Power from the people: the state of the vehicle-to-everything (V2X) market

V2X propositions – including vehicle-to-grid (V2G) – have faced barriers to commercialisation but 2025 should see major progress

4 minute read

Oliver McHugh

Senior EV Charging Research Analyst

Oliver McHugh

Senior EV Charging Research Analyst

Oliver analyses the global EV charging market, with a focus on North America.

Latest articles by Oliver

-

Opinion

Power from the people: the state of the vehicle-to-everything (V2X) market

-

Featured

Grid edge 2025 outlook

Elham Akhavan

Senior Microgrid Research Analyst

Elham Akhavan

Senior Microgrid Research Analyst

Elham leads our microgrid and distribution automation research under the Grid Edge team

Latest articles by Elham

-

Opinion

Power from the people: the state of the vehicle-to-everything (V2X) market

-

Featured

Grid edge 2025 outlook

Vehicle-to-everything (V2X) technology allows energy stored in an EV battery to be transferred back to the grid or to other energy-consuming applications. The benefits are wide and varied. For utilities, there is the appeal of distributed generation in thousands of driveways across their service area. For drivers, the interest in earning money from selling energy to the grid alongside the security of power backup. For fleet managers, the allure of a reduced total cost of ownership and extra revenue from demand response.

Despite these benefits, bidirectional EV charging adoption has been slow. But will 2025 be the year this will change?

Our report, Power from the people: the state of the vehicle-to-everything (V2X) market, sets out our view. Fill in the form for a complimentary extract, and read on for a short introduction to some of the key themes.

School buses provide an interesting V2X test case in the US

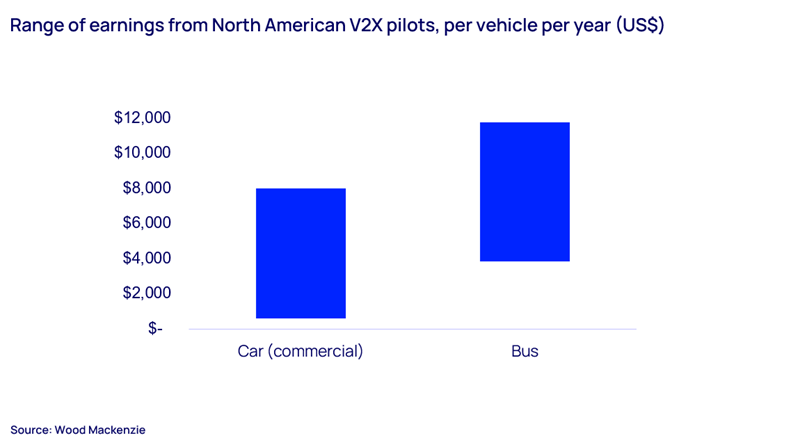

Pilot activity in the US has focused on electric school buses. Their significant downtime combined with reliable duty cycles and large batteries means V2X just makes sense. In 2025 we expect to see installed capacity of V2X chargers double as providers target school districts with the promise of lower running costs and improved air quality.

Utilities are used to connecting large loads to the grid, but interconnection processes for bidirectional chargers have proved significantly challenging. Solution providers have worked closely with utilities to speed up installation. There are several projects where bidirectional chargers have been installed ahead of an export interconnection agreement, with the hope that once utilities recognise the benefits the infrastructure will be ready.

Business models will be shaped by the high upfront costs of V2X infrastructure

In such a nascent area, business models are still developing. The conflicting needs of businesses with V2X will quickly appear, as grid revenue, ownership structures and value streams are contested. Use cases will also vary, with school districts serving as strategic sites to leverage school bus batteries for community resilience support – a model adopted in Florida and North Carolina.

The high upfront cost of this infrastructure will continue to drive business model innovation. Federal subsidies will die out and Transport-as-a-Service (TaaS) are emerging, taking on all the risk of the upfront cost in return for most of the benefit from the energy system.

V2X does not appear to pose battery degradation issues

The risk of increased battery degradation has not materialised as a significant finding in any pilot activity.

Battery degradation is impacted by several factors, including use case, temperature and charging mix (level 2 vs DC fast charging). The relative impact of bidirectional charging compared to these factors is small and evidence suggests gentle cycling may actually be beneficial to battery health.

Europe is outpacing the US in adoption of residential V2X – but momentum is gathering

Unlike in Europe where the focus has been residential, progress with residential V2X in the US has been slow. Up until now, using a vehicle as a backup generator has been the predominant use case. Tesla and Sunrun/Ford have vehicle-to-home (V2H) solutions which are not grid-tied, meaning their only use case is home power backup. The backdrop of hurricanes in southeastern US states last year makes this an appealing use case but ignores the full potential V2H can provide.

Grid-tied residential V2H pilots have started to gain momentum in the US, though a lack of vehicle choice remains a barrier. Sunrun successfully completed a V2H pilot in Maryland, but their pilot with Duke Energy was cancelled due to lower-than-expected take-up of the Ford F150 Lightning. PG&E have been active in this space and will be deploying pilots include different vehicle OEMs: Ford, Kia and most recently, GM. Auto OEM partners have been important to utilities, helping them engage directly with customers in their service area.

V2X’s big unknown is the future of AC vs DC bidirectionality

While AC promises cheaper charging infrastructure, DC has dominated pilot activity to date. Connecting AC V2X chargers to the grid has its issues as the conversion from AC to DC occurs in the vehicle, making certification with grid codes difficult for utilities.

DC V2X interconnection can be treated similarly to solar PV as the conversion takes place in the electric vehicle supply equipment (EVSE) – but this is an imperfect workaround. Many passenger EVs coming to market in 2025 will have vehicle-to-load (V2L) as a feature, often considered a precursor to AC V2X.

There will be movement with V2X in 2025 – but there is much to be ironed out before we see mass market adoption. Our report explores the challenges and opportunities in detail, and our complimentary extract includes:

- Projected increases in installed V2X capacity

- Key players and business models

- How European energy retailers are leveraging partnerships to benefit from V2X

- How the regulatory and policy landscape in the US could accelerate adoption

- And more.