Energy transition outlook: Africa

Universal energy access and renewables present significant investment opportunities in Africa – but unlocking vast energy resources remains a major financing challenge

2 minute read

Roshna N

Research Analyst, Energy Transition

Roshna N

Research Analyst, Energy Transition

Roshna N specialises in integrated energy and emission models for Asia-Pacific and African markets.

Latest articles by Roshna

-

Opinion

What are the energy transition technologies to watch in 2025?

-

Opinion

Energy transition outlook: Asia Pacific

-

Opinion

Energy transition outlook: Asia Pacific

-

Opinion

Energy transition outlook: Africa

-

Opinion

Energy transition outlook: Africa

-

The Edge

How the world gets onto a 1.5 °C pathway

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash leads a team of analysts designing research for the energy transition.

Latest articles by Prakash

-

Featured

Nuclear 2026 outlook

-

Opinion

Energy evolution: navigating the path to a sustainable future

-

The Edge

Five key takeaways from COP30

-

The Edge

Slipping climate targets and the “energy addition”

-

The Edge

The narrowing trans-Atlantic divide on the energy transition

-

Opinion

Energy transition outlook: Asia Pacific

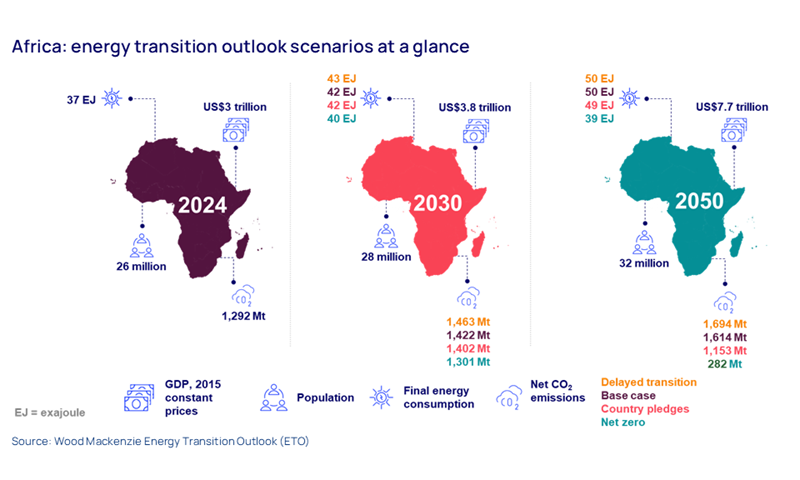

Africa holds immense potential for energy development. Abundant untapped resources in gas, oil, and renewable energy could transform the continent's energy landscape. Unlocking these vast resources would achieve greater prosperity, enhanced energy access and contribute to social well-being, economic growth and climate goals. With GDP projected to increase from US$3 trillion in 2024 to US$7.7 trillion by 2050 the opportunity is immense.

The energy transition in Africa must strike a balance between improving access to energy and addressing decarbonisation goals. So, can it energise and decarbonise quickly? What pathways can we expect?

Our energy transition outlook (ETO), from our Energy Transition Service, maps out four energy transition scenarios – with increasing levels of ambition and investment – and the regional updates delve into the detail at country level.

You can access a complimentary extract from the Africa edition – updated for 2025 – by filling in the form at the top of this page. And read on for a short introduction to some of the key themes.

Both renewables projects and fossil fuel production slowed in 2024 in many parts of Africa

Africa saw a drop in renewable energy installations in 2024. Solar capacity additions were around 3.5 GW in 2024 compared to 4 GW in 2023. Moreover, most of the installations were concentrated in South Africa.

Meanwhile, oil and gas production in the Sub-Saharan African region grew by 5% in 2024. This increased output was due to production growth in Nigeria, Senegal, Congo, Mozambique and Côte d'Ivoire. However, production of gas in Egypt, Algeria and Libya dropped compared to 2023.

Meanwhile, the demand gap remains deeply concerning. Around 42% of the continent’s population lacks access to electricity and nearly 70% lack access to clean cooking fuels.

Africa's emissions will continue to rise if its energy mix and consumption patterns remain unchanged

Improving energy access is a clear priority. However, greater emphasis must also be placed on low-carbon energy and efficiency to curb emissions and air pollution growth effectively.

Transitioning from bioenergy to electricity offers significant efficiency advantages, reducing the primary energy required to meet demand. Additionally, this shift provides critical benefits by lowering indoor air pollution and mitigating associated health risks.

Bioenergy demand currently constitutes 81% of residential, commercial and agriculture (RCA) energy demand. In our base case, this only declines to 70% by 2050, primarily as clean fuels growth fails to match the rising energy demand driven by population growth. Under a net zero scenario, bioenergy's share drops to 50% by 2050.

Funding will be key to realising Africa’s climate and development objectives. Africa desperately needs substantial external sources of low-cost financing – a major challenge when capital costs for African projects are often up to three times those of other countries. To date, it has received only a small portion of the promised annual US$100 billion in climate finance from OECD countries.

Get a closer look at Africa’s energy transition scenarios

The full report – updated for 2025 – explores these themes and more in detail, tackling key questions including:

- What is the outlook for commodity demand and the power supply mix under our base case, country pledges, net zero by 2050 and delayed energy transition scenarios?

- How much renewables, hydrogen and carbon capture do we expect to see deployed in the region to offset the potential decline in fossil fuel consumption?

- What is the scale of the financing challenge in Africa – and how might it be solved?