Energy transition outlook: EU

Europe’s flagship energy transition targets are not on track and delays in decarbonising end-use sectors look set to push net zero out beyond 2060 – accelerated EV adoption will be crucial

3 minute read

Lindsey Entwistle

Senior Research Analyst, Energy Transition

Lindsey Entwistle

Senior Research Analyst, Energy Transition

Lindsey provides analysis and insights into global policy, regulations and disruptive technologies.

Latest articles by Lindsey

-

Opinion

Energy evolution: navigating the path to a sustainable future

-

Opinion

What are the energy transition technologies to watch in 2025?

-

Opinion

Energy transition outlook: UK

-

Opinion

Energy transition outlook: UK

-

Opinion

Energy transition outlook: EU

-

Opinion

Energy transition outlook: EU

These are challenging times for Europe’s energy transition. The EU Parliament and national governments emerged from 2024 elections more fragmented as parties deprioritising low-carbon agendas and critical of established policies made gains. The ongoing Russia/Ukraine war continues to shine a spotlight on energy security and the role of renewables in displacing imported gas. Meanwhile, Trump’s second presidency raises questions around the EU’s strategy to cope with the fallout of trade wars and global repositioning on net zero ambitions.

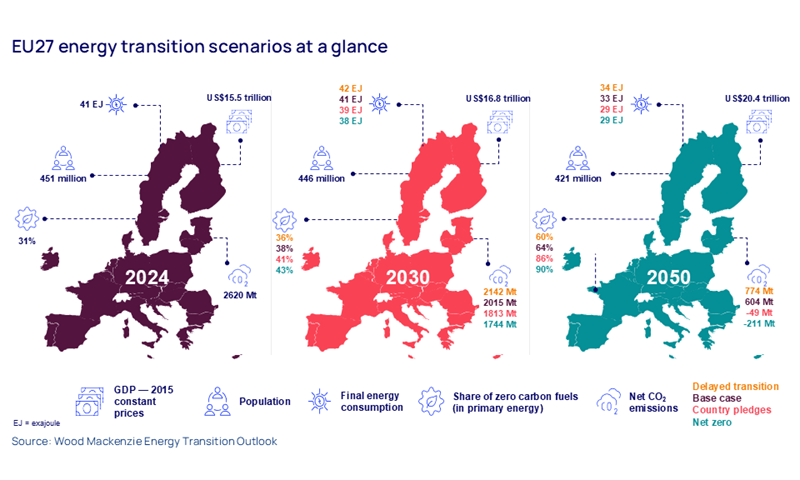

Against this backdrop of uncertainty, our updated energy transition outlook (ETO), from our Energy Transition Service, explores the progress made against renewable power targets. The report maps out four energy transition scenarios – with increasing levels of ambition and investment – and the regional updates delve into the detail at country level.

You can access a complimentary extract from the EU-27 edition by filling in the form at the top of this page. And read on for a short introduction to some of the key themes.

Net zero targets are within reach – but not on track

The flagship net zero by 2050 and supporting targets are not on track, with emissions at 604 Mtpa by 2050. We expect delays in decarbonising end-use sectors to push net zero out beyond 2060.

In our base case, energy related emissions fall by 47% by 2030, compared to 1990 levels. This falls short of the 55% reduction under ‘Fit for 55’ target, but is well ahead of other regions.

Progress varies across member countries. Nordic members achieve net zero ahead of targets in our base case, while others must accelerate EV adoption and industrial decarbonisation.

Renewables and electrification unlock energy security and decarbonisation – EV adoption must accelerate

In our base case, solar and wind generate half of power supply by 2030 at 20% and 30% respectively, with renewables starting to reduce reliance on gas generation by 2030. Additional solar and wind capacity of 930 TW and 526 GW are expected to be deployed by 2050.

A further 291 GW of wind capacity is needed for net zero. But solar capacity is already on track as the focus for net zero shifts away from additional assets to optimising existing assets, improving transmission systems and increasing energy storage.

EV adoption (including hybrid vehicles) is forecast to reach 80% share of the passenger fleet in our base case and 97% in our net zero by 2050 scenario. But the real differentiator to put the EU on track for net zero would be an immediate acceleration of the pace of adoption to hit 30% by 2030, up from the expected 25%.

Emerging technologies show promise but are stumbling at the starting block

The low-carbon hydrogen demand outlook is 5 Mtpa by 2030, well short of the REPower EU supply target of 10 Mt imports and 10 Mt production by 2030. Demand grows to 35 Mtpa by 2050, with 65% domestic supply – but a net zero scenario requires 49 Mtpa.

Carbon capture is now endorsed by the EU, with an ambitious target of 200 Mtpa storage capacity by 2040. We expect captured volumes of 68 Mtpa by 2040 while our net zero scenario needs 267 Mtpa by 2050.

Nuclear small modular reactors (SMR) and geothermal grow to 0.74% and 1.5% share of EU power supply by 2050 in our net zero scenario, as all low-carbon options are harnessed.

Get a closer look at Europe’s energy transition scenarios

The full report explores the outlook for commodity demand, power supply mix and end-use energy demand under our base case, country pledges scenario, net zero scenario and our new delayed transition. This includes country spotlights for: the Netherlands, Belgium, Denmark and Finland.

Our complimentary extract includes :

- Key themes to watch in 2025, including CBAM’s transitional phase

- Charts including net CO2 emissions by scenario, and EU energy demand

- Upgrades and downgrades: what’s changed since last year’s update?

- EU members’ differing approaches

- And more.