Sign up today to get the best of our expert insight in your inbox.

Getting China back on track

Government stimulus a positive move for oil, LNG and solar

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Tariffs - implications for the oil and gas sector

-

The Edge

Big Mining pivots to copper for growth

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

How gas could displace renewables in meeting surging US data centre demand

-

The Edge

Majors' capital allocation in a stuttering energy transition

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

What next for East Med gas?

-

The Edge

Battery energy storage comes of age

-

The Edge

CCUS’s breakthrough year

-

The Edge

Five themes shaping the energy world in 2025

-

The Edge

Renewable developers change tack

Alex Whitworth

Vice President, Head of Asia Pacific Power and Renewables Research

Alex Whitworth

Vice President, Head of Asia Pacific Power and Renewables Research

Alex leads our growing long term and short term power research team in Asia Pacific

Latest articles by Alex

-

The Edge

Walking Japan’s energy tightrope

-

Opinion

Asia Pacific power & renewables: 5 things to watch in 2025

-

The Edge

Getting China back on track

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

Asia Pacific power and renewables: what to look for in 2024

-

Opinion

Asia Pacific energy outlook: surging power or lacking charge?

Yanting Zhou

Principal Economist, Asia Pacific

Yanting Zhou

Principal Economist, Asia Pacific

Yanting leads our in-house macroeconomic research for Asian economies.

Latest articles by Yanting

-

The Edge

Getting China back on track

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

The Edge

Can China’s recovery turn the oil market around?

-

Opinion

China juggles four major economic changes in 2023

Sushant Gupta

Research Director, Asia Pacific Refining and Oils

Sushant Gupta

Research Director, Asia Pacific Refining and Oils

Sushant has over 15 years of experience with a strong focus on the refining, crude oil and chemicals industry.

Latest articles by Sushant

-

The Edge

Getting China back on track

-

The Edge

Refining’s perfect storm passes

-

Opinion

From grey and brown to green and blue: low-carbon hydrogen in refining

-

Opinion

Refinery emissions: implications of carbon tax and mitigation options

Miaoru Huang

Research Director, Asia Pacific Gas and LNG

Miaoru Huang

Research Director, Asia Pacific Gas and LNG

Miaoru leads our Northeast Asia gas research.

Latest articles by Miaoru

-

Opinion

Asia Pacific gas & LNG: 5 things to look for in 2025

-

Opinion

Gas & LNG in Asia: the next 10 years

-

The Edge

Getting China back on track

-

Opinion

The potential and opportunities in Guangdong LNG market

-

Opinion

China’s zonal gas transmission tariff: changes and implications

-

Opinion

Asia Pacific gas & LNG: 5 things to look for in 2024

China’s economic slump gathered pace in 2024, heightening concerns over commodity demand growth in the world’s biggest energy market. In response to a stagnant housing market, tightening credit and a faltering manufacturing outlook, the Chinese government recently announced its most far-reaching monetary and fiscal stimulus since the pandemic.

Can the stimulus package deliver for the domestic economy and bolster commodity markets? Gavin Thompson, Vice Chair EMEA, spoke to our China team about the expected impact on three key sectors.

First, oil demand

Conflict in the Middle East has inevitably spooked traders, but weakness in China’s economy is one of the factors keeping oil prices subdued amid wider threats to supply. Sentiment in H2 has been weighed down partly by expectations that Chinese oil demand won’t grow at all this year and may have peaked already.

WoodMac does not hold this view. Monetary easing should swiftly increase liquidity in the economy, helping manufacturers and property developers to access credit. This supports our forecast of a 0.4 million b/d increase in Chinese liquids demand in 2024, the largest global increase by any country. With similar levels of growth forecast for next year and 2026, Chinese peak oil demand doesn’t arrive until 2027.

Even so, risks to this outlook are skewed more to the downside. To succeed, China’s stimulus package must boost private property sales, currently at a five-year low across major cities, and reverse a manufacturing PMI that’s moving to contraction. Ongoing weakness in both sectors has contributed to a fall in diesel demand by 150,000 b/d, contributing to our downward revision in diesel demand in 2024.

Electrification is also cooling gasoline demand. EV sales in China have soared to over one million vehicles a month in the second half of 2024 – equivalent to around 30% growth over last year – as battery costs have continued to fall. As a result, gasoline bears the brunt, slowing to just over 40,000 b/d in H2 2024 year-on-year.

Second, LNG imports

China remains firmly at the wheel of rebounding Asian LNG demand. Despite economic headwinds, LNG demand is expected to exceed the 2021 record high of 80 Mt by 2025. Buyers continue to enter the market as China’s second-tier companies secure deliveries for Q4 as an anticipated La Niña weather system brings colder winter weather across Northeast Asia.

This shouldn’t underplay the inherent price sensitivity in China. If stimulus fails to adequately address the dents to industrial output and consumer confidence, tenders for LNG into 2025 will likely soften. With forward prices for both TTF and JKM rising, Chinese buyers have retreated from the spot market. Rising domestic production and Russian pipeline gas are also tempering LNG demand.

Looking forwards, we are closely watching both trucked LNG demand and Chinese hydro performance. Total trucked LNG volumes have recovered to 34 Mt, equivalent to 12% of total natural gas demand, but offtakers remain on edge over prices. Meanwhile, poor hydro performance boosted gas demand in southern China this summer, but improvements in reservoir-levels are already underway heading into winter.

Finally, China’s solar manufacturing sector

Chinese companies dominate global value chains across clean energy and electric vehicles, supported by policies aimed at increasing the world’s reliance on low-cost Chinese hardware.

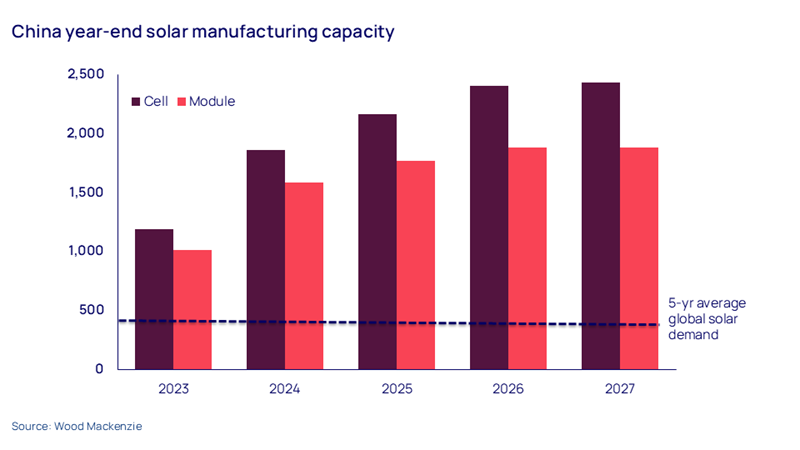

Solar exemplifies this. Backed by government incentives and cheap finance, China’s staggering 1,500 gigawatts of annual module manufacturing capacity is equal to about 80% of the global total, Wood Mackenzie data shows. But despite installations of around 300 GW at home last year, the pace of growth is now slowing, and average utilisation remains ominously low.

Government support for grid infrastructure and battery storage investments is critical, while the recent cut to interest rates and looser capital and credit provisions will be welcomed by the sector. Stimulus and policies to support domestic module price increases can also help.

Beijing has announced policies to boost domestic demand by encouraging higher utilisation of solar and wind. In a move to boost the country’s green equipment sectors, renewable energy targets have been set for major consumers such as aluminium producers, known as “electricity-eating tigers” due to their huge power demand.

Accessing overseas markets is also getting harder as China’s solar manufacturers chase exports to resolve overcapacity and realise higher prices. Import tariffs on Chinese solar technology are increasing in the US, Europe and elsewhere as governments seek to protect domestic producers. Unsurprisingly, China’s solar manufacturers have just been through a bloodbath of an earnings season.

Many have argued that even its most ambitious economic stimulus since China closed its borders in 2020 is insufficient to address the underlying structural challenges the country faces. Rivalling China’s low-cost clean tech dominance is a monumental challenge for the rest of the world. Overcoming its own galactic levels of industrial overcapacity remains Beijing’s own greatest economic hurdle.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.