The LNG Majors' strategies in five key charts

LNG remains at the heart of the Majors’ growth strategies

1 minute read

Sean Harrison

Senior Research Analyst, Gas & LNG

Sean Harrison

Senior Research Analyst, Gas & LNG

Sean specialises in North America LNG research, focusing on assets analysis, project economics and LNG contracting.

Latest articles by Sean

-

Opinion

Shining a light on the “coal versus LNG emissions” debate

-

Opinion

Video | Lens Gas & LNG: What is Venture Global's LNG strategy?

-

Opinion

Woodside acquires Tellurian and the Driftwood LNG project

-

Opinion

The LNG Majors' strategies in five key charts

-

Opinion

Why is Ruwais LNG an attractive position for the selected partners?

-

Opinion

Third wave US LNG: a $100 billion opportunity (part 2)

Daniel Toleman

Research Director, Global LNG

Daniel Toleman

Research Director, Global LNG

Daniel's expertise covers global LNG markets, asset analysis, project economics, contracting and corporate analysis.

Latest articles by Daniel

-

Opinion

Shining a light on the “coal versus LNG emissions” debate

-

Opinion

Asia Pacific gas & LNG: 5 things to look for in 2025

-

Opinion

Preparing for ADIPEC 2024: 3 crucial questions answered

-

Opinion

Transforming energy: 5 key questions ahead of Gastech 2024

-

Opinion

Woodside acquires Tellurian and the Driftwood LNG project

-

Opinion

The LNG Majors' strategies in five key charts

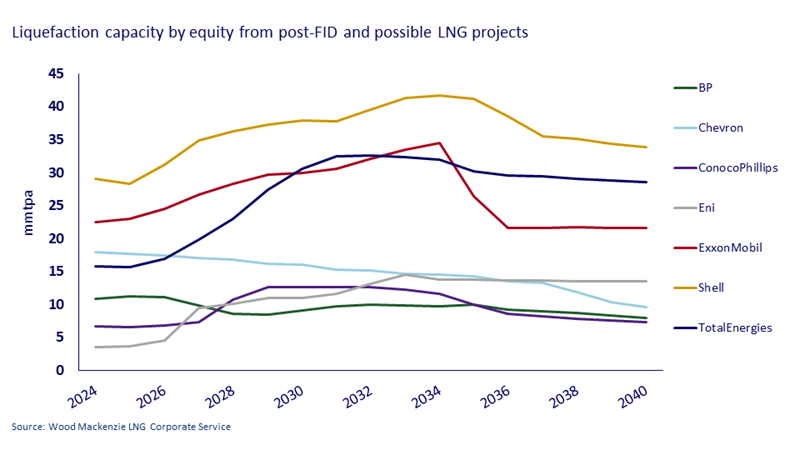

All the main players are growing their LNG portfolios. They are building out supply positions, signing sales agreements and integrating across the LNG value chain.

With LNG playing a growing role, it is vital to understand who the biggest players in the market are and how their strategies differ.

Fill out the form above to download The LNG Majors' strategies in five key charts, which explore the growth strategies of seven major LNG players. This analysis, brought to you by our LNG Corporate Service, can support your efforts in understanding your counterparties, making informed strategic decisions and staying ahead of the competition.