Get Ed Crooks' Energy Pulse in your inbox every week

Biden exit shakes up US presidential race

The election in November will have significant consequences for US energy. Uncertainty is already affecting some sectors

12 minute read

Ed Crooks

Senior Vice President, Thought Leadership Executive, Americas

Ed Crooks

Senior Vice President, Thought Leadership Executive, Americas

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Trump and Harris set out contrasting visions for US energy

-

Opinion

The rise of AI means surging investment in electricity supply. What will that mean for customers?

-

Opinion

Can America build new energy projects faster? Should it?

-

Opinion

The extraordinary comeback of concentrating solar power

-

Opinion

Permitting reform plans raise hopes for accelerated investment in US infrastructure

-

Opinion

How global trade can help build the clean energy economy

Uncertainty still swirls around the US elections on 5 November, but one thing is now clear: in January of next year, the country will have a new president. On Sunday, President Joe Biden announced that while it had been his intention to seek re-election in November, “I believe it is in the best interest of my party and the country for me to stand down”.

His decision means that former President Donald Trump will be running against a Democratic candidate yet to be determined. Vice-President Kamala Harris is the front-runner, and has been backed by President Biden, but other candidates may emerge before the party formally picks its nominee at its convention, which starts on 19 August.

The election result is likely to have momentous consequences for energy in the US. Uncertainty over the outcome is already having a material impact in some sectors, including LNG (more on this below). President Biden’s decision not to run has shaken up the race, potentially affecting former President Trump’s chances of securing a second term. It has also opened up the possibility of a Democrat with different views on energy entering the White House.

Vice-President Harris has a record of significantly stronger opposition to the oil and gas industry and support for emissions reductions than President Biden.

As of last week, President Biden was lagging behind former President Trump in the polls, although the race was close. Vice-President Harris was polling very similarly to President Biden, but his exit from the race has created an element of volatility that could mean those ratings, and assessments of other potential Democratic candidates, could change.

Former President Trump pledges to boost oil and gas production

In his speech to the Republican convention last week, former President Trump identified boosting oil and gas production as one of his first priorities if re-elected. “On Day One… Drill, baby, drill,” he said.

“We are a nation that has the opportunity to make an absolute fortune with its energy. We have it and China doesn’t,” he said. “We will be energy dominant and supply not only ourselves, but we will supply the rest of the world.”

He also pledged to cut spending on emissions reduction, saying that trillions of dollars had been spent on “the Green New Scam”. Money committed to climate policy would instead be redirected “for important projects like roads, bridges, dams,” he added.

Another priority, he said, would be to “end the electric vehicle mandate on day one, thereby saving the US auto industry from complete obliteration.” However, there was a nuance to that: Chinese vehicle manufacturers would be able to sell in the US, so long as “plants will be built in the United States and our people are going to man those plants.”

As I wrote back in January, a US president’s powers to influence the country’s oil and gas production are often over-estimated. On the campaign trail President Biden talked about making a transition away from the oil industry, but while he has been in office, the US has seen record oil and gas production and become the world’s largest LNG exporter.

Robert Clarke, Wood Mackenzie’s vice-president of Upstream research, says US oil and gas producers are committed to their strategies of removing volatility from business planning and using excess cash flow to reward investors, and it would take significant fiscal, regulatory and leasing reform to change their plans..

Factors that can be changed by the administration, including onshore and offshore leasing for development, and the pace of approvals for permits, can have an impact on production at the margin, growing over time. Moves to expedite permitting for pipelines and other infrastructure can also help oil and gas producers. But there is unlikely to be any large near-term effect on output under a second Trump administration.

Wood Mackenzie’s Clarke notes that perhaps the biggest impact of a victory for former President Trump could be in the shift of rhetoric from the White House, which would become an unequivocal champion for oil and gas. That could have a significant effect on industry sentiment, especially for smaller E&Ps.

Democratic contenders have varied records on energy

A Democratic victory in November would mean much more continuity with President Biden, including support for the tax breaks for low-carbon energy in the Inflation Reduction Act of 2022. However, a different individual in the White House would introduce some new perspectives on energy policy.

Vice-President Harris was previously the attorney-general for California and then a US senator for that state, and has generally been more strongly opposed to fossil fuels than President Biden. When she ran against him in the Democratic primary in 2019-20, she supported a national ban on hydraulic fracturing, and criticised Biden for his failure to support such a ban.

The climate plan that Harris launched in September 2019 included pledges to regulate the oil and gas industry more stringently, and to end sales of conventional internal combustion engine vehicles after 2035. She also proposed to create an Office of Climate and Environmental Justice Accountability to measure impacts on communities affected by climate change, and to monitor compliance with environmental regulations.

She was also a public supporter of the Green New Deal programme to develop low-carbon energy, and has backed a carbon tax as a “price on pollution”.

Earlier in her career, as a district attorney in San Francisco and then attorney-general of California, environmental issues were one of her priorities. Her claim to have sued ExxonMobil over the risks of climate change turned out to be overstated, but she did prosecute other cases over pollution. That has encouraged speculation that under a Harris administration there could be more environmental cases brought against oil and gas companies.

One of her possible challengers, Governor Gavin Newsom, is also from California. Like Vice-President Harris, he has staked out positions as a leader in tackling climate change, setting ambitious goals for the state of reaching net-zero carbon emissions and 100% clean electricity by 2045.

Other contenders, and possible running mates for Harris as vice-president, include Governor Gretchen Whitmer of Michigan, Governor Andy Beshear of Kentucky, and Governor JB Pritzker of Illinois. All have supported action to develop low-carbon energy, but with a varying emphasis.

Governor Whitmer last year backed a package of climate legislation for Michigan, emphasising that the new laws would “lower household utility costs, create tens of thousands of good-paying jobs, and protect Michigan’s precious air, water, and public health.” One of the key measures streamlined permitting of utility-scale low-carbon energy, addressing an issue that has been a growing concern for the renewables industry across the US.

Governor Beshear, leading a coal-producing state, has tended to avoid discussion of climate change, instead focusing on job creation in low-carbon energy. “I believe in an all-of-the-above energy strategy where we nurture our traditional energy industries while welcoming other and new jobs in,” he said last year.

Governor Pritzker has similarly put a focus on job creation in his energy policy, and last year signed legislation to prevent low-carbon energy projects being blocked by local bans on development.

President Biden’s position on energy shifted quite significantly between his primary campaign and his time in office. It is likely that any future Democratic president will be pulled closer to the policies of the Biden administration, whatever their previous statements have been. Being perceived as hostile to the oil industry could be politically damaging if gasoline prices rise strongly. But the records of the candidates give indications of their approaches and the instincts they would apply if elected.

Uncertainty casts a shadow over US LNG

One sector where it is clear that uncertainty over the election outcome is already having an effect is in the US LNG industry. The Biden administration in January announced a “pause” in export approvals for new LNG projects, pending an update of the Department of Energy’s analysis of their environmental and economic impacts.

Former President Trump has said that he would end the pause immediately if re-elected. Jennifer Granholm, the US energy secretary, has indicated that it would also be lifted by a future Democratic administration (although she was speaking back in March, when President Biden was still in the running to serve a second term).

Even if the ban does seem likely to be lifted by a future Democratic administration, however, there is still uncertainty over the framework for approvals in the future. The pause affects approvals by the Department of Energy for LNG projects to export gas to countries that do not have a free trade agreement (FTA) with the US. A future administration could resume awards of those permits, but only under certain conditions, such as proof that the exports would lead to a net reduction in greenhouse gas emissions, or commitments not to drive up the price of natural gas in the US.

While the uncertainty over the election and future policy persists, there is a significant impact on the industry, says Mark Bononi, Wood Mackenzie’s principal analyst for global gas and LNG asset research. There have been no new final investment decisions (FIDs) for US LNG projects in over a year, and new contract sales have fallen.

There is still activity in the industry, but it has mostly been at projects that have already secured their crucial non-FTA export approvals from the DoE. In particular, two projects that secured those approvals before the pause was announced, NextDecade’s Train 4 at Rio Grande LNG and Glenfarne’s Texas LNG, have been making significant progress.

There has been some activity, but it has mostly been for projects that have already secured their crucial non-FTA export approvals from the DoE. In particular, two projects that secured those approvals before the pause was announced, NextDecade’s Train 4 at Rio Grande LNG and Glenfarne’s Texas LNG, have been making significant progress.

NextDecade last month announced a non-binding Heads of Agreement for a 20-year LNG sale and purchase agreement with Aramco for offtake from Rio Grande Train 4. The deal, Aramco’s first direct global LNG offtake agreement, is the latest step in NextDecade’s “rapid and steady progress” towards FID for Train 4 in the second half of this year, Wood Mackenzie’s Bononi said.

Texas LNG, a nearby project, this month announced another offtake deal with an unidentified buyer, meaning that it now has sales covering 75% of its nameplate capacity. Its developer Glenfarne aims to take FID this year.

Some projects without non-FTA export approval have been making progress. Sempra last month announced an offtake agreement with Aramco for the Phase 2 expansion of its Port Arthur LNG plant. The agreement gives Aramco a 25% equity interest in the project. However, several hurdles remain to be crossed for that second phase to get to FID, including the award of that non-FTA export permit.

Venture Global’s last month secured approval from the Federal Energy Regulatory Commission for its Calcasieu Pass 2 LNG plant in Louisiana, which has been targeted by environmental campaigners. But that project also has yet to secure non-FTA export approval.

A federal court in Louisiana ruled earlier this month that the pause in approvals was unlawful, and should be ended “in its entirety, effective immediately”. But the administration said it disagreed with the ruling, and it is not expected to have any short-term impact.

Ultimately, the uncertainty over the future of US LNG exports will be resolved only once the election is over, and perhaps even later than that.

In the meantime, projects that have that non-FTA approval are competitively advantaged. Over the weekend, Woodside announced an agreement to buy Tellurian, including its Driftwood LNG project, for about US$900 million in cash, equivalent to US$1 per share. Driftwood LNG is fully permitted, including authorisation for non-FTA exports, with a total capacity of 27.6 mmtpa.

Other views

Is it time for a global climate bank – Simon Flowers and others

The outlook for European power and renewables – Peter Osbaldstone and others

The global power market outlook: can global power generation keep up with the energy transition?

Waste to wealth: unlocking circular value chains – Guy Bailey and Husam Taha

National Oil Company international M&A spend hits 20-year low

Q&A: What China’s push for ‘new quality productive forces’ means for climate action – Anika Patel

The market’s next Black Swan is climate change – Mark Gongloff

Quote of the week

“Recently, we’ve seen the wettest 18 months on record in England. Thousands of acres of farmland have been submerged for extended periods, leading to the loss of crops and animals. The impact of this is expected to be felt well into 2025. Livelihoods have been disrupted and lives lost in the UK and overseas as a direct consequence of climate impacts, which are becoming more severe… Adapting to the physical risks of climate change is a pre-requisite for delivering the path to Net Zero. Otherwise, plans risk being less effective or more costly.”

Complaining about the weather is a long-established British tradition. The UK government’s advisory Climate Change Committee cited evidence in its latest annual Progress Report to Parliament, showing that complaints about increased rainfall have a basis in fact. As a result, it argued, the UK’s plan for adapting to a warming world “lacks the pace and ambition to address growing climate risks which we are already experiencing.”

Chart of the week

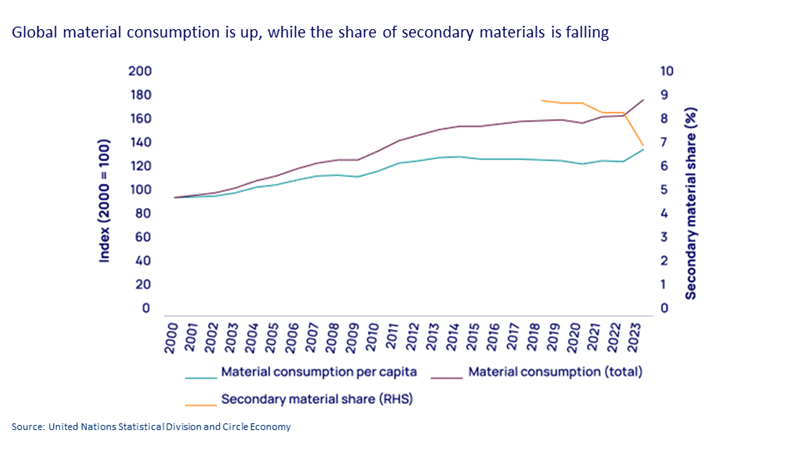

This comes from a very interesting news Horizons report by my colleagues Guy Bailey and Husam Taha, about the key challenges involved in the creation of circular value chains, and some effective solutions for overcoming them. It shows indices for materials consumption, in absolute terms (the brown line) and on a per capita basis (the green line) since 2000, as well as the share of secondary supply in materials overall, which is the orange line. You can see how, despite all the talk about materials efficiency and building a circular economy, materials use has been on a rising trend, albeit with a levelling-off on a per capita basis during the 2010s. And the share of secondary materials in total supply has actually been falling. For explanations of these trends, and ideas on some possible solutions, take a look at the full report.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today to ensure you don’t miss a thing.