Tough at the top The threats to US energy dominance

April 2025

April 2025

President Donald Trump's announcement of steep increases in US tariffs, and the retaliatory measures taken by other economies, have thrown financial markets and the outlook for the world economy into turmoil. The situation remains volatile, and the outcomes uncertain.

But one objective remains constant in the Trump administration's America First strategy: the pursuit of US “energy dominance”. The aim is to continue increasing domestic oil and gas supply, to generate employment and investment, cut costs for consumers, reinforce national security and strengthen US global influence.

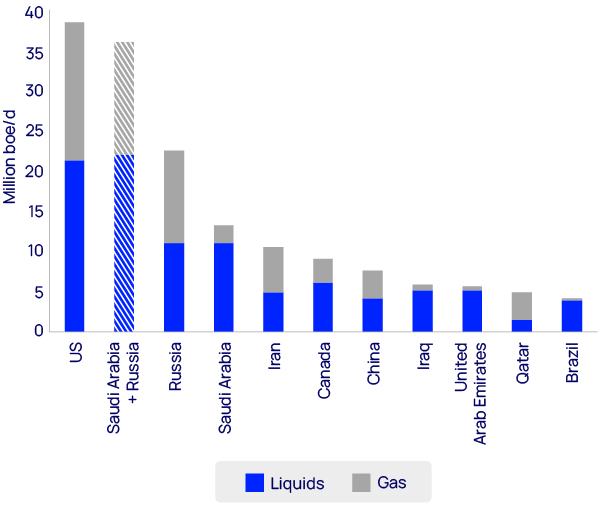

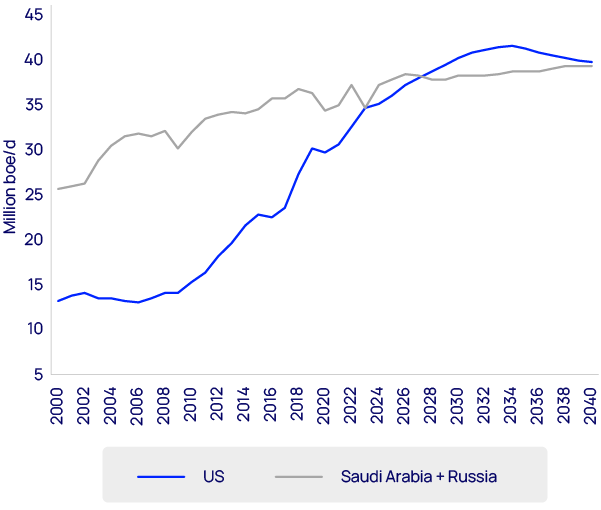

On more than one measure, the US is already dominant. US oil production – including crude, condensate and natural gas liquids – has risen nearly three-fold over the past 15 years and now accounts for 20% of all global supply. US natural gas production has doubled since 2005 and now makes up a quarter of global output. In fact, the US now produces more hydrocarbons than its two largest competitors combined, and its dominance of world production is set to increase over the next decade.

This huge growth in production of energy is also increasing US influence over world markets. Last year, the US became the world’s largest exporter of liquefied natural gas (LNG). It was also the third-largest exporter of crude and condensate.

In this month’s Horizons, we explore the implications of the spectacular success of US oil and gas in the 21st century. We examine its global impact and assess whether this period of dominance can continue.

Together, oil and gas fuel 52% of the world’s primary energy. Wood Mackenzie models suggest that this share of supply will remain above 50% for another 20 years. But even if demand for oil and gas remains robust for decades, the US industry will face challenges. Maturing resource plays, evolving business models and disruptions to trade flows will all need to be managed. At the same time, alternatives to oil and gas, particularly electric vehicles and battery storage, will continue to make progress.

If the US wants to maintain dominance in oil and gas – and, by extension, in energy more broadly – through the 2030s and beyond, it will need to look to its strengths. Additional shale innovation can lower supply costs. Refreshed exploration can help offset overreliance on producing assets. And making the country’s unique upstream fiscal framework even more attractive can help pull in more capital.

With its rapid progress on electric vehicles (EVs), battery storage, renewables and nuclear power, China has shown that is it possible to build an alternative energy ecosystem, albeit one that is still heavily reliant on coal. Concerns about climate change may have slipped down the political agenda in many countries, but as they come back into focus, the potential for decarbonisation in that alternative ecosystem could give China a competitive advantage.

If the US wants to turn its current success into lasting dominance, companies, investors and policymakers will need to think strategically about the long-term challenges the country faces.

The rise of US energy dominance

Oil and gas is a sector of comparative advantage for the US. It has one of the world’s largest hydrocarbon resource bases and a highly innovative upstream industry that has engineered solutions to produce its unconventional oil and gas economically.

Thanks to the boom of the past 20 years, the US now produces more oil than Saudi Arabia and more gas than Russia. Indeed, including natural gas liquids (NGLs) such as ethane and propane, the US now produces more oil and gas than Saudi Arabia and Russia combined.

The rise of the US to this leading position in oil and gas has transformed its global energy influence. Recall the position 25 years ago, when it seemed the US would be ever more reliant on imports.

Now, however:

- US LNG exports to Europe have played a vital role in the continent’s economies by maintaining gas supply after Russia’s pipeline exports were reduced sharply in 2022.

- Record US oil volumes have shielded the US economy from supply shocks and allowed stricter international sanctions on other producers.

- Growing LNG exports have strengthened US ties to key economies in Asia and will continue to deepen its influence in the region into the 2030s.

- Increased oil and gas exports are a tool for reducing US trade deficits.

The roots of upstream outperformance

The story of US success in unconventional oil and gas plays has been told many times and has many drivers. In our judgement, though, the following four factors are most distinctive in making the US an exceptional upstream region:

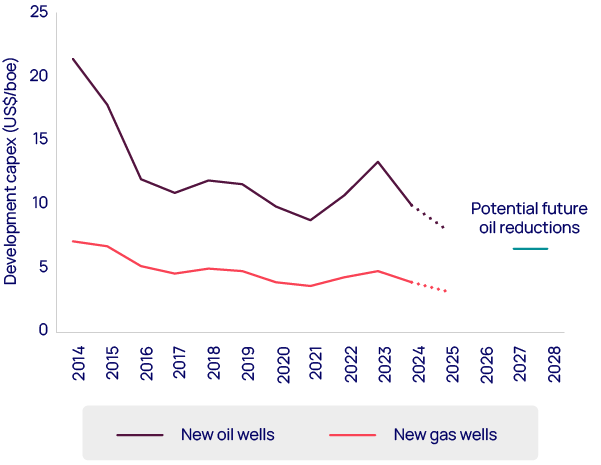

1. Repeated cost reductions

When unconventional plays turned mainstream in 2005, breakevens – the commodity prices needed for individual wells to generate economic value – hovered around US$70/bbl for oil and US$5/mcf for gas. Today, those threshold prices in the best basins are as much as 65% lower in real terms, at US$35/bbl and US$2.50/mcf, respectively.

Better resource recovery, improved supply-chain management and technology-led efficiency gains have meant that in over a dozen US shale plays, unit costs rival some of the world’s best conventional basins.

2. Flexible capital builds a big cumulative base

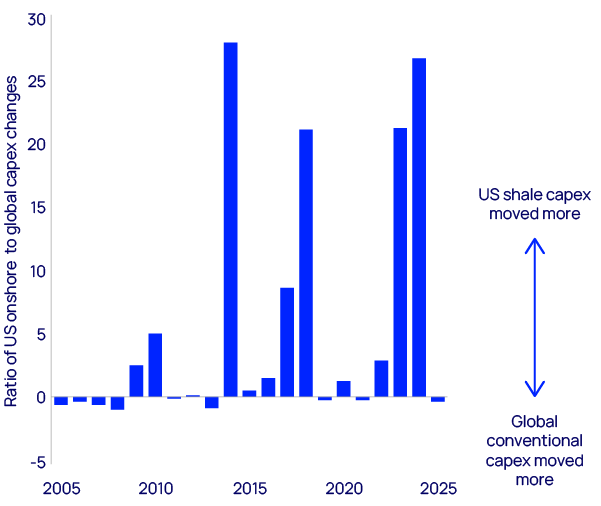

Short-cycle flexibility – the ability of capex to change in a matter of months in response to commodity price strength or weakness – is a key differentiator of the US industry compared with most of its rivals around the world.

In some industries, stop-start investment is seen as a weakness in generating consistent returns. In Lower 48 projects it is a strength. Wells are drilled in weeks, and the cash-flow profile can result in payback periods of less than 12 months.

Companies can lean into price strength, pull back in price weakness or go countercyclical quickly and boldly when service costs are low. At times, those advantages have allowed US shale capex to accelerate 20 times faster than global conventional investment.

3. Friendly fiscal frameworks reward investment

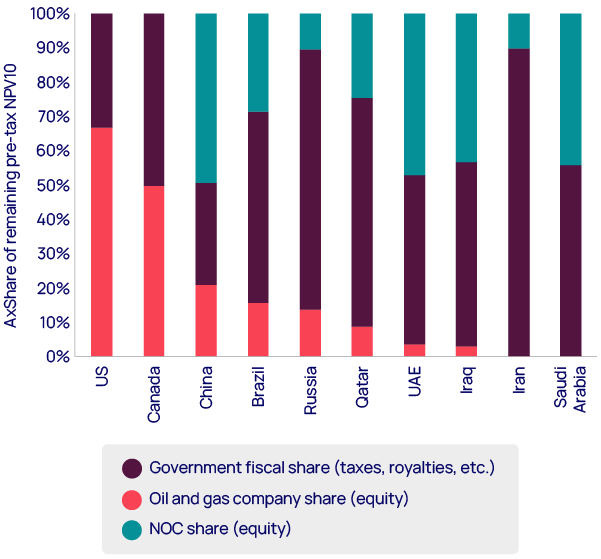

US upstream tax terms are remarkably investor friendly. Typically, a country’s terms get tougher as its production grows, but the US has been predictably stable and attractive to investors.

Even accounting for high royalty rates on core shale acreage onshore, producing companies still retain more than 65% of remaining NPV10 (net present value discounted at 10% per annum). This huge value retention compared with other countries with more demanding fiscal systems and/or significant national oil company (NOC) participation helps keep US upstream cash reinvestment uniquely high. It also helped to attract massive pools of low-cost capital in shale’s first decade.

4. Consolidation breeds improvement

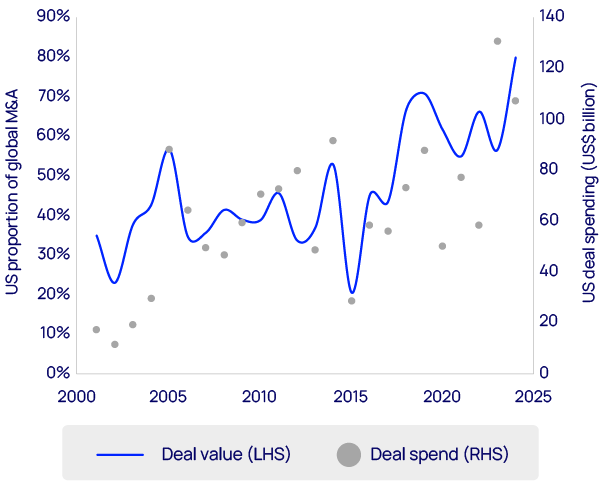

Deal markets in the latest upstream consolidation cycle have been directly linked to innovation and competition. Buyers have been acquiring assets to deploy new technologies and integration at scale.

The Lower 48 has seen two consecutive years of US$100 billion in merger and acquisition (M&A) transactions, with US companies including ExxonMobil, Chevron and ConocoPhillips taking opportunities to capture more resources to develop at a lower cost.

Active M&A and turnover in assets make it possible for companies with differentiated capabilities to drive improvements across the US industry.

Challenges to continued US dominance

US upstream dominance is set to continue for some time yet on current trends. However, its leadership faces challenges and may eventually erode.

- Production is so large now that just offsetting natural declines is challenging. The Lower 48 has to add new supply equal to Norway’s output each year just to stay flat.

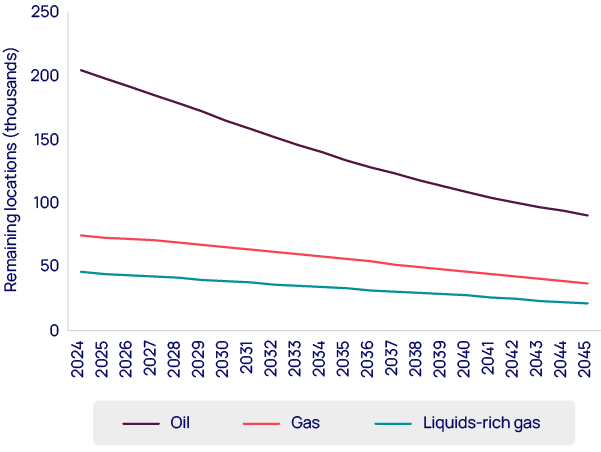

- The massive shale resource base that propelled the US to unmatched production scale is maturing. Recovery per foot drilled has turned stagnant in the largest producing reservoirs.

- Fixed dividend commitments not in place in the earlier years of shale put pressure on reinvestment rates. At lower prices, there’s no room to fund growth.

- Tariffs and cross-border carbon taxes may make it harder for the US to compete in what are currently its most attractive export markets.

In Wood Mackenzie’s base-case forecast, US dominance comes under pressure as production volumes – primarily oil – begin to decline in the early 2030s. But if demand expectations erode and a drop towards US$50/bbl emerges for crude, declines would occur much sooner and be more severe.

This projected plateau in US output levels could have far-reaching implications.

First, raising capital for big strategic investments, including M&A, might become harder if the US upstream industry focuses on harvesting the remaining resource base in declining plays. Companies in a country where production is declining will be valued at lower multiples, which will make it more difficult for them to acquire growth opportunities around the world.

Second, buyers of US energy exports could take pause as they continue to reevaluate global relationships and Lower 48 production expectations. International purchasers stepping back or slowing down could put additional price pressures on US producers, accelerating their downward trajectory.

Third, the US sector has been configured to optimise drilling and completing complex horizontal wells when prices are high and basins are growing. Many operators lack the same level of expertise in enhancing value from late-life production and declining assets.

Conundrum of replacements

Wood Mackenzie forecasts that between 2035 and 2040, US oil and gas production will decline by about 1.7 million boe/d. Over the same period, we expect its low-carbon energy production to increase by roughly the same amount in energy-equivalent terms.

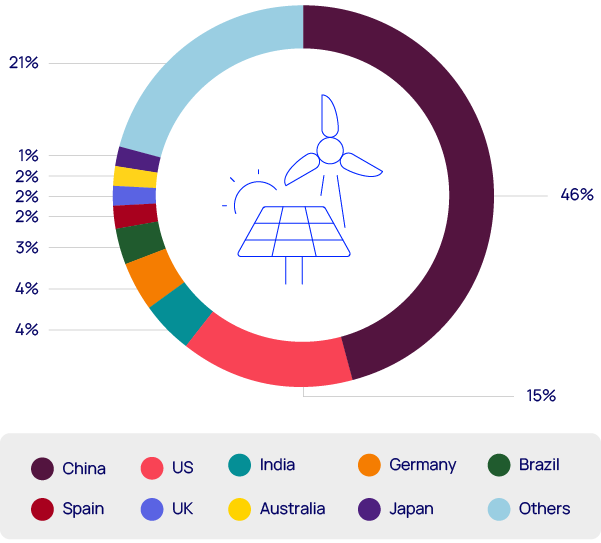

On a global scale, however, US growth in low-carbon technologies is being significantly outpaced by that of China. Where the US is a petrostate, China is an electrostate. In market share terms, its dominance of supply chains for technologies such as lithium-ion batteries, EVs and solar cells is far greater than that of the US in oil and gas.

Strategic planning and sustained government support have helped China accelerate the electrification of road transport and the development of renewables and nuclear power with a view to reducing reliance on imported energy and curbing local air pollution.

Where the US has a comparative advantage in oil and gas production, China has it in high-volume, low-cost manufacturing. It is using that advantage to transform its own energy system and to create an export industry that is having a growing impact on other countries.

China’s exports of low-carbon energy technologies are an increasingly influential factor in world markets. This year, we expect exports from China to account for roughly 20% of the ex-China market for EVs, and 30% of the ex-China market for batteries for vehicles and energy storage.

Actions for maintaining leadership

Nevertheless, the US could preserve – and even extend – its global dominance of oil and gas production by reinvigorating the factors that allowed shale to break through in the first place. Innovation, exploration and favourable regulation could lead to stronger production than we are currently forecasting.

Innovation collaboration

New technology initiatives by the major oil companies in the Permian Basin are tight oil’s current wildcard. ExxonMobil, for example, is pioneering a suite of innovative subsurface diagnostics and reservoir models – including artificial intelligence (AI) – never seen in shale. The project has been in the works since before the company’s record acquisition of Pioneer in 2023.

These initiatives are focused on lowering the cost of supply by redesigning wells and pads in nearly real time to eliminate non-productive capex. This downhole overspending issue has always plagued tight oil. If successful, lower unit costs will open new tranches of undrilled inventory for greater resource recovery.

Many independents are sceptical of the majors’ approach, wanting to see the results before they believe them. Working to replicate some of these data initiatives, rather than resist them, would benefit the entire sector.

If new digital tools can lower breakevens by US$5/bbl, which we think is possible, future tight oil projects will remain as competitive as any other global supply source and extend the Permian Basin’s production profile.

Grassroots shale exploration

Exploration is needed to replenish top-tier well inventory and the sector’s exploration spending has been falling precipitously, down 65% since 2012. Within 10 years, Wood Mackenzie models suggest industry will have drilled nearly half of all its remaining low-cost tight oil locations.

Play-opening projects in the Utica, Uinta and deeper Permian benches have had good results, but more can be done. Derisking, delineation and midstream investment are needed to make the size of these new opportunities as material as existing assets.

The pace at which companies are drilling through their inventory is slower for gas than for oil. However, as demand for gas ratchets up, identifying additional locations for future production will become increasingly important.

Regulatory enablement

The rapid pipeline buildout in shale’s early years was a key enabler of growth. But long-haul interstate pipeline expansions slowed in critical regions, even as the plays continued to deliver lower-cost supply. Consequently, severe price discounts obstruct more exploration and investment.

Improved infrastructure buildout would help relieve those constraints and boost the profitability of high potential supply projects. The Trump administration has embarked on reform of federal permitting frameworks, with the aim of creating a faster path to infrastructure expansion.

Fiscal changes and lower royalty rates could also enhance project profitability and provide additional economic incentives to fund expansion. Broadening the use of intangible drilling cost deductions could attract more capital. If depreciation allowances were increased, that would reduce tax liabilities and increase incremental cash available for reinvestment. But it will be hard to move the needle, as US upstream fiscal terms are so good already.

Explore our latest thinking in Horizons

Loading...

Why sign-up?

By submitting your details you’ll gain access to the latest Horizons report, part of a thought-leadership series exploring the themes shaping the energy natural resources landscape. You’ll also receive the Inside Track, our weekly newsletter, so you won’t miss out on future editions.