US solar: full benefits of the Inflation Reduction Act are yet to materialize

Domestic manufacturing announcements have exploded, but developing solar projects are on pause pending clarity on various IRA provisions

4 minute read

Michelle Davis

Head of Global Solar

Michelle Davis

Head of Global Solar

Michelle leads our solar research, identifying emerging industry themes and cultivating a team of solar thought leaders.

Latest articles by Michelle

-

Opinion

What could further trade actions mean for the US solar supply chain?

-

Opinion

Sunny skies ahead: the solar market and supply chain in 2024 and beyond

-

Opinion

Our top takeaways from the Solar & Energy Storage Summit 2024

-

Opinion

The US solar industry is off to a strong start in the first quarter

-

Opinion

Is the IRA paying off for the US solar supply chain?

-

Opinion

US solar shattered records in 2023, but will this continue in 2024?

The US solar industry has had a strong first half of the year, installing 12 GWdc. Delayed projects from 2022 continue to come online as imports of solar modules continue to rise. The US is still navigating several trade policy issues, but it’s clear that the industry’s efforts to adapt its supply chains are paying off.

August marked one year since the passage of the Inflation Reduction Act (IRA), one of the most historic pieces of federal legislation for the clean energy industry. In our US Solar Market Insight Q3 2023 report, created in collaboration with the Solar Energy Industries Association (SEIA), we highlight the impacts of the legislation thus far, and what the industry is still waiting for clarity on.

Fill in the form for a complimentary copy of the 15-page executive summary. Or read on for some key highlights.

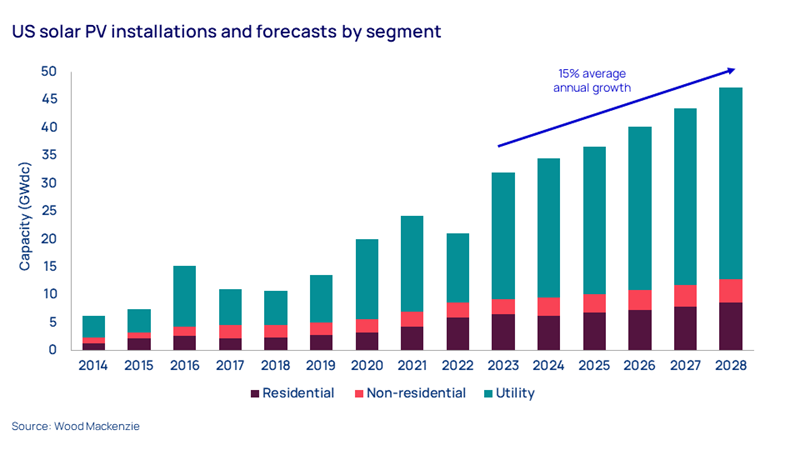

Second-quarter solar installations reinforce our 52% growth outlook for 2023

Healthy installation volumes in the first half of the year support our expectations for nearly 32 GWdc of capacity to come online this year. This will be a welcome return to growth after annual solar additions contracted in 2022 due to intense supply chain constraints related to the pandemic, the Auxin anticircumvention case and other regulatory trade action.

This growth is predominantly driven by the utility-scale segment. Imports of solar modules have increased considerably compared to last year – module imports through the first half of the year reached 24.4 GWdc compared to only 11.4 GWdc in the first half of 2022. And Florida, a rapidly growing market for utility-scale solar, has already installed over 2 GWdc of capacity in the first half of the year.

These factors have led to a 13% uplift (2.5 GWdc) to the utility-scale outlook compared to last quarter.

One year after passage of the IRA, the full benefits have yet to materialize

Beyond the next few years, much of the growth we anticipate in the solar industry is driven by the benefits of the IRA. As we’ve reported, the IRA has brought an immense wave of optimism to the industry. In the last year, Wood Mackenzie and SEIA have tracked dozens of announcements for new solar manufacturing facilities across the supply chain stemming from the law’s manufacturing provisions and the anticipated increases in solar demand. If all of the announced plans for module manufacturing facilities materialize, the US (including Puerto Rico) would increase its total capacity by an order of magnitude by 2026 – from 10.6 GW to 108.5 GW.

But the IRA has yet to drive more solar projects through final stages of development, causing pipeline growth to stagnate. In the year leading up to the IRA’s passage, an average of 5.8 GWdc of utility-scale solar was procured each quarter. In the year since then, that average has fallen to 3.8 GWdc.

In many major commercial solar markets (Maine, Massachusetts, New Jersey and New York), where IRA incentives are expected to increase development of projects under 5 MWac, pipelines have either shrunk or remained flat recently.

Pipeline stagnation is being caused by multiple factors, such as high interest rates, elevated hardware and labor costs and increased local opposition to clean energy projects.

Michelle Davis

Head of Global Solar

Michelle leads our solar research, identifying emerging industry themes and cultivating a team of solar thought leaders.

Latest articles by Michelle

-

Opinion

What could further trade actions mean for the US solar supply chain?

-

Opinion

Sunny skies ahead: the solar market and supply chain in 2024 and beyond

-

Opinion

Our top takeaways from the Solar & Energy Storage Summit 2024

-

Opinion

The US solar industry is off to a strong start in the first quarter

-

Opinion

Is the IRA paying off for the US solar supply chain?

-

Opinion

US solar shattered records in 2023, but will this continue in 2024?

This isn’t due to a lack of interest in solar project development. If anything, the amount of capital seeking high-quality solar project investments has only increased. Pipeline stagnation is being caused by multiple factors, such as high interest rates, elevated hardware and labor costs and increased local opposition to clean energy projects. But the uncertainty around qualifying and claiming IRA benefits is exacerbating this as well.

Over the last year, the Department of the Treasury has released numerous pieces of guidance on how to qualify for the various provisions of the IRA. This has helped answer some questions, but left others unanswered. The processes for qualifying for various tax credit adders have proven more complicated than the industry anticipated, particularly for the domestic content tax credit adder. Without full clarity on qualifications and processes, developers, manufacturers, and financiers are often left in limbo.

As a result, the full benefits of the IRA, in the form of more development of solar projects that meet various policy objectives, won’t manifest until developers, asset owners and financiers have enough regulatory clarity to make confident investments.

We still expect the US solar industry to nearly triple in the next five years

Despite the near-term challenge of navigating IRA guidance, the growth outlook for the US solar industry is strong. Our outlooks have changed minimally since last quarter. We increased our outlook for utility-scale in the near-term, but lowered expectations slightly in the outer years.

After 2023, annual growth for utility-scale solar averages 9% as pipelines of contracted projects come online. Distributed solar markets will experience fluctuations in growth over the next five years as net billing is implemented in California, community solar markets work through interconnection challenges and emerging markets pick up momentum. Residential solar grows 6% on average over the next five years while non-residential solar grows 8%.

There is a cumulative total of 153 GWdc of solar capacity installed through the first half of 2023, and we expect this figure to grow to 375 GWdc by the end of 2028. Even with the current challenges facing this market, the solar industry is looking at many years of sustained, strong growth.

Get a much closer look at the US solar market

The full report explores each segment in detail, reports on solar supply chain dynamics and national system pricing trends based on recent global solar manufacturing buildout.