway. Bridget van Dorsten, Hydrogen Analyst, is speaking at the conference and took me through her latest thoughts on how the industry is developing.

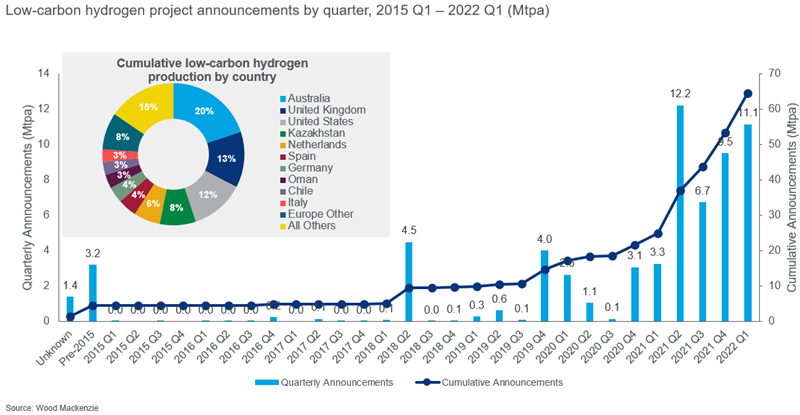

First, global investment in low-carbon hydrogen supply is ramping up. There were 75 new project announcements in Q1, totalling 11.1 mmtpa of new capacity, close to a quarterly record. The US (51%) dominated the Q1 project announcements, while Spain (20%), Paraguay (11%) and Egypt (8%) give a sense of how hydrogen is going global.

These new projects lifted the cumulative global pipeline by 20% to 64 mmtpa, of which almost two-thirds are in the six leading countries including Australia, the UK, the US and the Netherlands.

Green hydrogen, electrolysed from water using renewable electricity, has long dominated the project pipeline, accounting for 80% of all projects from 2018 to 2021. Blue hydrogen, produced by splitting natural gas into hydrogen and CO2 and fitted with carbon capture and storage, has accounted for the rest.

Q1 2022 saw an intriguing shift with green hydrogen projects accounting for 95% of those added to the project pipeline, with blue hydrogen just 5%. This may prove to be a quirk of the flow of projects reaching investment decisions in Q1. But the slowdown in blue hydrogen investment will set alarm bells ringing for CCS developers, particularly in Europe where half of all current CCS projects are for blue hydrogen use cases.

Second, the energy crisis will stimulate international trade in hydrogen. Hydrogen is central to Europe’s future energy mix, even more so as it pivots away from dependence on imported Russian gas following the war in Ukraine. But elevated gas and power prices over the next several years threaten to weaken the economics of blue and green hydrogen in Europe. The result will be less investment and a deficit in the domestic hydrogen projects required to strengthen Europe’s energy security.

Europe’s loss will be hydrogen exporters’ gain. Producers in markets with relatively stable gas and power prices and lower costs of production – including the Middle East, North Africa, Australia and the US – will be among the winners.

Third, electrolyser vendors are moving quickly to build “gigafactory”-scale facilities, but the size of the prize keeps moving up. Vendors have a project backlog of 45 GWel whereas current manufacturing capacity will only support 14 GWel annually by 2023. We think such mismatches are typical of any nascent industry.

Concrete policy will lift the bar further. The UK government recently announced a doubling of its hydrogen capacity target from 5 GW to 10 GW. That also sends a strong signal for the domestic supply chain to put down roots.

Fourth, policy globally is laying the foundations for growth. COP26 last November was the catalyst for countries to set net zero targets and for many, hydrogen is becoming a central part of the delivery. More than 75 governments have now announced hydrogen plans, roadmaps, strategies and goals at various stages of development. India (expansion of hydrogen policy), Croatia (roadmap), Peru (roadmap development) and Denmark (roadmap clarification) all advanced a hydrogen policy in Q1 2022.

Lastly, offtake agreements are helping the early-stage financing of the industry and are vital to de-risking projects. In one of the biggest agreements so far, Australia-based Fortescue Future Industries and German utility E.ON signed an MoU to deliver 5 Mtpa by 2030. We expect offtake agreements to proliferate and for commercial arrangements to evolve into long-term contracts as the industry matures.