Sign up today to get the best of our expert insight in your inbox.

Energy storage technology: three trends to watch

Energy storage market dynamics are shaping the evolution of battery formats, components and production

3 minute read

Kevin (Gunan) Shang

Principal Research Analyst, Energy Storage Supply Chain and Technology

Kevin (Gunan) Shang

Principal Research Analyst, Energy Storage Supply Chain and Technology

Kevin leads leads research and analysis on the energy storage supply chain and technology.

Latest articles by Kevin (Gunan)

-

Opinion

Energy storage technology: three trends to watch

-

Opinion

Sustainable smelting: how green can it go?

-

Opinion

Quantifying battery raw material demand

Jiayue Zheng

Managing Consultant, Energy storage

Jiayue Zheng

Managing Consultant, Energy storage

Jiayue is a consultant in Wood Mackenzie’s Power and Renewables team, focusing on the energy storage supply chain.

Latest articles by Jiayue

-

Opinion

China’s solar & storage exports achieve record growth with more than 40% surge

-

Opinion

Powering down: lithium battery supply exceeds demand

-

Opinion

Energy storage technology: three trends to watch

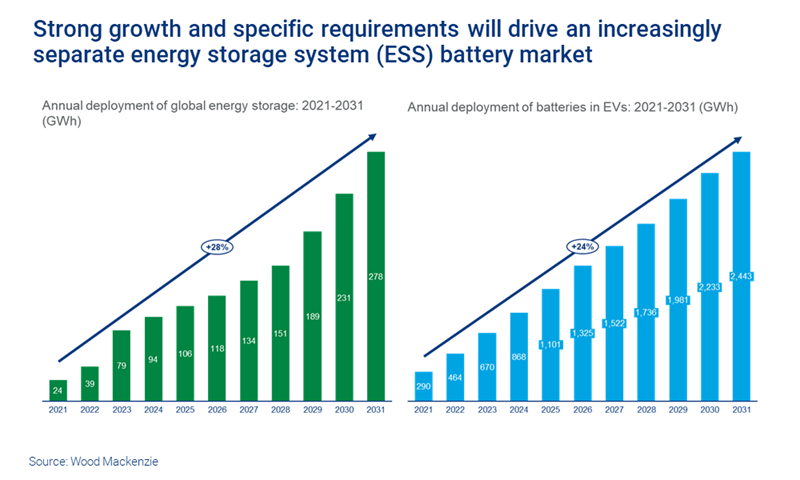

Rapid growth in deployments is making the energy storage system (ESS) sector the new competitive battlefield for battery manufacturers. Whether diversifying from the electric vehicle (EV) market or focusing specifically on ESS, it’s an attractive opportunity to capitalise on a strong outlook over the next decade.

We recently kicked off a series of energy storage technology reports, drawing on insight from our Energy Storage Service. The first report focuses on how ESS market dynamics are driving developments in lithium-ion cell components and designs. Read on for an overview of three key trends to watch.

1. The divergence between batteries for ESS and EVs is accelerating

A combination of technology, market, manufacturing and policy factors is driving rapid changes in the lithium-ion battery market landscape. With ESS uptake accelerating, the specific performance requirements for ESS batteries are increasingly being addressed by divergence from the market for batteries used in EVs.

In contrast to EV batteries, where the focus is on improving energy density to boost range and reducing charging time, the priorities for ESS batteries are cost, durability and storage duration. Stationary batteries need to be competitive with conventional peak and frequency modulation technology on price. They also need a longer lifespan of up to 10,000 charging cycles – three times that of EV batteries. In addition, there is increasing demand for longer-duration ESS applications.

Policy will also influence the divergence of the battery market. In the US, the terms of the Inflation Reduction Act entitle ESS projects that comprise at least 40% domestic content (rising to 55% by 2029) to a 10% additional investment tax credit. By comparison, requirements for critical mineral sourcing for EV batteries will be much more stringent, and require traceability.

This will add to production costs and drive separation of battery supply for the ESS market to avoid the price of ESS batteries being needlessly increased.

2. LFP cathode chemistry is gaining momentum in energy storage applications

New technology such as advanced silicon-based and lithium metal anode technologies and all-solid-state batteries are aimed at boosting energy density. As such they will prioritise the EV and consumer electronics markets.

In contrast, developments in batteries for energy storage applications focus on the particular needs of the sector. Lithium iron phosphate (LFP) cathode technology is fast becoming popular in the ESS market, thanks to its safety performance, long cycle life and the abundance (and therefore lower cost) of iron and phosphate raw materials.

Another technology which is moving quickly in terms of commercialisation and has attractive prospects for stationary storage applications is the sodium-ion (Na-ion) cell. Na-ion batteries work on a similar principle to lithium-ion (Li-ion) batteries but are likely to be less sensitive to rising lithium, cobalt and nickel prices than LFP.

3. Cost reduction is driving innovation in cell size and format for ESS

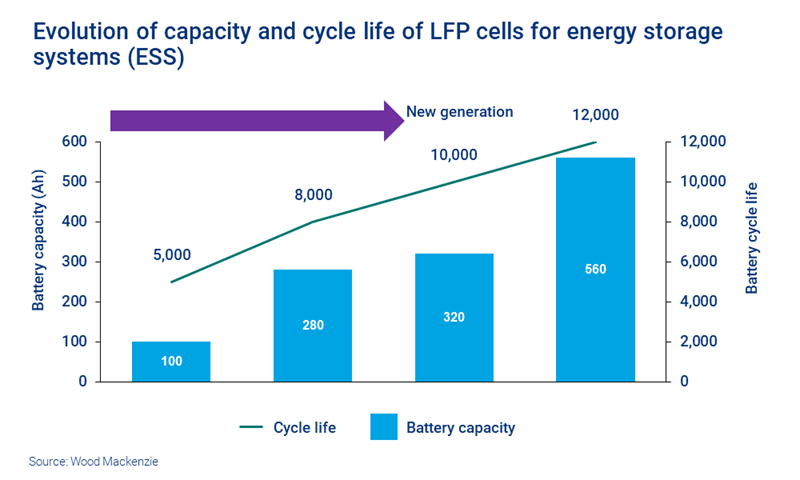

Ultimately, developments in battery size and format are also moving fast in the ESS market. A meaningful way of reducing cost is by increasing the capacity and size of cells. This reduces the number of system components, bringing down bill of materials (BOM) costs, simplifying assembly and integration, and reducing the burden on the battery management system (BMS).

Already 280 Ah (ampere hours) is becoming the new standard for LFP batteries in grid-scale applications, with larger capacities of up to 560 Ah and a higher cycle life of up to 12,000 times in the pipeline. However, larger cells need increased manufacturing capabilities and also have implications for safety management.

In terms of battery format, prismatic cells currently dominate grid-scale ESS, mainly because they are favoured by Chinese battery manufacturers. They are space efficient but expensive to manufacture and die relatively quickly due to less efficient thermal management.

By comparison, cylindrical cells are relatively safe, cheap and easy to manufacture, and economical to run due to their long calendar life. Their shape creates cavities between cells in a pack, reducing volumetric energy density, however, this is less of an issue for ESS applications than for EVs. We forecast the latest generation of larger cylindrical 46xx LFP cells will be used in various energy storage markets over the next decade.

To get a closer look at energy storage tech trends to watch, visit the store to read this report in full.