Three challenges that will stretch spandex in 2020

Rapid growth means spandex is poised to become a mainstream fibre – what stands in the way of its success?

1 minute read

Over the past decade, spandex has sustained a growth rate more than double the fibres industry average. It has emerged from its role as a small-scale yarn for specialist legwear, lingerie and sportswear and moved into a much wider range of garments. This transition has been supported by a rapid fall in prices, as new spinning technologies and low-overhead producers strip out costs.

But can spandex continue its growth path? And what are the pitfalls of moving into the mainstream?

Our annual Global Spandex Market Report is a comprehensive study that includes supply and demand outlooks and corporate analysis. Fill in the form for a copy of the report preview or read on for a summary of three challenges the industry faces in 2020.

1. Covid-19 has put growth patterns into reverse

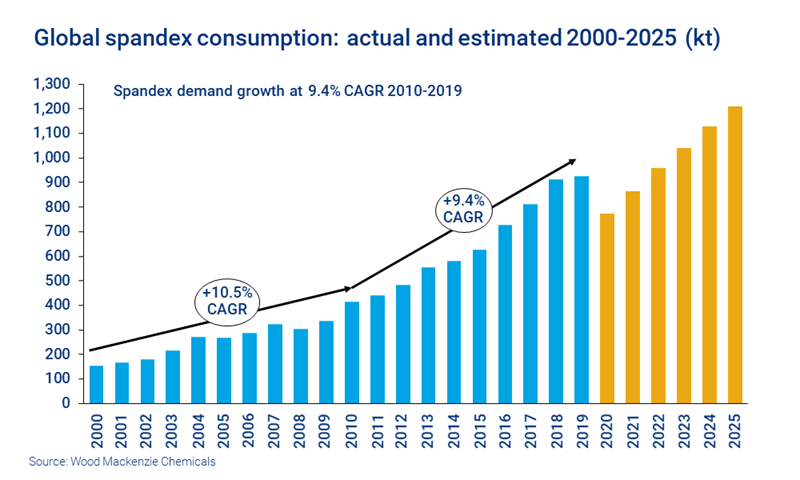

Global spandex mill consumption was 415 kt in 2010 and more than doubled to 914 kt in 2018. Last year, we expected that the 1 million tonnes mark would be passed in 2020. This symbolic milestone would have confirmed spandex’s arrival as a mainstream textile fibre.

However, slowing global economic growth in 2019 pegged volumes back to 927 kt, and worse was to come. The coronavirus pandemic hit the core Chinese market first, and the impact quickly spread. We now forecast 2020 consumption heavily down at 771 kt.

The longer-term drivers still point to growth, but a million tonnes of spandex sales is a milestone that’s now unlikely to be passed until at least 2023.

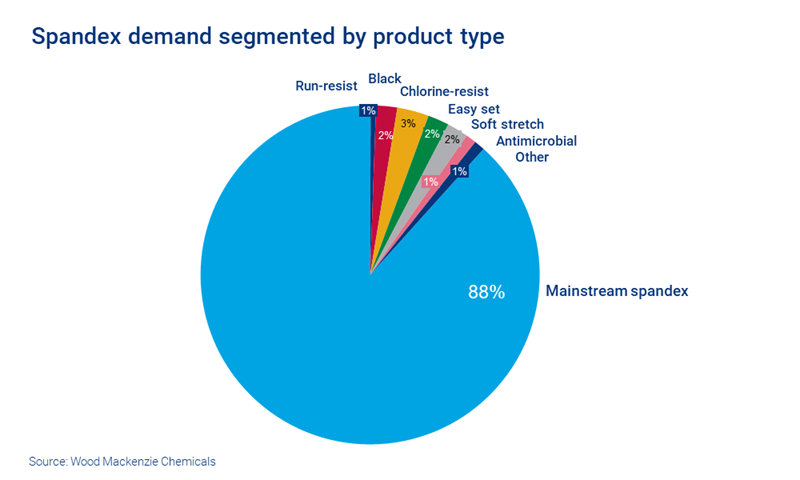

2. A lack of yarn innovation could lead to commoditisation

As spandex moves away from its specialist niche, commoditisation is a risk. In our view, the global spandex industry has made little progress in launching genuinely new yarn products over the past decade. New developments are often minor variants of existing product types. And without greater innovation a trend towards commoditisation could gather momentum.

The constraints of current spandex manufacturing technology are a factor. Production systems for spandex – extrusion within a closed gas system – allow much less flexibility than conventional synthetics, like nylon and polyester, extruded under atmospheric conditions. The spandex industry may need to become smarter about other aspects of product positioning to avoid the fate of mainstream synthetics.

Strategies vary across the industry. Lycra, for example, is known for a formidable marketing structure that adds value along the supply chain through, for example, new product development and styling and design innovation. An industry pioneer, Lycra retains significant leverage within specialist segments and aims to extend this into newer middle-class Asian populations. The tough competitive environment will test its ability to defend its premium approach.

Our Global Spandex Market Report includes analysis of key spandex companies, including Lycra (and the Shandong Ruyi deal), Asahi and Hyosung. Fill in the form at the top of this page for a preview.

3. Demand for more sustainable textiles and apparel is growing

The last year has seen a massive upswing in societal concerns about the environmental impact of textiles. Retailers and brands are setting ambitious targets for use of recycled content and sustainable production and investing in research initiatives that drive a circular economy.

For spandex, as a minority component, there is a two-fold challenge. Does spandex content affect the recycling process for other fibre types? And can spandex itself provide a recycled yarn offer? Mixed polymer content is an issue for the most cost-effective recycling systems. Newer technologies can produce virgin quality recycled polyester, leaving spandex as part of the residual waste. Extracting spandex to provide a recycled fibre offer is also possible, but the economics are challenging.

Spandex’s aesthetic and technical properties support its central position in the stretch market. But major brands are now encouraging a search for stretch methodologies that are more compatible with nylon and polyester products. If a breakthrough is made, spandex could have a serious rival.

For a more detailed look at the environmental issues facing the industry, and how brands are responding, read our Global Spandex Market Report. The 116-page study also includes:

- Forecast to 2025 using our detailed proprietary modelling

- Spandex supply by company, plant and region

- Regional supply/demand balances and global trends in capacity utilisation.

Fill in the form at the top of this page for a complimentary preview.