Nickel and copper: building blocks for a greener future

As the energy transition drives surging demand, boosting supply will be key for copper and nickel

1 minute read

Andrew Mitchell

Director, Nickel Research

Andrew Mitchell

Director, Nickel Research

Specialising in nickel for over 20 years, Andrew has a deep understanding of the metals and mining industry.

Latest articles by Andrew

-

Opinion

Four key takeaways from LME 2024

-

Opinion

Nickel and copper: building blocks for a greener future

-

Opinion

How electric vehicles are driving the nickel sulphate market

Nick Pickens

Research Director, Global Mining

Nick Pickens

Research Director, Global Mining

Nick has over 20 years of experience in the metals and mining sector across base, bulk and precious metals.

Latest articles by Nick

-

Featured

Metals & mining 2025 outlook

-

Opinion

Copper rush: A strategic analysis

-

Opinion

Video | The long-term outlook for copper

-

Opinion

Four key takeaways from LME 2024

-

Opinion

BHP’s all-share offer for Anglo American

-

Featured

Metals and mining 2024 outlook

Both nickel and copper possess properties that give them a central role in the drive for a greener future. While demand from existing use cases will continue to grow steadily, electric vehicle (EV) and energy storage applications will underpin a huge increase in long-term demand.

At the recent Future Facing Mined Commodities Forum, we looked at the importance of these two metals for the energy transition and how the industry will need to adapt to bridge looming supply gaps.

Got half an hour? Fill in the form to access a complimentary replay of the focused sessions on nickel and copper, along with the presentation slides. Got five minutes? Read on for an introduction to some of the key themes.

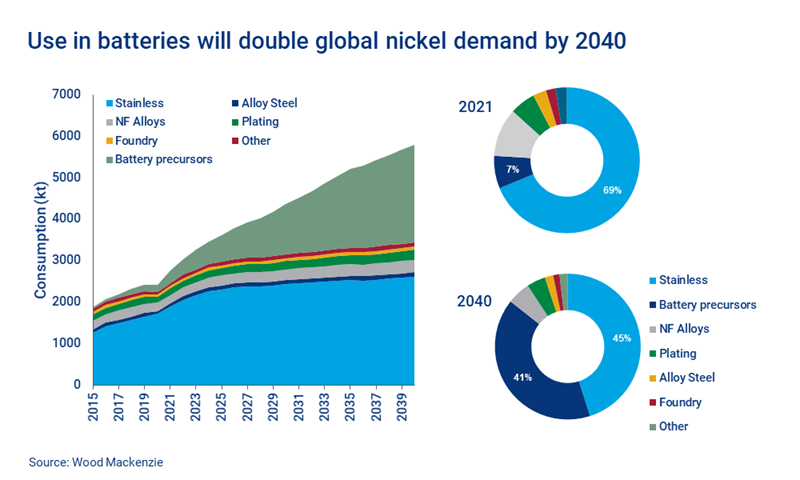

Global nickel demand growth: the future is batteries

While stainless steel will continue to be the main first use for nickel, the major engine of demand growth over the next two decades will be batteries. From only 7% of the total market in 2021, we expect battery use to grow to 40% of nickel consumption by 2040. That will push nickel demand to double in size to six million tonnes per year.

Our estimate for nickel use in batteries has increased by 900,000 tonnes in the past six months, mainly due to greater net zero commitments from governments and automakers. The increasing importance of energy storage to enable wider use of renewables will also be an important factor in driving demand.

Supplying the nickel required will be challenging in an ESG-constrained world

Our current forecast indicates the need for an additional 1.65 million tonnes of nickel to be brought into production between 2026 and 2038. Given that an additional 1.8 million tonnes of nickel will have been brought online between 2011 and 2023, that ought to be feasible.

However, the vast majority of new capacity development over the past decade has been in Indonesia and has had significant environmental side effects. Recent pledges by Indonesia to reverse deforestation and cease coal-fired power station development would make repeating these growth rates extremely challenging.

How regionality and legislation will drive nickel recycling

There is a growing focus on using locally-produced raw materials in Europe and the US. However, the lack of new project development for nickel mining outside Asia means battery manufacturers will need to turn to recycling to plug the gap.

US battery recyclers are setting up plants close to cell scrap generation – this proximity to feed sources will help to reduce Scope 3 emissions. However, government initiatives and legislation will be needed to support recycling and really drive it forward.

Our current projection is that 20% of nickel demand for EVs (420,000 tonnes) will be recovered from EV recycling by 2040.

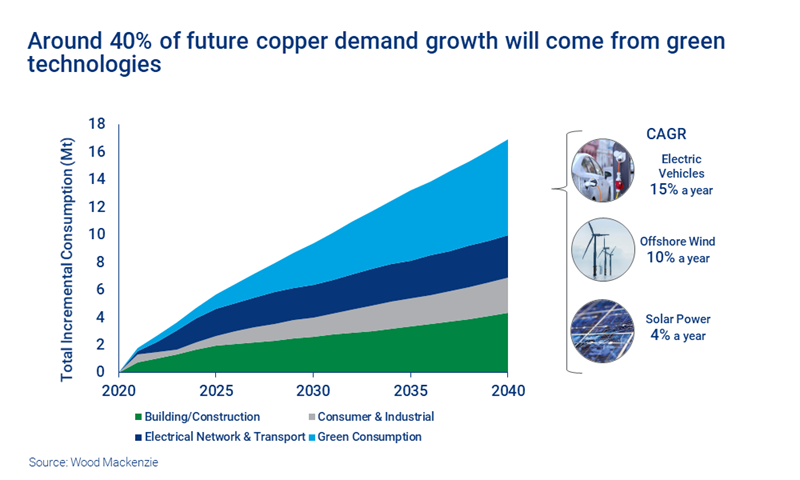

Copper: a traditional metal finds significant new uses

Humans have used copper for thousands of years, both for its aesthetic qualities and for its malleability, heat transfer and antibacterial properties. But it is the red metal’s abilities as an electrical conductor that will be the main driver of increased demand over the next 20 years and beyond.

We expect 40% of future demand growth to come from electrical applications in green technologies, including EVs, offshore wind and solar.

Copper: why the red metal is a green solution

Copper’s green credentials aren’t limited to its role in low-carbon end uses. The carbon intensity to produce finished copper is just a quarter that of aluminium, based on data from our Metals & Mining Emissions Benchmarking Tool.

What’s more, a large proportion of planned copper mining projects globally intend to use low carbon intensity power sources. For example, in the Copperbelt of Zambia and the Democratic Republic of Congo, power comes almost exclusively from hydro. Meanwhile, in Chile up to 50% of power used is hydro, wind or solar, with over 90% of new capacity set to be renewable.

Copper and aluminium are interchangeable in many use cases, so the lower tax burden for more carbon-efficient copper could make it extremely attractive on a like-for-like basis.

Future copper requirements will be partly met by scrap

While its ESG profile is good for future copper demand, the current pool of around 2.5 million tonnes of advanced mining projects is smaller than a decade ago. This will create a 10-year supply gap of up to five million tonnes to 2031.

As with nickel, given the rapid scaling of demand we expect much of the future requirement for copper will need to be met through recycling. There are signs of significant investment in new processing capability in North America and Europe as well as Asia. That gives us confidence that as much as six million tonnes of the 16 million tonnes of additional total copper demand over the next 20 years will be met by recycled feedstock.

Get closer to the detail

At the Future Facing Mined Commodities Forum we explored the future of copper and nickel in detail. Fill in the form at the top of the page for a complimentary replay and a copy of our presentation slides.