US residential solar: cloudy skies will lead to a market reset in 2024

2023 was a year of fragmentation for the residential solar financing market

4 minute read

Zoë Gaston

Principal Analyst, US Distributed Solar

Zoë Gaston

Principal Analyst, US Distributed Solar

Zoë's areas of focus include residential solar policy and project finance

Latest articles by Zoë

-

Opinion

US residential solar turbulence persisted through 2024

-

Opinion

Solar surge: the US solar industry shatters records in 2024

-

Opinion

US residential solar market turmoil reached new heights this year

-

Opinion

RE+ 2024: Our 7 biggest takeaways

-

Opinion

The US solar industry is off to a strong start in the first quarter

-

Opinion

US residential solar: cloudy skies will lead to a market reset in 2024

The passage of the Inflation Reduction Act (IRA) in 2022 heralded long-term growth for the segment, increasing and extending the investment tax credit (ITC). However, the tangible benefits of this legislation are taking longer than expected to materialise.

At the end of 2022, high interest rates started to afflict the industry. Throughout 2023, the residential solar market experienced a ripple effect from high financing costs, leading to lower consumer demand, changes in financing terms, installer cash flow constraints, numerous bankruptcies, heightened concerns about consumer protection, and a sharp decline in residential stock prices.

Wood Mackenzie’s US residential solar finance update H1 2024 delves into the state of residential solar consumer finance in the US. The report highlights the key players, trends, and forecasts of the third-party ownership (leases and power purchase agreements) and customer ownership (cash and loan purchases) markets.

Fill in the form at the top of the page to access a complimentary extract from the H1 2024 report and read on for some key highlights:

The residential solar market is not on the verge of collapse but will contract in 2024

While media rhetoric speculates about a looming collapse, the market set its fifth consecutive year of record installed capacity in 2023. One primary driver of this growth was the implementation of California’s less lucrative successor solar tariff last spring, which created a temporary surge of installations through the third quarter of 2023.

Wood Mackenzie forecasts a 13% year-over-year decline in installations in 2024 as consumer demand remains weak and California installations drop by an expected 40%. While the market is not on the verge of collapse—it will experience a reset in 2024, particularly in terms of the financing landscape and competitive dynamics.

The third-party ownership market is experiencing a resurgence

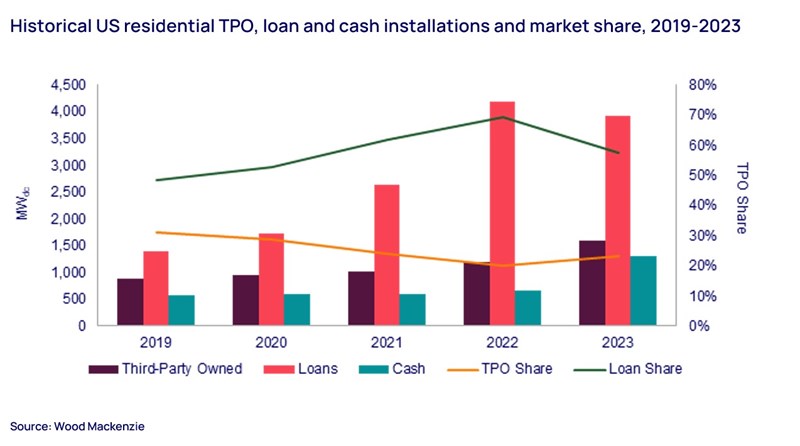

There are two main pathways for homeowners to go solar: own the system themselves (cash or loan-financed) or enter an agreement with a third-party owner (lease or PPA). The low financing rate era led to a loan boom over the past few years, with the loan segment reaching nearly 70% market share in 2022. However, demand weakened as loan interest rates and customer fees skyrocketed at the end of 2022. Lenders made erratic rate increases and experienced declines in funded volumes. The loan segment declined by 6% in 2023 but maintained its majority market share of 58%.

While third-party ownership (TPO) products peaked in 2015, the segment consecutively lost market share through 2022 as it was difficult for TPO providers to compete against zero or low-interest rate loans.

However, provisions under the IRA created an advantage for the TPO segment, establishing three tax credit adders for eligible TPO projects, each worth 10%. The TPO segment is now seeing a (slow) resurgence with new players and partnerships. While TPO volumes by 32% and set an annual record, the segment only reached a 23% market share.

The consolidation of the financing market is disintegrating

There has also been a shakeup in the market’s competitive dynamics. Historically, the top three lenders dominated the loan market, making up nearly 80% of the combined market share in 2022. However, as top players struggled, their combined market share fell to 54% in 2023. While the TPO segment was still largely a duopoly in 2023, with Sunrun and Sunnova holding 80% of the total market share, the landscape may soon change.

As new players enter the mix, the residential solar financing market has become more fragmented. Wood Mackenzie’s “unknown” share of the market increased from 14% in 2022 to 43% in 2023. On the loan side, credit unions are gaining popularity. Newer companies are learning from others’ mistakes and aren’t burdened by the need to make money back on losses from rising interest rates. For TPO, the increased interest and investment in the space attracts new players, but competing with more established TPO providers will take more time.

The residential solar market will recover in 2025 but will look different

The residential solar market will recover in 2025 but will continue to evolve. The market has grown rapidly over the last decade, and while this turbulent time is painful, many are hopeful that it will weed out bad actors and mature in a way that will better protect consumers.

Wood Mackenzie expects the TPO segment to gain momentum over the next few years, reaching 41% market share by 2026. However, the loan segment will maintain its majority share throughout our five-year outlook, as there will always be a substantial subset of customers who want to own their solar system.

Learn more

For a closer look at our US residential solar finance update, fill in the form at the top of the page to download your complimentary extract of the report.