Sign up today to get the best of our expert insight in your inbox.

Big Oil: upstream M&A gets serious

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

View Simon Flowers's full profileGreig Aitken

Director, Corporate Research

Greig Aitken

Director, Corporate Research

With over 12 years of experience, Greig brings a holistic view of corporate activity to the upstream M&A research team.

View Greig Aitken's full profileAlex Beeker

Research Director, Corporate Research

Alex Beeker

Research Director, Corporate Research

Alex is a research director on our Corporate Research team, focused on the Majors and US Independents.

Latest articles by Alex

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

Chesapeake-Southwestern Energy deal: ten key takeaways

-

Opinion

What does the Chevron-Hess deal mean for oil and gas?

-

The Edge

Big Oil: upstream M&A gets serious

-

Opinion

Lower 48 midstream not immune to oil price volatility

David Clark

Vice President, Corporate Research

David Clark

Vice President, Corporate Research

Latest articles by David

-

Opinion

What does the Chevron-Hess deal mean for oil and gas?

-

The Edge

Big Oil: upstream M&A gets serious

-

Opinion

The making of a Megamajor – ExxonMobil acquires Pioneer Natural Resources

-

Opinion

A new tight oil powerhouse: Permian Resources and Earthstone create a new large-cap US E&P

-

Editorial

US Independents: cash is king in “stay flat” mode

Tom Ellacott

Senior Vice President, Corporate Research

Tom Ellacott

Senior Vice President, Corporate Research

Tom leads our corporate thought leadership, drawing on more than 20 years' industry knowledge.

Latest articles by Tom

-

Featured

Corporate oil & gas 2025 outlook

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

Can ExxonMobil make attractive returns from its US CCUS portfolio?

-

Opinion

How do integrated companies position themselves in the changing downstream landscape?

-

The Edge

How and why big oil is strengthening its oil and gas exposure

Luke Parker

Vice President, Corporate Research

Luke Parker

Vice President, Corporate Research

Luke is Vice President of Corporate Research with a specific focus on the Supermajors.

Latest articles by Luke

-

Opinion

Video | Shell and Equinor announce UK asset merger to create new JV

-

Opinion

Beyond ESG: measuring corporate sustainability in an uncertain world

-

The Edge

Big Oil: upstream M&A gets serious

-

Opinion

Are NOCs prepared for the energy transition?

-

The Edge

How NOCs compare with IOCs on energy transition strategy

-

Featured

How can Big Oil stay investible through the energy transition?

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

The Edge

Why upstream companies might break their capital discipline rules

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

Global upstream update: oil supply questions and portfolio resets

-

The Edge

What’s driving the upstream revival in Southeast Asia?

-

Opinion

Global upstream update: UK fiscal woes, Major exploration and Latin American promise

-

The Edge

How higher interest rates could hold up energy transition investment

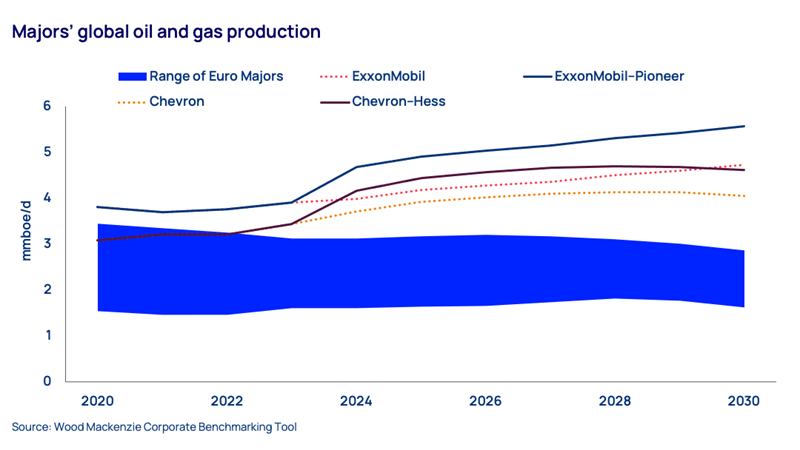

ExxonMobil’s and Chevron’s belief in the durability of upstream could hardly be better demonstrated by the game-changing acquisitions of two flagship US Independents. It’s a pivotal moment for the sector and widens the strategic gulf with the Euro Majors. Here are our team’s thoughts.

First, what drove these deals?

Previous large-scale consolidation has typically been in downturns and/or opportunistic. This time, the industry is in an upcycle and one in which investors value scale. The stock market re-rating over the last two years rewarded ExxonMobil and Chevron with premium-rated equity currency to fund all-stock acquisitions – a less risky proposition in volatile commodity markets than leveraging the balance sheet. These were friendly takeovers of companies trading near all-time highs.

The deals have striking similarities other than routine cost synergies. These include the scale and quality of the acquired assets, which may even serve to strengthen the buyers’ stock market ratings. They have bought advantaged barrels, with deal value driven by oil. The sustained growth in production in each broadly mirrors the trajectory to peak global liquids demand that Wood Mackenzie forecasts for the early 2030s.

The impact of the acquisitions is transformational for ExxonMobil and Chevron’s long-term cash flow profile. We estimate that the two US Majors combined will generate more than half the total free cash flow of the seven Majors by the mid-2030s in our base case oil price forecasts.

Chevron’s acquisition of Hess diversifies a portfolio that is overly concentrated in the Permian, Australia and Kazakhstan. It also adds the Bakken to Chevron’s Lower 48 positions and provides more exposure to the deepwater Gulf of Mexico. But Hess’s giant Guyana oil discoveries are the jewel in the crown: the 30% stake in the Stabroek block could contribute over 10% of Chevron’s total production next decade. In contrast, absorbing Pioneer makes ExxonMobil’s upstream portfolio the most concentrated of the Majors, though the increased risk is minimal within the wider, integrated business.

Second, what’s the message on sustainability?

ExxonMobil and Chevron will remain among the highest-rated IOCs in WoodMac’s Resilience and Sustainability ratings, CoRSI. The two acquisitions add high-margin, low-emissions oil with a long runway, boosting sustainability. ExxonMobil has committed to accelerating Pioneer’s targets for Permian scope 1 and 2 net zero emissions.

The elephant in the room is what the acquisitions mean for ExxonMobil’s and Chevron’s scope 3 net zero targets. Doubling down on upstream ramps up the future challenge of scope 3 emissions, particularly in the event of an accelerated transition. It’s not such a big deal today when the short-term political focus is on energy security; things may be very different early next decade.

Thirdly, what can Euro Majors do in response?

Like-for-like M&A would pose significant challenges. The opportunity set for corporate acquisitions isn’t exclusively US-listed Independents, but there’s not much else globally that could move the needle if they wanted to do so – and two of the best US targets have now gone. The Euro Majors lack the synergies US Majors bring to US Independents, and European-based shareholders are likely to be less enthused than their US counterparts. Most importantly, the Euro Majors lack the highly rated equity to do all-stock deals. A debt-funded acquisition that stretches the balance sheet is a non-starter in the current environment.

A lower-key alternative is business as usual. TotalEnergies and Eni have made a good fist of building upstream through exploration success and smaller-scale M&A over several years and can continue to do so.

The spotlight will be on BP’s and Shell’s response in the coming months. Each has a new CEO (BP’s pending) and both companies have signalled earlier this year an intention to lean back into oil and gas, prolonging production.

The focus for all oil and gas companies, ultimately, has to be value creation rather than size. A specific goal for the Euro Majors is to narrow and even close the structural valuation gap to their premium-rated US peers. Large-scale M&A might be the answer to achieving both, but the odds are heavily stacked against it. Mega-mergers seem too giant a leap with the transition pathway so uncertain and European corporate cultures still diverse.

Absent an innovative breakthrough to a US listing and the expected premium rating that could bring, the ‘business as usual’ route is the likely way forward for the Euro Majors. No transformational acquisitions, but incremental M&A with more investment in exploration and development – and, at all times, keeping a tight rein on capital discipline.

Thanks to: Greig Aitken, Alex Beeker, David Clark, Tom Ellacott and Luke Parker (Corporate Analysis) and Fraser McKay (Upstream).

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world. Sign up today using the form at the top of the page to get The Edge delivered to your inbox.