Hydrogen: five market developments to watch

Supportive policies are creating renewed momentum in the low-carbon hydrogen market

3 minute read

Murray Douglas

Vice President – Hydrogen & Derivatives Research

Murray Douglas

Vice President – Hydrogen & Derivatives Research

Murray is responsible for Wood Mackenzie’s Global coverage across the hydrogen value chain.

Latest articles by Murray

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what utilities and developers need to know

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what industrial players need to know

-

Opinion

eBook | Investing in hydrogen from now to 2050: what you need to know

-

Opinion

What lies ahead for hydrogen and low-carbon ammonia?

-

Opinion

Ebook | Overcoming the challenges around hydrogen deployment

-

Opinion

Hydrogen offtake contracts: securing project outcomes

After fallout from the energy crisis caused a drop-off in new projects in Q4 2022, 2023 started far more promisingly for low-carbon hydrogen. With policy announcements from Canada, Europe and the UK providing more clarity for developers, there has been a series of new additions to the project pipeline and ambitious announcements for electrolyser manufacturing continue to emerge.

Our Q1 2023 Global Hydrogen Market Tracker draws on insight from Lens Hydrogen to provide detailed analysis of developments over the past quarter. Read on for a selection of high-level insights from the report. And if you’d like to learn more about the road ahead for hydrogen, fill in the form for a complimentary extract from our latest Hydrogen strategic planning outlook.

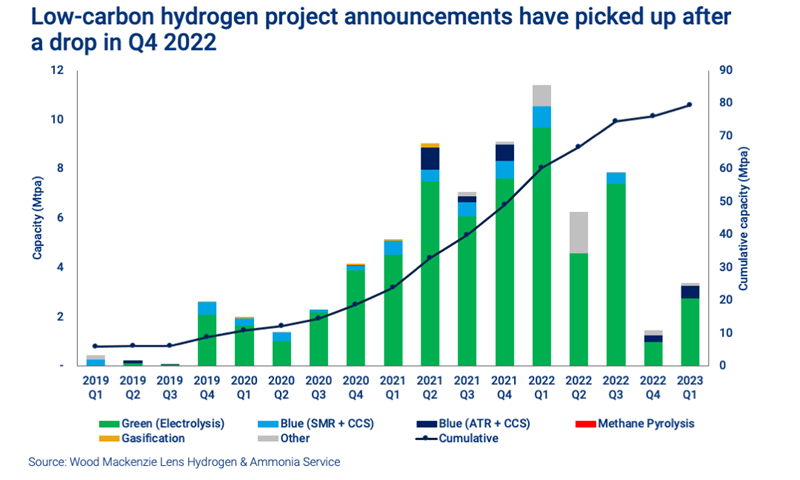

1. Project announcements rebounded in Q1 2023

After a sluggish final quarter of 2022 in which less than 1 Mtpa of new project capacity was announced, Q1 2023 saw project announcements rebound – albeit not yet to the record levels seen in 2021 and early 2022. Global proposed low-carbon hydrogen capacity now exceeds 79 Mtpa.

Among the most notable announcements globally was BP’s 2 GWe HyVal green hydrogen project in Spain, which will support decarbonisation of its Castellón refinery. Other 1 GW+ projects announced included the Megaton Project in Denmark (2 GWe), the Thierbach Project in Germany (1.1 GWe), ScaleH2 in Australia (1 GWe) and Colbun SA Green Ammonia in Chile (1 GWe).

2. The US looks sets to overtake Australia as the leader in announced low-carbon hydrogen capacity

Thanks in large part to the momentum generated by the Inflation Reduction Act (IRA), the US now accounts for 15% of global low-carbon hydrogen projects. It looks set to overtake Australia as the leading country in the world for announced capacity.

The IRA certainly seems to be doing its intended job of accelerating the energy transition as far as low-carbon hydrogen is concerned. Underpinned by the generous production tax credits on offer, a flow of US projects is advancing towards final investment decision (FID).

Linde, for instance, will invest US$1.8 billion in a blue hydrogen facility on the US Gulf Coast. This will supply OCI’s blue ammonia project, which has already begun construction. Meanwhile, ExxonMobil has awarded front end engineering and design to Technip Energies for the 0.86 Mtpa blue hydrogen project at its Baytown refining and petrochemical complex in Texas.

Notably, blue hydrogen dominates in the most advanced projects – especially in the US.

3. Other countries are responding to the US IRA with their own hydrogen policies

In the wake of the IRA’s success, Canada, Europe and the UK all announced new policies focused on supporting the growth of low-carbon hydrogen. Canada’s Clean Hydrogen Tax Credit goes beyond the IRA by including clean ammonia, which should make the country particularly appealing for ammonia production.

Elsewhere, the European Commission released the long-awaited Delegated Acts. The first creates rules for the electricity used to produce hydrogen, while the second addresses the carbon intensity of hydrogen and its derivatives. The EU also announced the European Hydrogen Bank, which will subsidise renewable hydrogen to make it more competitive against fossil fuels.

4. Announced hydrogen projects for 2030 exceed demand, but more projects are needed long term

Thanks partly to the more secure policy outlook, 66% of projects are now targeting start-up by the end of the decade. Only around one-third of these are actually needed to meet expected base-case demand, but many will struggle to progress at the pace required anyway.

Post-2030, there is a substantial need for more projects to meet longer-term demand forecasts to 2050. The full report explores the demand outlook in more detail.

5. Ammonia continues to be the leading end-use sector for low-carbon hydrogen

Thanks to its versatility to act as a feedstock, fuel and hydrogen carrier, ammonia continues to be the leading end-use sector for low-carbon hydrogen.

Low-carbon ammonia’s own potential role in the net zero economy mean this trend is likely to continue.

Stay on top of hydrogen market developments

Want to take a closer look at developments in low-carbon hydrogen globally? Fll in the form at the top of the page for a complimentary extract from our latest Hydrogen strategic planning outlook.

Energy & Natural Resources Summit: EMEA

Investing for success in a low-carbon future | 21 September, in London

Register now