Rare earth elements: frequently asked questions

Know your lanthanum from your lutetium

1 minute read

By Ross Embleton, Analyst and David Merriman, Manager, Battery & Electric Vehicle Materials

Rare earth elements (REEs) are lustrous, silvery-white, soft heavy metals with a vast array of industrial applications. They’re used in the electrical and electronic industries, the oil industry, aviation and the manufacture of glass and lasers, among other things. However, their use in magnet technologies, in particular, provide an opportunity to improve the efficiency of and/or miniaturise critical electronic components. The development of high strength rare earth permanent magnets has proven crucial to the development of certain new energy technologies.

We recently held a webinar on the global market for and trends in REEs. Fill in the form to receive a complimentary copy of the presentation slides. Read on for an introduction to the minerals and the market.

What are the rare earth elements?

REEs, also known as lanthanides, are a group of 15 elements ranging from lanthanum to lutetium in the periodic table. They can be separated into two categories:

- Light REEs – including lanthanum (La), cerium (Ce), praseodymium (Pr) and neodymium (Nd)

- Heavy REEs – the suite of lanthanides ranging from samarium (Sm) to lutetium (Lu) and plus yttrium (Y).

Scandium (Sc) is sometimes grouped with rare earths because of its similar chemical properties, though naturally scandium is more closely associated with aluminium deposits. The natural abundance of rare earths varies according to local geology, but the highest concentrations are typically found in alkaline complexes and carbonatites (a type of igneous rock).

How are rare earth elements used?

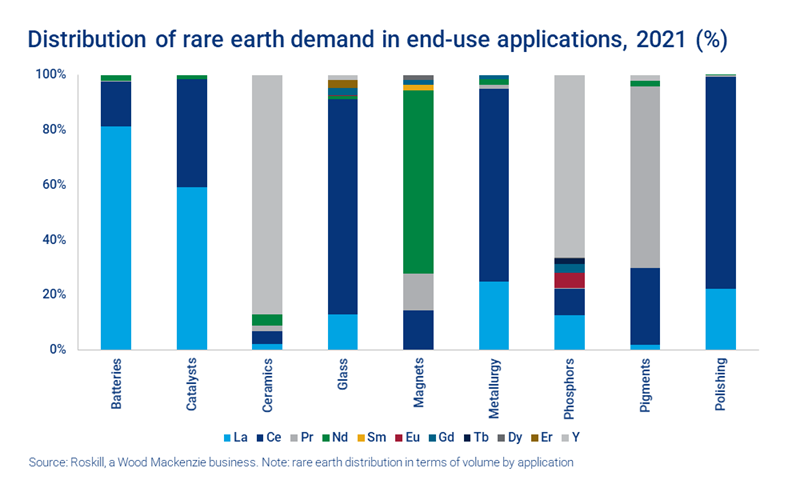

REEs have numerous applications, being used in specialty ceramics, fluorescent lighting and PET scanners. New energy technologies, specifically, wind turbines and electric vehicle (EV) drivetrains, have spurred demand for rare earth permanent magnets, with neodymium (NdFeB) magnets commanding the largest market share. Rare earth magnets largely use Nd, Pr and, to a lesser extent, dysprosium (Dy) or terbium (Tb).

While growth in rare earth magnet demand has outpaced growth in other applications, the consumption of rare earths (primarily La and Ce) for catalysts, polishing powders and metallurgical applications accounted for 42% of rare earth demand in volume terms in 2020, whilst permanet magnets accounted for 29%. In terms of market value, however, La and Ce demand made up only 3% and 4% of the market, respectively, while Nd accounted for 62%, Pr for 13% and Dy for 10.2%.

Where are REEs found?

Commercial extraction of rare earths is dominated by a small number of mineralogies, including bastnaesite, ion-adsorption clays, monazite and xenotime, which together account for more than 95% of economic production.

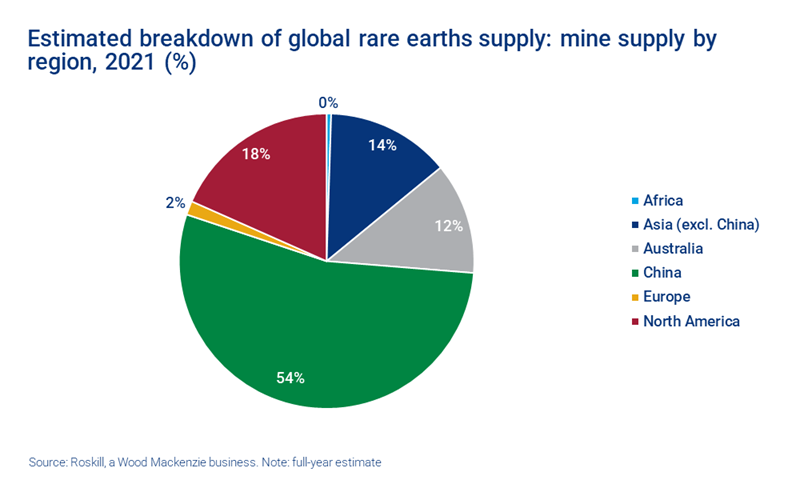

The light REEs are predominantly recovered from mineral concentrates of monazite and bastnaesite in China, the US, Australia, India and Madagascar, but also, to a lesser extent, from the mineral loparite, mined in Russia.

Most heavy REEs are sourced from ion-adsorption clay deposits and xenotime mineralisation in Myanmar and China, with minor volumes sourced from Australia.

Where is refined production centred?

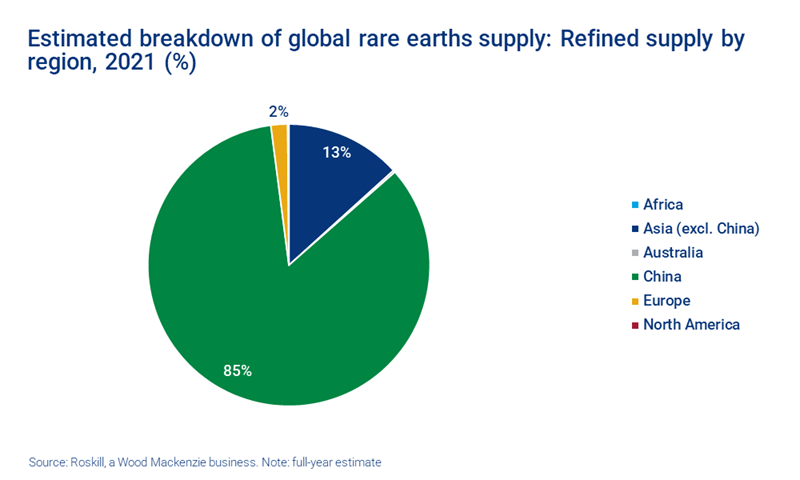

Concentrates of rare earth minerals are exclusively processed into refined products, either as mixed or semi-separated compounds or individual rare earth compounds. For magnetic applications, rare earth oxides must be further refined into rare earth metals and alloys, the requisite precursor materials for magnet manufacturing.

Refined production is heavily centred in China, where domestic production is supported both by domestic mining operations and imports of ores and mineral concentrates. China increased its proportion of global refined supply from 45% of global production in 1991 to in excess of 97% in 2009. Low prices and a migration of downstream customers into the Chinese market resulted in the closure or suspension of many non-Chinese operations. Unofficial or illegal production of rare earths also contributed to China’s dominance, where heavy REE-enriched deposits in southern provinces were targeted in a bid to capitalise on high prices in the late 2000s. As prices fell in the early 2010s, the environmental and social damage caused by illegal mining prompted a state-led crackdown on said operations.

Although high rare earth prices between 2009 and 2011 enabled an increase in Chinese production, it also incentivised a surge in the exploration and development of rare earth projects globally. Despite several operations commissioning rare earth capacity outside of China, only a handful of companies maintained consistent production as prices declined between 2012 and 2016.

In 2020, China accounted for 85% of global production of refined rare earth products, with other Asian countries (Malaysia, India and Vietnam) and comparatively minor European operations accounting for the remainder. China also consolidated its domestic rare earth industry into six state-owned enterprises, giving it greater control over the supply and pricing of rare earth exports globally.

What does the energy transition mean for rare earths?

The global transition to a lower-carbon future has fuelled significant interest in the rare earths industry. Prices have risen, resulting in a diverse pipeline of projects in terms of geography and mineralogy. The majority have been known and explored for more than a decade, but suffered from a lack of market investment due to fluctuating conditions and competition for investment from battery material-focused projects.

Notable recent developments include:

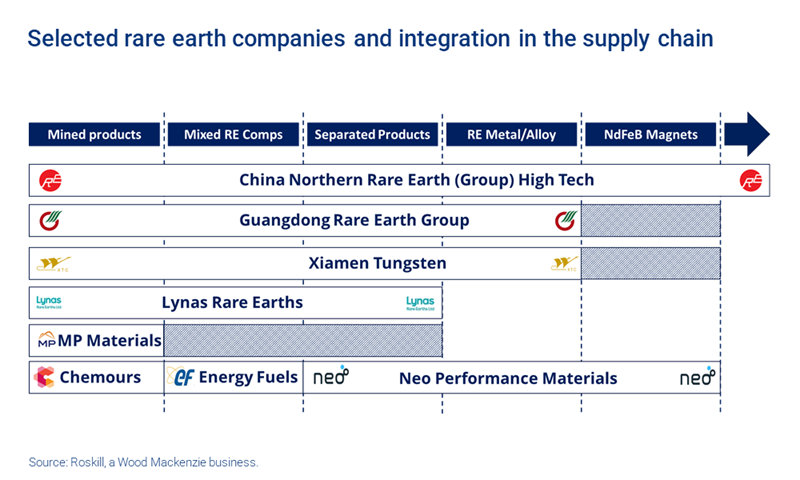

- The start of a production initiative between Chemours, Energy Fuels (EF) and Neo Performance Materials (NPM). At its White Mesa facility in Utah, EF processes monazite sands from Chemours’ Starke project in northeast Florida. The process involves extracting uranium and thorium and producing a mixed rare earth carbonate product to be shipped to Neo’s Silmet facility in Estonia for separation.

- Commercial-scale production of rare earth concentrate began at the Nechalacho mine, Northwest Territories, Canada this year. Material will be sent for refining at the Saskatchewan Research Council’s cracking and leaching facility in Saskatoon in late 2021.

- In Australia, financial and legislative support from central government is helping to incentivise the development of multiple rare earth operations, including Iluka Resources’ Eneabba refinery and Arafura Resources’ Nolans project.

- The ongoing relocation of Lynas’ LAMP cracking and leaching facility from Malaysia to Kalgoorlie, Western Australia, would see the first commercial-scale rare earth cracking and leaching capacity commissioned in Australia. Lynas has also entered into agreements with the US Department of Defense to establish light REE and heavy REE separation facilities in Texas.

Could China’s REE dominance present a supply challenge?

Rare earths have been an ever-present and longstanding member of many critical raw material lists. The geographic concentration of rare earth mining and refined production has long raised concerns over the potential for supply disruption and the wide-ranging end-use markets they serve. Around 90% of NdFeB magnet manufacturing currently takes place in China, despite efforts to diversify mined and refined supply. This raises geopolitical concerns.

You can read more on this and other issues pertaining to the REE market in the selection of slides we have compiled from our recent webinar. This includes charts on:

- Rare earths: demand and market value

- China’s REE supply dominance and rare earth landscape

- Future pipeline of rare earth projects

- Supply outlook

- And more.

Fill in the form at the top of the page to receive your complimentary copy.