Adding fire to e-fuels Are synthetic fuels the key to unlocking growth in hydrogen?

Electrification is the key enabler of the energy transition. Some sectors will be difficult to electrify, however, including segments of transportation. Batteries are a poor substitute for the energy-dense fuels that currently power ships, long-haul aircraft and heavy-duty commercial vehicles, for instance.

E-fuels ‒ also known as electrofuels, eFuels, synthetic fuels, Power-to-X (PtX), Power-to-Liquids (PtL) and renewable fuels of non-biological origin (RFNBOs) ‒ are a synthetic alternative to fossil fuels. They can decarbonise hard-to-abate sectors without the need for the early scrapping of long-life equipment.

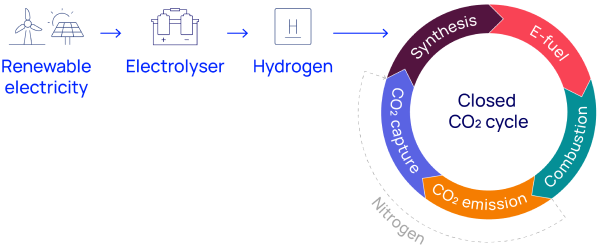

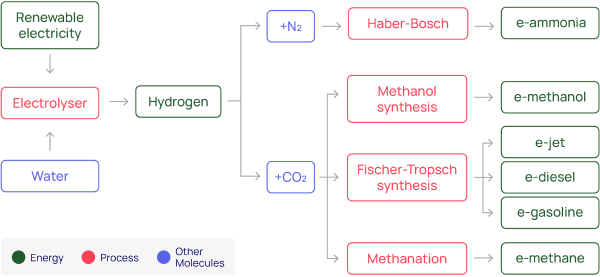

E-fuels are produced by combining electrolytic (green) hydrogen, made by electrolysing water using renewable electricity, with captured carbon or nitrogen. An e-fuel can be considered carbon neutral if the emissions released into the atmosphere during its combustion are equal to (or less than) the captured CO₂ used to produce it.

Identifying pathways from legacy fuels into low-carbon alternatives is a perennial challenge for incumbent energy players. Bioenergy investments have gained momentum, but concerns persist over the availability of feedstock. The food-versus-fuel debate lingers. Although primarily considered a long-term disruptor, e-fuels offer companies an intriguing prospect at the intersection of electrons and molecules. The potential to capitalise on existing technical, commercial and marketing capabilities makes it an appealing, if challenging, opportunity for many.

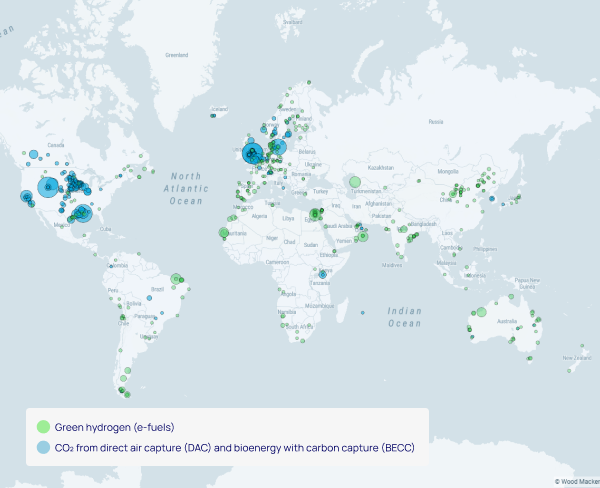

The energy transition requires e-fuels, but they depend on the successful deployment of other technologies that are still nascent and expensive, such as green hydrogen and CO2 capture. Consequently, while the e-fuels opportunity won’t materialise until after 2030, companies that position themselves now will improve their chances of success. Finding the optimal blend of competitive hydrogen costs, CO2 sourcing and policy support will be key – and that will come down to selecting the most attractive location.

Sizeable challenges to large-scale deployment

Commercial viability is the key challenge in scaling up e-fuel production. Green hydrogen production and CO₂ capture costs are high. These costs can even increase with the introduction of rules such as the Delegated Acts in Europe, which define when hydrogen and hydrogen derivatives can be considered an RFNBO. The subsequent conversion process to the final e-fuel product is both energy and capital intensive – and delivery costs must also be considered. There is no shortage of offtakers seeking low-carbon fuels, but the gap between cost of production and willingness to pay is sizeable.

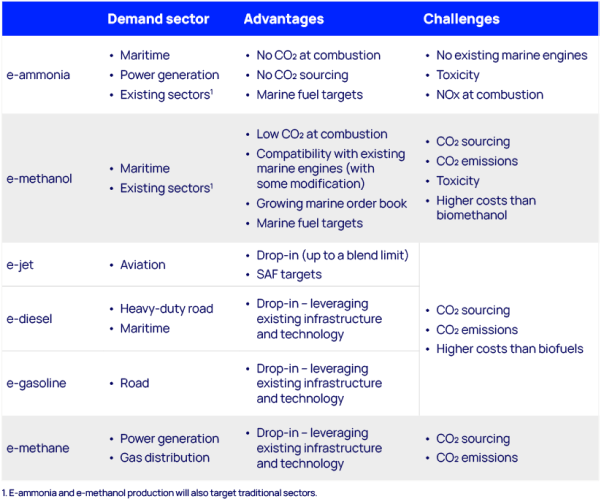

Different conversion technologies are used to produce e-fuels depending on the desired final product. These processes are largely the same as those that industry uses for equivalent carbon-intensive final products. However, new technologies are emerging that promise to lower costs and improve efficiencies, along with alternative routes, such as converting e-methanol into e-jet (e-kerosene). As it stands, however, and regardless of the route, the key challenge for all these technologies is in integrating green hydrogen, carbon or nitrogen, and their subsequent conversion in a large-scale commercial e-fuel production facility.

Each e-fuel has an incumbent fuel it aims to displace, all of which are much cheaper. Consequently, the development of e-fuels will be dictated by policy to mandate volumes, place a cost on emissions and lower production costs, all of which will increase offtakers’ willingness to pay.

Policy: carrot or stick – or both?

Policymakers acknowledge the role of low-carbon liquid fuels in the energy transition, and the need to limit the risk of food-versus-fuel competition from biofuels has fostered policy support for e-fuels.

Indeed, many markets already have set sustainable aviation fuel (SAF) targets and corresponding e-jet (e-kerosene) targets. In April 2024, the UK confirmed that its power-to-liquid obligation would start in 2028 at 0.2% of jet fuel demand, reaching 3.5% by 2040. The US Treasury subsequently released guidance on its SAF credit, including for SAF synthetic blending.

The International Maritime Organization has committed the global shipping industry to achieving net zero emissions by 2050. To achieve this, the mechanisms being considered include greenhouse gas (GHG) fuel standards, levies and cap-and-trade systems. These will all encourage shippers to consider e-fuel alternatives – particularly e-methanol and, longer-term, e-ammonia.

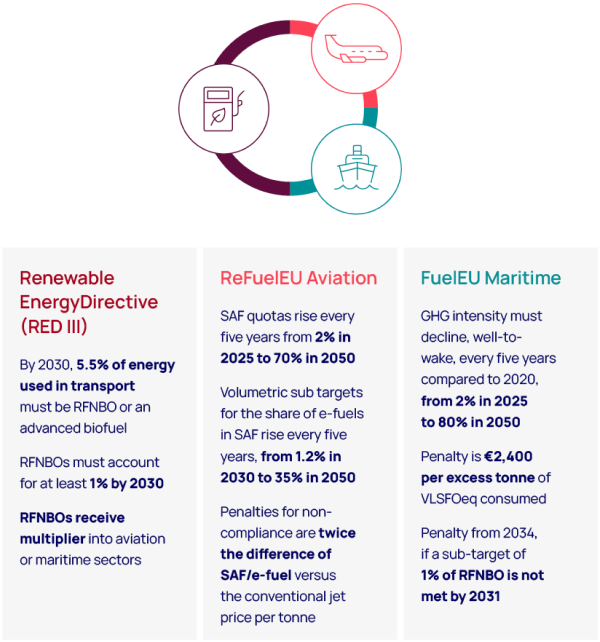

It is Europe, however, that is leading the formation of targets, incentives and penalties to support e-fuels.

The ReFuelEU Aviation and FuelEU Maritime laws are designed to give investors certainty that the cost gap between low-carbon fuels and incumbent fuels can be closed. Underlying RFNBO mandates encourage developers to pursue e-fuel production opportunities.

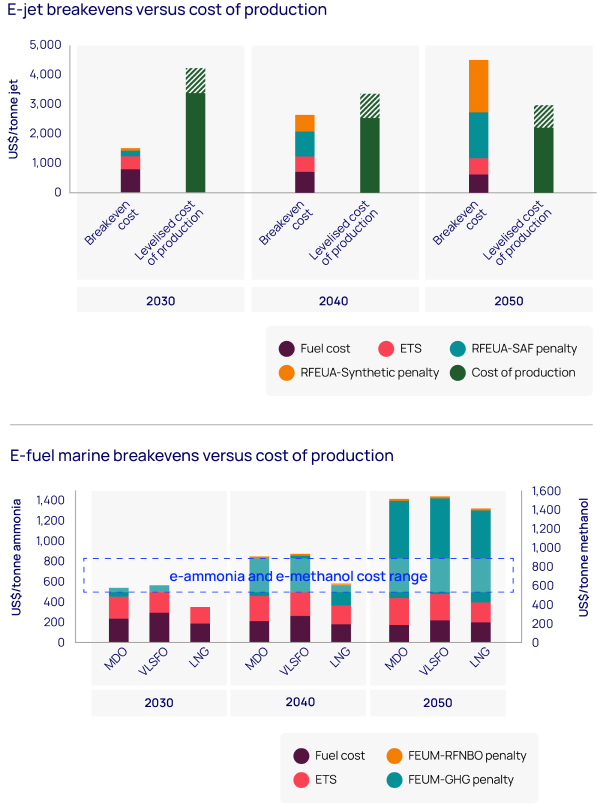

ReFuelEU Aviation applies penalties where SAF and RFNBO fail to meet targets. Penalties increase over time, so that by 2040, the lowest-cost e-jet producers will be able to compete for some demand without subsidies. Under FuelEU Maritime legislation, e-methanol and e-ammonia will compete without subsidies from 2040, as the penalties for not meeting GHG targets and RFNBO mandates increase the marginal cost of running on incumbent marine fossil fuels.

In its next hydrogen bank auction, the European Commission is ringfencing subsidy support for the marine sector, which will help projects advance before the impact of FuelEU Maritime kicks in.

REU: ReFuelEU Aviation

FEUM: FuelEU Maritime

Source: Wood Mackenzie Lens Hydrogen and Liquid Renewable Fuels Service; European Commission

What are the keys to success?

Location, location, location

Feedstock cost advantage will be the primary driver of commercial e-fuel success, as it is in other petrochemical conversion processes. Subsidy top-ups and other incentives will help, but locations with low-cost sources of hydrogen and CO₂ will have the edge in e-fuel production.

Declines in hydrogen production costs remain elusive near term, but will come

The cost of renewable electricity remains the key determinant of green hydrogen production costs. Inflationary pressures have increased costs in renewable generation in recent years, but solar costs have declined 14% in the past year. Economies of scale have yet to be realised in first-of-a-kind green hydrogen projects, and engineering, procurement and construction (EPC) capacity will take time to develop.

Evidence of falling costs is emerging, however. Developers bidding in Europe’s inaugural Hydrogen Bank auction were emboldened to bid at surprisingly low levels. The auction set its subsidy payment ceiling at €4.5/kg, but all winning bids came in at less than €0.50/kg. At least two of the seven winning projects targeted e-fuels, highlighting that the gap between the cost of production and offtakers’ willingness to pay is already closing.

The range of costs involved in producing green hydrogen remain wide. Those locations with the lowest renewable generation costs – especially where low-cost solar, wind or hydro can be combined – will occupy the lowest rungs on the cost curve. However, in many of these markets, the domestic end-use market for hydrogen is limited, so the opportunity to convert that hydrogen into e-fuel that can be transported to and traded in premium markets and sectors is compelling.

CO₂ sourcing costs will rise as the industry grows and rules tighten

In the near term, e-fuel proposals aim to source CO₂ from a variety of feedstocks. Biogenic sources with a low cost of capture, such as biogas and ethanol plants, will dominate. But the available molecules from such facilities will become scarcer and more dispersed. Costs will rise as e-fuel producers scour for feedstock while looking to scale.

Long term, as governments set standards for e-fuels, CO₂ sourcing will need to expand significantly – and it will need to go beyond point-source industrial capture. Indeed, for e-fuels to be RFNBO-compliant in Europe, point-source CO₂ capture from fossil-fuel power generation will only be permitted until 2036 and from other fossil-fuel industries until 2041. Consequently, large volumes from net carbon dioxide removal (CDR) technologies – direct air capture (DAC) and bioenergy with carbon capture (BECC) – will be required.

The challenges to CDR at scale are considerable. DAC costs exceed US$800/tCO₂ today, and while BECC costs are lower (US$80 to US$150/tCO₂), the opportunities are limited. DAC costs will come down, but will remain high through the end of the decade (US$500 to US$600/tCO₂ as first-of-a-kind plants are built).

Globally, policy support for the CDR-to-e-fuels pathway is weak. The 45Q tax credit in the US – one of the strongest carbon-capture incentives in the world – penalises the e-fuels pathway by reducing the credit’s value if captured CO₂ is used rather than stored (by US$25/tCO₂ for BECC or US$50/tCO₂ for DAC). Some funding schemes, such as the Canadian Investment Tax Credit, could offer strong incentives, but are unclear. Other CDR frameworks, such as the EU Carbon Removal Certification framework, exclude CDR to e-fuels from eligibility.

There is a risk that policy support will remain weak and that CDR to e-fuels will remain at a disadvantage to CDR to storage. In this case, compliance and voluntary markets for low-carbon fuels would need to be strong enough to justify the high cost of CDR-sourced CO₂ in e-fuel production.

Who could be the winners in the e-fuel race?

Producers with access to the lowest-cost renewable generation will have the edge. Yet, those same locations won’t always have the most advantaged CO₂ sources. First movers have found success in pairing low-cost renewables and biogenic CO₂ sources.

Consequently, scaling up BECC ahead of an anticipated fall in DAC costs will provide the greatest opportunities. Of course, the rules and subsidies in place to support e-fuel production, including the e-fuel value chain, will also have significant bearing.

- Biofuel producers: the lowest-cost means of meeting many of the coming aviation and maritime targets will be directly through biofuels. Renewable fuel suppliers, such as Neste, Chevron Renewable Energy Group and Diamond Green Diesel (a Valero and Darling Ingredients joint venture), have developed leading positions. Interest continues to build from new entrants, and these early movers will be looking to price up to the margin against the next low-carbon fuel alternative of e-fuels.

- Biomass power generators: globally, there is 73 GW of biomass generation capacity online today across more than 2,200 projects, highlighting just how fragmented the market is. Drax (2,580 MW) and Ferrybridge (2,098 MW) in the UK are the two largest, having converted from coal plant to biomass. Both are planning carbon capture developments where the CO2 could be sold directly to e-fuel producers. There is no shortage of coal generators globally that could follow suit, but biomass feedstock constraints will eventually surface, and these generators often require subsidy support.

- Vertical integration: energy producers, including refiners and fuel marketers, who see a long-term future for e-fuels should look to build integrated positions throughout the value chain into renewable generation and biogenic CO₂ sources. Although the CO₂ can be sourced directly, the privileged few with low-cost biogenic CO₂ will look to price as close to the margin of the next scalable CDR or DAC.

- Subsidy accumulators: regimes around the world will operate differently. Those who can layer together subsidies across renewable generation, hydrogen production and CO₂ capture, then price towards displacement costs in markets with penalties, appear strongest. But many developers will be wary of over-reliance on subsidies given the risk of policy shifts in such a nascent market.

- Access to premium offtakers: one of the challenges most regularly cited by low-carbon hydrogen developers is sourcing offtakers willing to pay the necessary premium. This comes into sharper focus when it comes to e-fuels, given the uncertainty as to the direction in which costs are headed, how rules governing RFNBO might evolve and what technologies might disrupt the current outlook.

- Developers require long-term commitments – from either offtakers or governments. It’s unlikely that the former will stretch much beyond five years considering the nascent stage of the e-fuel market, so policymakers will have to step up to cover the cost gap and stand firm against the rules and regulations being signalled today, such as ReFuelEU Aviation and FuelEU Maritime.

- Technology providers and licensors: the conversion processes are long established across many e-fuels, from which existing licensors are set to benefit, but several technology providers are looking to disrupt the space.

- Traders: e-fuels will create a commercial intersection between electrons and molecules across transport sectors that is new to the energy industry. Aviation, maritime and heavy-duty road transport use different incumbent fuels where competition has never existed. These sectors are now competing for the same biofuels and the same green hydrogen and CO₂ underpinning e-fuels. Green hydrogen and CO₂ will be pitted against biofuels to meet low-carbon demand in these sectors, with biogenic CO₂ sought after to produce the most competitive RFNBO-compliant e-fuels. Such uncertainty and potential volatility are what traders seek.

Hydrogen Conference

Join us from 12-13 November 2025 in London to get exclusive insights and hear detailed commentary on the most pertinent topics facing the hydrogen sector today.

Explore our latest thinking in Horizons

Loading...