Are NOCs prepared for the energy transition?

We analyse and rate national oil companies for resilience and sustainability

3 minute read

Luke Parker

Vice President, Corporate Research

Luke Parker

Vice President, Corporate Research

Luke is Vice President of Corporate Research with a specific focus on the Supermajors.

Latest articles by Luke

-

The Edge

Majors' capital allocation in a stuttering energy transition

-

Opinion

Video | Shell and Equinor announce UK asset merger to create new JV

-

Opinion

Beyond ESG: measuring corporate sustainability in an uncertain world

-

The Edge

Big Oil: upstream M&A gets serious

-

Opinion

Are NOCs prepared for the energy transition?

-

The Edge

How NOCs compare with IOCs on energy transition strategy

Andrew Harwood

Vice President Research, Upstream & Carbon Management, Corporate

Andrew Harwood

Vice President Research, Upstream & Carbon Management, Corporate

Andrew is responsible for our corporate coverage in Asia Pacific.

Latest articles by Andrew

-

Opinion

A two-decade decline in exploration is driving the need for carbon neutral investment in Australia’s upstream sector

-

Opinion

Asia Pacific upstream: 5 things to look for in 2024

-

Opinion

Size matters: which International E&Ps are best positioned to ride out industry consolidation?

-

Opinion

Are NOCs prepared for the energy transition?

-

Opinion

Will COP27 be a turning point for oil and gas funding?

-

Opinion

How hard will the oil price crash hit APAC upstream investment?

Yuqi Hu

Managing Consultant, Corporate Research

Yuqi Hu

Managing Consultant, Corporate Research

Yuqi is a Senior Consultant on the Corporate Research team. She has worked at Sinopec, Aramco and Clariant.

Latest articles by Yuqi

-

Opinion

How do integrated companies position themselves in the changing downstream landscape?

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

-

Opinion

Are NOCs prepared for the energy transition?

Neivan Boroujerdi

Director, Corporate Research

Neivan Boroujerdi

Director, Corporate Research

Neivan leads Wood Mackenzie's global corporate NOC coverage.

Latest articles by Neivan

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

ADNOC doubles net hydrogen production through stake in ExxonMobil’s Baytown project

-

Opinion

ADNOC acquires stake in Rovuma LNG from Galp

-

Opinion

Benchmarking the Middle East NOCs against the supermajors

-

The Edge

How and why big oil is strengthening its oil and gas exposure

Raphael Portela

Principal Research Analyst, Corporate Analysis

Raphael Portela

Principal Research Analyst, Corporate Analysis

Raphael focuses on Latin America and its national oil companies as a senior analyst on our Corporate Research team.

Latest articles by Raphael

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

What does Milei mean for oil and gas in Argentina?

-

Opinion

Are NOCs prepared for the energy transition?

-

Opinion

Unwrapping key players in Colombia's upstream sector

-

Opinion

Are NOCs rising to the energy transition challenge?

With the energy sector transforming, resilience and sustainability are critical to national oil companies (NOCs). These factors form the foundations of future investibility. The drivers and constraints NOCs face may vary but all have room to improve – and good reason for doing so. So, how well are these companies positioned in the face of the uncertainty and risk created by the energy transition?

In our latest report CoRSI: Benchmarking the NOCs we present the latest analysis from our Corporate Resilience and Sustainability Indices (CoRSI) tool, which has recently been expanded to cover eight key NOCs. Fill out the form to download a complimentary extract from the report, or read on for a brief overview of its key findings.

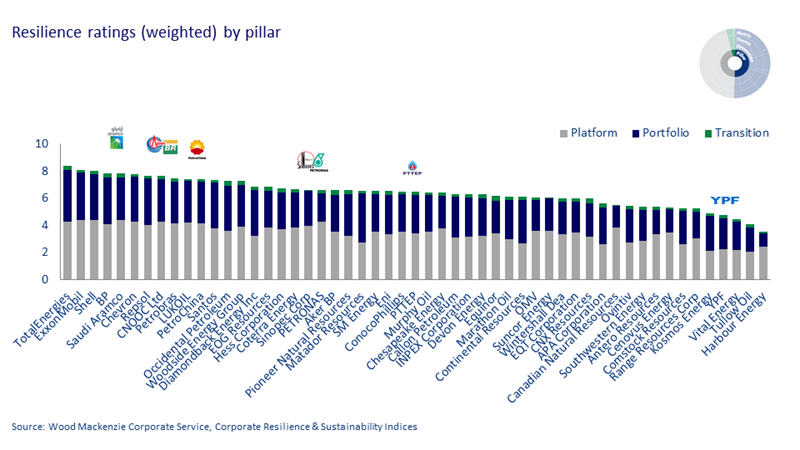

Resilience: how well are NOCs placed to handle a near-term shock?

A range of factors affect NOCs’ resilience as a business, including financial health, cash flow at low prices, investment flexibility and concentration risk. Taken together, they provide a strong indication of how well companies will cope with a near-term shock.

Most NOCs’ overall resilience ratings are at a cyclical high, following two years of high prices and financial deleveraging (see chart below). Record cash flows have been underpinned by sustained capital discipline; as a result, strong balance sheets provide financial flexibility, while low production costs and favourable tax terms for most protect cash generation at low prices. At the same time, NOCs’ sheer scale equips them to withstand price shocks. Overall, most are well positioned to weather another collapse in commodity prices.

However, while the majority of NOCs are financially strong, it should be noted that there is greater variation in our ratings for Portfolio Resilience, with some firms set to find themselves at a disadvantage if prices fall too low. NOCs face some fundamental challenges to their long-term resilience in this respect, with limited investment flexibility resulting in an excessive commitment to domestic upstream and a lack of unconventional exposure. At the same time, NOCs’ downstream portfolios are often affected by regulatory pricing controls imposed by their respective governments, which reduces profitability.

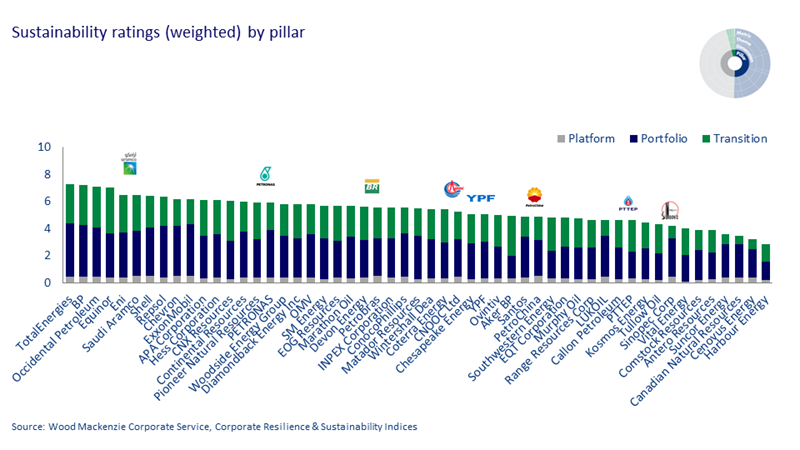

Sustainability: how well are NOCs positioned to navigate the transition?

Long-term sustainability is defined by a different set of factors, including portfolio longevity, carbon risk, and transition strategy and progress. NOCs’ Sustainability ratings are generally weaker, both in comparison to their Resilience ratings and versus other oil companies (see chart below).

The leading NOCs rank alongside the Majors on measures relating to Portfolio Sustainability. However, Transition ratings are low across the peer group, with limited progress on decarbonising existing assets or diversifying into low-carbon energy. Fundamentally, most NOCs have been relatively slow to act on climate risk and have so far failed to seize the opportunities presented by the energy transition.

On the plus side, some NOCs enjoy advantaged onshore or deepwater positions that provide high-margin barrels with protection from price downside. Many also have aggressive timelines for Scope 1 and 2 emissions reductions aligned with their governments’ net-zero goals. What’s more, despite above average emissions intensity for most NOCs, net present value (NPV) risk is limited thanks to lower regional carbon price assumptions.

On the other hand, NOCs typically face some fundamental challenges to improving their sustainability ratings. For one thing, a lack of recent exploration success has left many with a shortage of long-term growth options and below average internal rates of return (IRR). For another, NOCs have shown little interest in high-grading their portfolios; mature domestic upstream assets and intrinsically carbon-intensive downstream positions mean most have high emissions intensity.

Finally, most NOCs are weak on governance and disclosure, with no Scope 3 targets set, and low-carbon businesses still in their infancy. The former is relatively easy to address for those companies that are motivated to do so, but the latter will require concerted effort and considerable resource.

Now that you have a general overview, don’t forget to fill in the form at the top of the page to download your complimentary extract from the report. This includes more detailed analysis of the performance of individual NOCs across a wide range of relevant factors, including ratings for financial position, scale, longevity, concentration risk, cash flow & value, new project returns, investment flexibility, current carbon exposure, and strategy & targets.