Global deepwater production to increase 60%

The fastest growing resource theme in the industry has inherent emissions advantages for the sector

3 minute read

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

Opinion

Global upstream update: diverging development strategies in Latin America, investment at risk in Africa, and Kazakhstan supply tensions explained

-

Opinion

Is oil price volatility a threat to upstream production, investment and supply chains?

-

Opinion

Global upstream update: UK fiscal changes and an Asia-Pacific licence bonanza

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

The Edge

Why upstream companies might break their capital discipline rules

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus leads our benchmark analysis of global Pre-FID delays, and deep water developments.

Latest articles by Angus

-

The Edge

Why upstream companies might break their capital discipline rules

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

How to make upstream licensing work

-

The Edge

What’s driving the upstream revival in Southeast Asia?

-

Opinion

A two-decade decline in exploration is driving the need for carbon neutral investment in Australia’s upstream sector

-

Opinion

Asia Pacific upstream: 5 things to look for in 2024

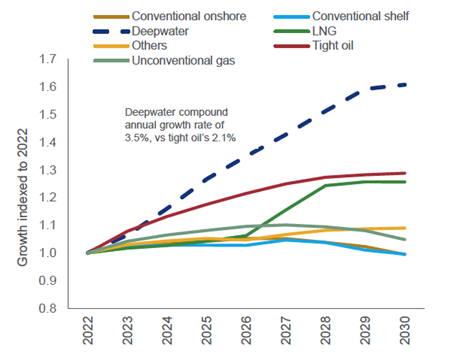

Deepwater is the fastest growing upstream oil and gas resource theme. From just 300,000 barrels of oil equivalent per day (boe/d) in 1990, production is expected to hit 10.4 million boe/d in 2022. By the end of the decade, that figure should pass 17 million boe/d.

Our latest global upstream report explains what’s driving deepwater’s rapid growth, along with the challenges and opportunities the sector represents. Fill out the form to get access to the full Insight, or read on for a quick overview.

Production to grow by six million boe/d this decade

Deepwater production is set to increase by over 60% between 2022 and 2030, growing from 6% to 8% of overall upstream production. Ultra-deepwater production – from depths of 1,500 metres and above is growing fastest – by 2024 it will account for more than half of all deepwater production (our definition is 400 metres of water depth or above).

Brazil remains the leading deepwater producer, it accounts for around 30% of current global capacity and will continue to grow. Guyana, the most significant new entrant, will be producing one million boe/d within the next five years. In total 14 other countries will contribute to the deepwater supply mix in the coming years.

The sector remains under the control of a small number of key players

Despite the diversification of sources, and of corporate participants, control over major deepwater projects sits in the hands of relatively few companies. Just eight companies account for 65% of deepwater production and 67% of the remaining project value.

Petrobras and the seven Majors dominate deepwater production, operating 22 of the top 25 deepwater assets. Petrobras’ deepwater portfolio is around twice as big as its nearest peer, Shell, which stands out among the majors for leading production and cash flow. ExxonMobil and TotalEnergies show the highest rates of growth this decade.

Advantaged barrels: deepwater’s enviable economic and emissions metrics

Typically, only the best subsurface plays become commercial in water this deep. Deepwater basins therefore tend to be hyper productive, recovering huge volumes of oil and gas from each well. This translates into high economic returns and low Scope 1 and 2 emissions intensities relative to most other oil and gas resource themes.

But there is still room for emissions improvement. The Majors are focused on cutting deepwater emissions by reducing flaring and methane leaks, optimising operations at existing platforms and, where possible, facility electrification. Brazil’s scale means it is the highest absolute emitter and its performance is contingent on Petrobras’ decarbonisation aspirations.

There is a robust pre-FID project pipeline, offering plenty of investment opportunities across a range of jurisdictions. Average investment returns in our global database of deepwater development projects are 24%, at US$60/bbl Brent, but the bookends are far apart. The best returns are generated by smaller oil fields which can be tied back to nearby infrastructure. The lowest are long leadtime gas supply projects.

Supply chain constraints are a concern

Service companies have made huge fleet reductions for key equipment such as floating rigs and productions systems since the peaks of the 2010s. With activity levels growing, equipment and services availability will be a constraint.

Cost inflation will continue to risk project economics as higher utilisation combines with higher commodity prices. In some regions deepwater rig costs have doubled compared to 2021 dayrates. It has hit global hotspots such as the US GoM and Brazil hardest, Gato do Mato in the Brazilian pre-salt for example, will be delayed by up to two years due to rising costs.

Constraints in the global deepwater supply chain will, with time, increase lead times and unit costs across the board. Participants have pushed operational efficiencies such as cutting drill-days and modularising facilities to offset some of the impact, but the hard-fought efficiency gains made during previous downturns are starting to reverse.

Don’t forget to fill in the form to access the report extract, which includes a wide range of charts exploring these issues in more detail.

Data in this report was powered by Lens Upstream. Find out more