Gas prices enter a bearish spring amid crude market volatility

As winter fades, so too has the support for natural gas prices

2 minute read

Daniel Myers

Senior Research Analyst, North America Gas

Daniel Myers

Senior Research Analyst, North America Gas

Daniel delivers short-term fundamental modelling and regional market analysis.

Latest articles by Daniel

-

Opinion

Gas prices enter a bearish spring amid crude market volatility

-

Opinion

North America gas: 5 things to look for in 2025

-

Opinion

Harris v Trump: A fork in the road for US energy

-

Opinion

North America gas: 5 things to look for in 2024

-

Opinion

What is the impact of the Mountain Valley Pipeline (MVP) on shifting South Atlantic gas price dynamics?

Ryan Duman

Director, Americas Upstream

Ryan Duman

Director, Americas Upstream

Ryan specialises in supply forecasting, basin characterisation, upstream decarbonisation and economic modeling.

Latest articles by Ryan

-

Opinion

Gas prices enter a bearish spring amid crude market volatility

-

The Edge

Three factors driving US liquids production to new heights

-

Opinion

A new tight oil powerhouse: Permian Resources and Earthstone create a new large-cap US E&P

Henry Hub is entering a bearish spring, driven by a potent mix of waning heating demand, surging supply, and mounting macroeconomic uncertainty. The result? Significant downward pressure on gas prices – and more questions than answers for the months ahead.

In this update, we explore:

- Can strong LNG exports continue to buoy the market against overwhelming supply growth?

- Will the current storage deficit disappear entirely by next month?

- How might falling crude prices ripple through associated gas production?

Read on for what’s driving the market—and what could come next.

Storage outlook: deficit fading fast

Storage levels – once a major source of bullish sentiment – are rapidly normalising. Analysts now expect the storage deficit compared to five-year average levels to be nearly eliminated by next month. Combined with strong production, this outlook has only added to the bearish tone sweeping through the market.

Crude oil’s domino effect

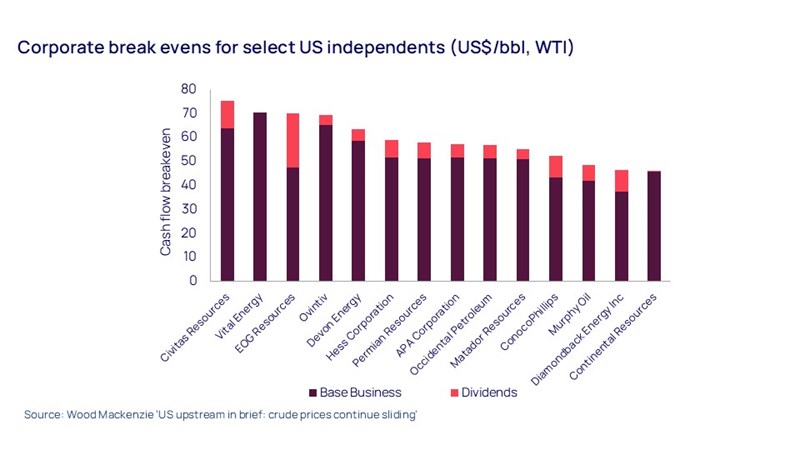

The crude oil market isn’t offering much relief, either. Front-month WTI prices plunged below US$60/bbl last week – a level not seen since 2021. Although prices have rebounded slightly to around US$61.25, they remain roughly 23% below January’s near-$80 highs.

This drop was triggered by US President Donald Trump’s recent tariff announcements, which have raised fresh concerns about global economic growth and energy demand. That pressure was compounded when OPEC+ confirmed plans to ramp up its supply hike in May.

While the immediate impact on associated gas production may be limited, sustained lower oil prices could start affecting development plans and rig counts. The lag time – typically six to nine months – means current price levels are shaping decisions that will influence supply later this year and into 2026.

Cost pressures rising

Adding to the challenge, the new tariffs are also expected to push Lower 48 drilling and completion costs higher – by an estimated 4% on average. For producers already working with tight margins, this added cost pressure could further dampen activity levels.

Looking ahead for the gas market

WTI prices holding in the US$55–$60/bbl range may not spark an immediate collapse in rig counts, but they are below the planning assumptions of many operators. A deeper slide – particularly below US$50/bbl – would likely have a far more significant effect, potentially reshaping oil and associated gas supply forecasts heading into 2026.

In short: the market is entering a period of recalibration. Supply remains strong, demand uncertain, and geopolitical risks elevated. We’ll be watching closely to see if LNG exports and summer cooling demand can provide any meaningful lift – or if the bearish winds will continue to blow.

Fill in the form above to receive more insights like this in your inbox.

North America Gas Service

Gain a deeper understanding of the evolving Canadian and US gas market dynamics with our North America Gas Service.

North America Gas Service is a vital resource for understanding complex gas market dynamics and planning for the future. It provides short- to long-term natural gas forecasts that include detailed gas market analysis and supply data, such as North American gas pipeline flows and natural gas inventory forecasts. With access to our insight reports and expert analysts, you can make confident and informed data-driven decisions.