Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency -

Sonia KerrSonia.kerr@woodmac.com

+44 330 174 7267

New projects in the upstream oil and gas industry to double in 2017 predicts Wood Mackenzie

2 minute read

LONDON/HOUSTON/SINGAPORE, 11 January 2017 — Wood Mackenzie forecasts the investment cycle will show the first signs of growth in 2017 since 2014 and final investment decisions (FIDs) will double, compared with 2016.

Malcolm Dickson, a principal analyst for Upstream Oil and Gas for Wood Mackenzie, said: "2017 will demonstrate how efficient the oil and gas industry has become; showing projects in better shape all round."

According to Wood Mackenzie's global upstream outlook for 2017, confidence will start to return to the sector, with exploration and production spend set to rise by 3% to US$450 billion. Though a corner is being turned, this is still 40% below the heady days of 2014. At the forefront of the revival will be US tight oil. Costs will continue to fall in 2017, though only marginally. But for all the pain of the downturn, a leaner industry is starting to emerge.

Capex deflation has averaged 20% over the past two years. With service sector margins wafer thin, Wood Mackenzie believes there’s now only room for small reductions and capital costs are expected to fall by an average of 3% to 7%.

The key themes of Wood Mackenzie's Global Upstream: 5 things to look for in 2017 report are:

• Global investment will rise, reversing two years of severe decline.

• FIDs will double and deep water is back on the agenda.

• Costs will bottom out as an efficiency boom takes hold, but more work is required.

• Fiscal rules need to improve to attract scarce investment.

Rise in global investment in 2017 after two years of severe decline

"The global investment cycle will show the first signs of growth in 2017, bringing the crushing two-year investment slump to a close," said Dickson.

US tight oil, and the Permian basin in particular, will lead the way, distinguished by low breakevens, scale and flexibility. US Lower 48 spend is set to grow by 23%, to US$61 billion, with upside if oil prices rise strongly and US Independents are emboldened by a Trump presidency.

Number of project FIDs to double

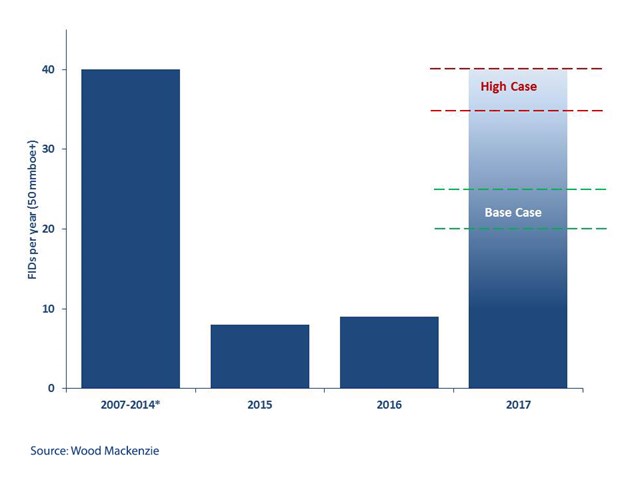

Wood Mackenzie predicts the number of FIDs will rise to more than 20 in 2017, compared with nine in 2016. This is still well short of the 2010-2014 average of 40 a year. But these are generally smaller, more efficient projects, and capex per barrel of oil equivalent (boe) averages just US$7 per barrel, down from US$17 per barrel for the 2014 projects.

"Companies will get more bang for their buck as development incremental internal rates of return (IRR) will jump from 9% to 16%, comparing 2014 to 2017," said Dickson. "This is in part a result of a shift in capital allocation away from complex mega projects towards smaller, incremental projects in the Canadian oil sands and deep water."

A leaner industry has emerged from the downturn

"Nowhere is the mantra ‘doing more with less’ more evident than onshore US. There has been a dramatic increase in efficiency in the sector, exemplified by the drillers, who are managing to complete wells up to 30% quicker," he added.

Wood Mackenzie says as the tight oil sector heats up further, the spectre of cost inflation looms in 2017. But any increase in costs may well be offset by further efficiency gains in earlier-life plays. For example, there’s still potential for a further improvement in drilling speed of 20% to 30% in some early-life tight oil plays.

Deep water will spring back to life in 2017, but more cost cutting is needed in the long run

Deepwater FIDs will be a leading indicator the tide is turning. The best development assets will hold their own against tight oil, especially as more risk-averse tight oil operators start to screen opportunities under higher discount rates.

According to Wood Mackenzie's global upstream outlook, projects slated for FID in 2017 are largely looking good, but the longer-term deepwater pipeline is more challenged. Of the 40 larger pre-FID deepwater projects, around half fail to hit 15% IRR at US$60 a barrel.

"The industry has selected the best projects to optimise and take forward. In 2017 it will have to turn its attention towards optimising the next wave of developments to get them sanction-ready," said Dickson.

Fiscal terms will need to improve to attract scarce investment

Graham Kellas, senior vice president of global fiscal research at Wood Mackenzie, said: "Some governments will be tempted to increase tax rates, but those with uncompetitive fiscal regimes will have to make changes to ensure they can attract still-scarce new capital. Getting the risk-reward balance right will be a critical factor in attracting scarce investment capture in 2017, even for resource-rich hotspots such as Iran and Mexico."