Get Ed Crooks' Energy Pulse in your inbox every week

The coronavirus second wave hits demand for oil

The numbers of new reported Covid-19 cases have been surging in Europe and the US, forcing lockdowns and putting a brake on the economy

1 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

The Trump administration remakes US environmental approvals

-

Opinion

What do President Trump’s tariffs mean for energy?

-

Opinion

US tariff announcements add to uncertainty

-

Opinion

US energy companies brace for tariff impact

-

Opinion

What does DeepSeek AI mean for energy?

-

Opinion

Questions over the Trump administration’s plans for solar and wind

At the time of writing, the 2020 US presidential election was still not yet decided. Close races and slow counts in four key states meant that both Joe Biden and President Donald Trump still had a chance of forming the next administration. Whoever is in the White House next year, though, one of their most urgent priorities will have to be the Covid-19 pandemic, which has been resurgent in the US and around the world.

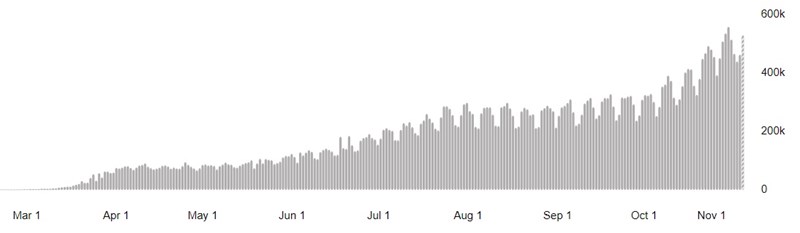

While Americans were focused on politics, the coronavirus has been attracting less attention, but the number of new cases reported each day has been rising fast. The US has now had about 9.5 million cases of Covid-19, with 121,000 reported on Thursday, a new record. Worldwide, there have been 47.9 million cases, and the number of new infections reported each day is still on a rising trend. Over the past week there have been about 500,000 cases a day reported to the World Health Organization, more than five times the number when the first wave was at its worst in the US and Europe in April.

This chart from the WHO shows how the global total number of cases reported each day has been rising steadily.

The number of deaths has not gone up at anything like the same rate, but it has been increasing since September. Worldwide about 45,300 people died from Covid-19 last week, not far off the first wave’s peak in mid-April of about 51,000. And in the face of the growing threat, many European countries have been reintroducing restrictions on businesses and the public. In England, a second four-week lockdown began on Thursday, with pubs, restaurants, gyms and “non-essential” shops all closed. France began its lockdown on 30 October and Germany on 1 November. Four Italian regions including more than a quarter of the country’s population were put into “red zone” lockdown on Wednesday night, with strictly limited movement in and out, and people generally forced to stay home.

The emergence of this new round of restrictions in Europe, and signs of economic weakness in some other countries including the US, have prompted Wood Mackenzie’s analysts to revise down their forecasts for world oil consumption in the last quarter of 2020 and the first of 2021. Demand is now expected to be about 94.3 million barrels a day in the current quarter, down about 6% from the final three months of 2020. In the first quarter of next year it is expected to be about 95 million b/d; up about 1.5 million b/d from the same period of 2020.

The most striking point about the new forecasts, however, is that expected oil consumption in China in the second half of this year has actually been revised up slightly. China’s economy has been hit by the pandemic, of course, but the country’s success in controlling Covid-19 means that its economy will be able to grow this year, a remarkable performance at a time when the world is suffering its sharpest downturn since the aftermath of World War 2. We project that China will use about 14.1 million barrels of oil per day this quarter, up 4.5% from the last quarter of 2019. “China is doing better than anybody else, because it has addressed the virus effectively,” said Ann-Louise Hittle, Wood Mackenzie’s head of Macro Oils.

As demand has been flagging, oil exports from Libya have been ramping up, following the ceasefire between warring factions. The result has been pressure on crude prices, with benchmark Brent dropping to close to $36 a barrel at the start of the month. Since then it has benefited from a healthy rebound, reaching about $40.50 barrel on Friday morning. But the balance of supply and demand suggests global inventories are likely to rise this quarter and next.

For the OPEC+ group of OPEC members and allies including Russia, market conditions have forced a rethink of the plan to relax production curbs at the start of next year. Abdelmadjid Attar, energy minister of Algeria, which currently holds OPEC’s rotating presidency, described the situation in world oil markets as “very dangerous”, according to the state news agency APS. He urged the OPEC+ group to extend the current level of production curbs, a reduction of 7.7 million b/d from pre-crisis levels, into next year. The current schedule is for those curbs to ease off to a 5.8 million b/d reduction in January, but it looks increasingly likely that that increase in output will be delayed. On Monday Alexander Novak, Russia’s energy minister, talked to leaders of the country’s oil companies about a possible extension of this year’s curbs into next year. And OPEC and Russia have even been thinking about the possibility of deeper production cuts early in 2021, Reuters reported.

In the run-up to the next OPEC+ meeting on 1 December, the group’s members are going to be under pressure to avoid adding to global oversupply in January. A 17 November meeting of the OPEC+ Joint Ministerial Monitoring Committee, co-chaired by Russia’s Novak and his Saudi Arabian counterpart Prince Abdul Aziz Bin Salman, will be important for sending a signal to the markets about their intentions.

China to end conventional gasoline and diesel vehicle sales by 2035

The resilience of China’s oil demand this year has been a reminder of the country’s growing reliance on imports. China’s oil production will rise slightly this year to an average of 3.88 million b/d for 2020, according to Wood Mackenzie’s Macro Oils team, but in the long term it is on a slowly declining trend, while demand keeps rising until the early 2030s.

Those trends create clear risks for China in terms of the economy’s exposure to the next surge in oil prices, and potentially in national security vulnerabilities. The Chinese government has now set out its plan to reduce those risks: it is planning to phase out sales of conventional internal combustion engine vehicles by 2035. In a government-backed road map from industry experts and a policy paper from the State Council, China is setting a goal that by that date, half of all vehicle sales should be EVs, including plug-in hybrids and fuel cell vehicles, and the rest should be hybrids. The hybrids will still use gasoline, of course, but more efficiently than in conventional engines.

China’s goal is less ambitious than many being set around the world. The UK government is expected to set out plans to end internal combustion engine car sales by 2030. California wants all cars sold in the state to be zero-emissions by 2035. Even so, China’s plan is a significant step, with implications right up the supply chain, from domestic production of EVs, to battery manufacturing to processing and extraction of raw materials. And in being less ambitious, says Wood Mackenzie’s Ram Chandrasekaran, “China has set itself a realistic target”.

Wood Mackenzie analysts have been crunching the numbers on the likely implications for global oil demand. Watch this space for further details.

Counting the cost of plugging and abandoning US oil and gas wells

There are over 2.4 million conventional wells and 215,000 horizontal wells in Wood Mackenzie’s Lens dataset for the US Lower 48, and eventually all of them are going to come to the end of their productive lives. When that happens, they are supposed to be plugged and abandoned (P&A), to prevent gas leaks above and below the surface, and to free the land for other uses. As investors increasingly focus on ESG issues, there is likely to be mounting pressure on E&P companies to make sure their exhausted wells are properly plugged, to reduce methane leaks.

The total cost of plugging all those US Lower 48 wells would be about US$90 billion, undiscounted and in today’s money, according to new research from Wood Mackenzie’s Brandon Myers and Nathan Nemeth. Many of them will continue to produce economically for a long time, of course, putting those costs decades into the future. But the rapid decline rates of horizontal wells used for tight oil production mean that some of them could be uneconomic after 20 years or so. Myers and Nemeth note: “The first big wave of unconventional horizontal wells will soon be P&A candidates.” Low commodity prices can mean that wells become uneconomic more quickly, meaning that the P&A liabilities materialise sooner.

It is an issue that is likely to become increasingly important for investors, and also has implications for government policy. When E&Ps drill wells, states and the federal government require them to post bonds or other financial assurance to cover P&A and restoration costs if they go bankrupt. But there are still an estimated 2.1 million wells in the US that are abandoned but not plugged, and hundreds of thousands of them are orphaned, with unknown or insolvent owners.

A report over the summer from Columbia University’s Center on Global Energy Policy and Resources for the Future proposed a federal programme to plug abandoned and orphaned wells as a way to cut pollution while creating oil and gas jobs. Given that combination of advantages, it is an idea that could attract bipartisan support.

In brief

With the presidential race at the top of the ballot still in the balance, there were several state-specific votes in the US elections with important implications for energy. In Nevada, voters backed an amendment to the state constitution requiring electric utilities to acquire 50% of their power from renewables by 2030, rising in stages from 20% today. In Alaska, a ballot measure to increase taxes on large fields on the North Slope, affecting the Alpine, Kuparuk, and Prudhoe Bay fields, appeared to be heading for defeat with 58% of the votes in. And in Texas, the Democrat Chrysta Castañeda failed to win a place on the Railroad Commission, the energy regulator. She had campaigned for “a cleaner, healthier Texas”, but was comfortably beaten by her Republican opponent Jim Wright.

Equinor has become the latest European oil company to set a goal of net zero emissions by 2050. The company also has an interim goal of cutting the carbon intensity of its upstream production to below 44% of the current industry average by 2025; a target that seems demanding but achievable, through steps including efficiency improvements, expanding offshore electrification, and divesting higher emissions assets. The longer-term goal, Wood Mackenzie’s Kristina Beadle said, would be “much more challenging”.

Engie has pulled out of a proposed US$6.9 billion 20-year contract to buy LNG from NextDecade, after the French government raised concerns about the deal. The French government, which owns 23.6% of Engie, faced “embarrassment” over signing a high-profile contract to buy gas produced using hydraulic fracturing, Le Monde reported. The technique is banned in France. NextDecade is developing the Rio Grande LNG export project in Texas, and says it is still aiming to take a final investment decision next year.

Royal Dutch Shell is closing its refinery in Convent, Louisiana. The refinery was built by Texaco in the 1960s.

There were more electric than diesel cars registered in Europe in September, for the first time. EVs and hybrids took 25% of the market, with sales up 139% from September 2019. Just five years ago, about 50% of cars sold in Europe had diesel engines.

The Australian state of Victoria is backing the installation of a “humungous” 300 megawatt battery from Tesla to help support the grid as renewable generation increases.

And finally: a possible new source for all those additional metal supplies that will be needed for the energy transition. The asteroid 16 Psyche, orbiting round the sun between Mars and Jupiter, may be almost entirely made of metal, in particular iron and nickel. The iron content alone was valued at $10,000 quadrillion at prevailing market price, although it is hard to think that prices would remain stable if a lump of iron roughly the size of Massachusetts became available. Given the expected growth in demand for batteries, if you are thinking of trying your hand at some asteroid mining, Psyche’s nickel content might be a better target.

Other views

Gavin Thompson — In conversation with Asia-Pacific’s CEOs

Kelly McCoy — Climate change, DERs, and other updates from the grid edge

Simon Flowers — The energy transition will be built with metals

Molly Cox — What is the future of solar development in Latin America?

Robinson Meyer — How Jeff Bezos is spending his $10 billion Earth Fund

Kate Mackenzie — It’s hard to tell how serious Wall Street is about climate

Quote of the week

“Equinor is preparing for an expected gradual decline in global demand for oil and gas from around 2030 onwards. Value creation, not volume replacement, is and will be guiding Equinor’s decisions. In the longer term, Equinor expects to produce less oil and gas than today. To develop Equinor as a broad energy company, renewables will be a significant growth area.”— Setting out its goal of net zero emissions, Equinor joined the ranks of those predicting a peak in world oil demand around the end of the decade.

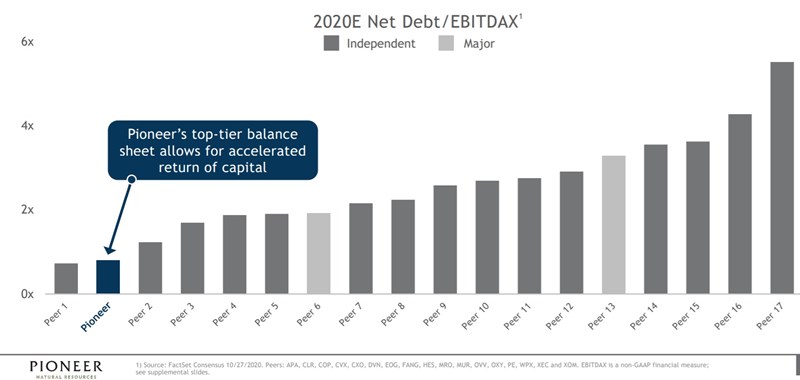

Chart of the week

This is a slide from the presentation given by Pioneer Natural Resources to discuss its third quarter earnings this week. It compares Pioneer’s debt position to a peer group including other large independent producers as well as ExxonMobil and Chevron. It makes the point that Pioneer wants to highlight: its balance sheet is in much better shape to withstand a downturn than most of its peers. It is also a reminder that much of the industry is under severe financial strain.