Global refinery closure outlook to 2035

Insights into the regions and reasons of potential refinery closures

3 minute read

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

Opinion

Oil and refined products in 2025: a commodity trader’s guide

-

Opinion

Global refinery closure outlook to 2035

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

Opinion

International Energy Week 2025: our key takeaways for oil & gas

-

Opinion

7 questions about Trump tariffs and their impact on the North American oil market answered

-

Featured

Oils & chemicals 2025 outlook

Avanpal Sehmi Singh

Research Analyst, Oils and Chemicals

Avanpal Sehmi Singh

Research Analyst, Oils and Chemicals

Avanpal is focused on refinery evaluation modelling and long-term outlooks for Europe and FSU.

Latest articles by Avanpal

View Avanpal Sehmi Singh's full profileAlvaro Mangado

Research Analyst, Refining and Oil Products

Alvaro Mangado

Research Analyst, Refining and Oil Products

Alavro participates in the developing of our outlook through refinery models, refining services and market insights.

Latest articles by Alvaro

View Alvaro Mangado's full profileAshutosh Gaonkar

Research Analyst

Although global oil demand is expected to grow, the long-term outlook for many refineries is uncertain. In Wood Mackenzie’s latest global refinery closure threat analysis we assess 420 sites and highlight which ones are most at risk of closure by 2035.

Fill in the form to download the full report or read on for a summary of the factors threatening refinery assets.

Margins and market challenges

Refining margins are expected to stay strong in the short term. A “rising tide lifts all boats” means that we expect limited rationalisation as margins improve into the 2030s. Pressure will build over the next decade once oil demand peaks, likely in the early 2030s, margins will start to fall. Europe, in particular, is seeing a noticeable drop in demand driven by a shift toward electric vehicles. European refineries also suffer higher operating costs from the costs of their carbon emissions. This combination is making it increasingly difficult for some refineries to stay economically viable.

Standalone refineries (those with no petrochemicals integration) make up the majority of at-risk assets. Many of them lack the ability to adjust to changing market conditions or generate extra value from chemicals. Even some complex and deep-conversion refineries are at risk, especially from carbon taxes.

Our net cash margin (NCM) forecasts show that 101 out of 420 global refineries are at risk of closure. These sites represent around 18.4 million barrels per day (b/d) of capacity, which is 21% of current global capacity .

Petrochemical integration

Refineries that are integrated with petrochemical units often perform better, generating stronger returns as demand for plastics and other chemical products continues to grow. But that doesn’t make them immune to risk.

Out of the 101 refineries flagged as at risk, only 29 are integrated with petrochemicals. However, just 13 of these include steam crackers, which are also facing closure risks in some markets. If a steam cracker closes, it removes the uplift invalue from petrochemicals and the refinery loses a critical outlet for petrochemical feedstocks, making the whole site more vulnerable. Sites that rely heavily on steam cracker margins are especially exposed.

Ownership models

Who owns a refinery also influences its long-term outlook. Those owned by national oil companies (NOCs), joint ventures (JVs) or independents make up the majority of the shortlisted sites, however, NOCs are generally seen as less likely to shut sites down, even if margins are poor as they often have government backing.

By contrast, international oil companies (IOCs) are more likely to close or sell underperforming, older or marginal refineries to independent operators . IOCs have been restructuring their portfolios by focusing on sites that are highly competitive in terms of both earnings and emissions.

Carbon costs and decarbonisation

Decarbonisation has become a decisive factor in determining the long-term viability of refineries, particularly for complex and deep conversion sites in regions with high forecasted carbon taxes. Refineries without committed investments in low-carbon technologies, such as carbon capture, energy efficiency upgrades, or alternative fuels, are especially exposed. Those located in regions with established or escalating carbon pricing costs, including the EU, UK, and Canada, are under the greatest pressure. By 2035, carbon prices in these regions are projected to reach levels up to three times higher than the global average, impacting margins and increasing the need for strategic decarbonisation investments for assets to survive.

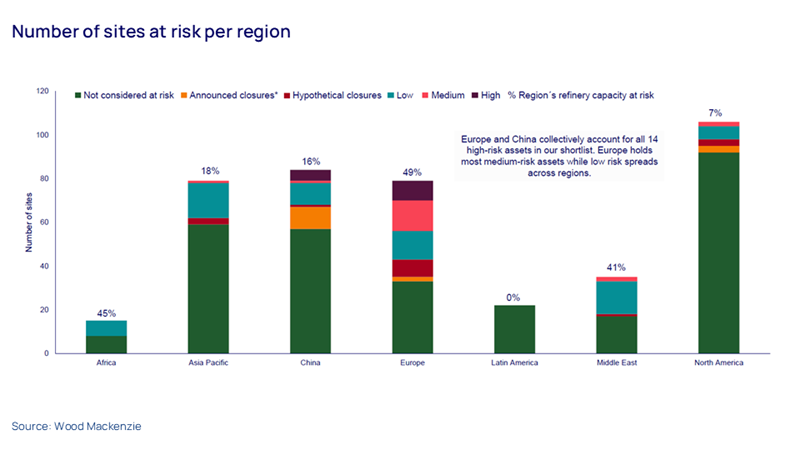

A regional overview

Refinery closure risks vary widely by region, with Europe and the Middle East together accounting for over half of the global capacity identified as at some risk by 2035. Europe and China alone hold the majority of high-risk sites, with Europe home to 60% of them. While 5.1 million b/d of European capacity is classified as medium or low risk, more than half of that falls into the medium-risk category.

In contrast, Asia Pacific and China represent approximately 30% of the world’s low-risk capacity, spread across 28 sites. These refineries are predominantly complex or deep conversion facilities, with a significant number integrated with petrochemical operations, offering a margin advantage.

Africa and the Middle East together account for 4.7 million b/d of 16.2 million b/d capacity considered at low or medium risk across 24 sites. All of the shortlisted African sites are considered low-risk but they represent nearly half of Africa’s total refining capacity today.

In North America, 1.5 million b/d of capacity across eight sites in the U.S., Canada, and Mexico are assessed as medium or low risk with all refineries lacking the advantages of petrochemical integration.

Fill out the form to download your complimentary report.