Doing more with less: Is there enough upstream investment?

July 2023

Authors

The oil and gas sector is in an upcycle, as demand rebounds strongly from the Covid-19 pandemic. The roll-out of a low-carbon energy system is going to take time. Oil will continue to drive the global economy and define energy security for many years to come.

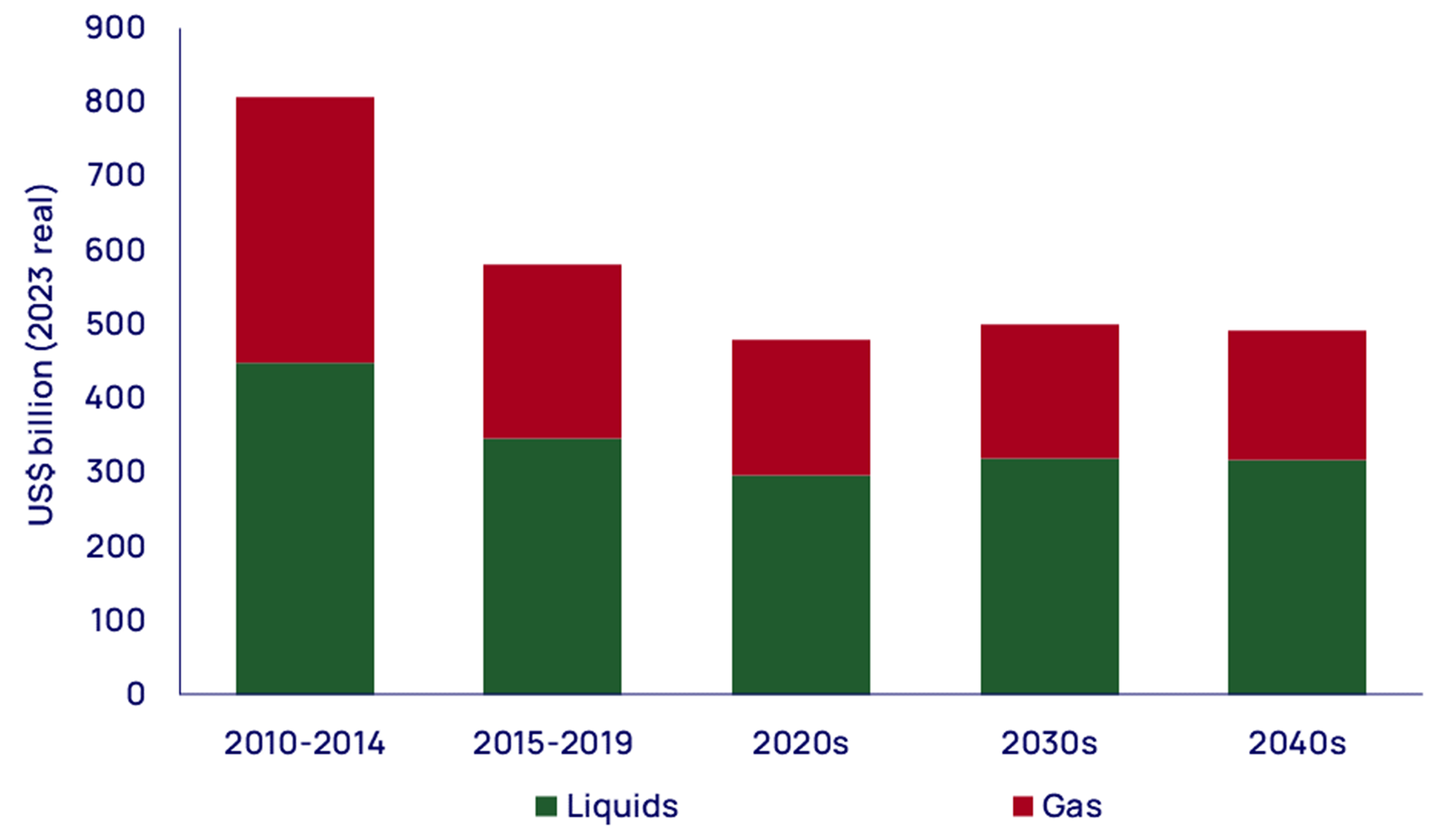

After three years of recovery, upstream asset development spending is just under US$500 billion a year, up by a third from a 2020 low, but barely half the US$914 billion 2014 peak (in 2023 terms). The apparent shortfall has fed a widespread belief that the industry is underinvesting and that a supply crunch is inevitable, be it sooner or later.

Wood Mackenzie never subscribed to this. Our long-held opinion was that spending and supply would recover to meet demand. Some previous advocates of the underinvestment thesis are now beginning to align with our view.

We calculate that investment around today’s levels can deliver the supply needed to meet demand through to its peak and beyond. There are three main reasons: the development of giant low-cost oil resources, relentless capital discipline and a transformational improvement in investment efficiency.

Delivering the necessary supply at a reasonable cost will underpin the global economy and boost energy security. But it will also leave the world well short of the goals of the Paris Agreement to limit global warming to less than 1.5 °C.

Peak oil demand could still be a decade away

For decades, oil demand has inched ever higher. The global population has increased year after year, driving economic growth. The transition to a less carbon-intensive economy hasn’t kept pace with society’s desire for more – more personal mobility, more goods and more services.

The developing world has become the primary engine of global oil demand growth, contributing most of the 1 million b/d average annual oil demand growth from 2000 to 2019. Global consumption touched a high of 101 million b/d in 2019 before Covid hit but bounced back strongly. We expect the pre-pandemic high to be eclipsed this year.

Oil demand will continue to rise for several years, though growth will slow progressively after 2024

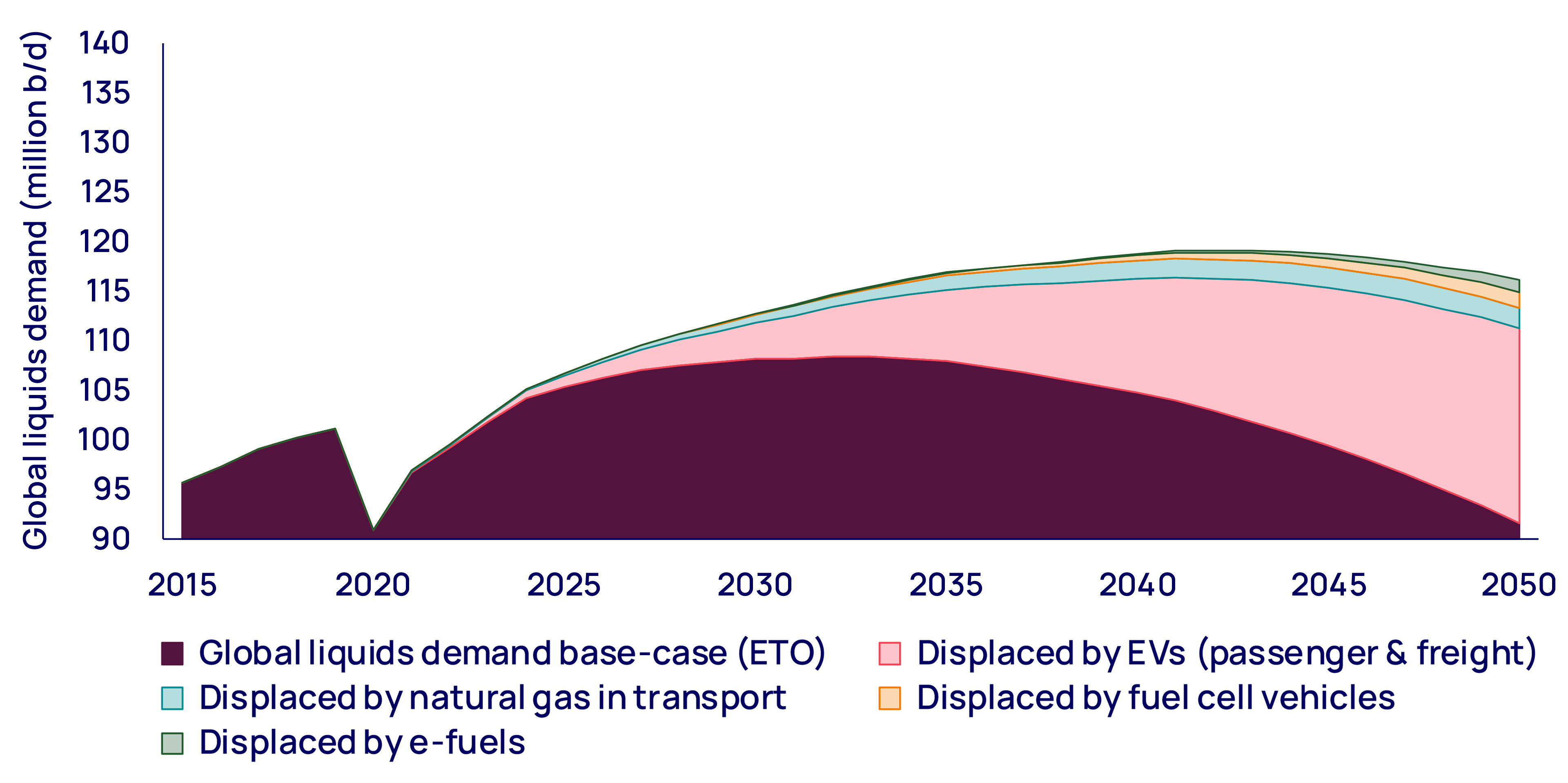

The invasion of Ukraine underlined the global economy’s dependence on oil and other fossil fuels. Oil demand will continue to rise for several years, though growth will slow progressively after 2024, from the current elevated rate of over 2 million b/d per year, as the post-pandemic recovery fades. We expect demand to peak at 108 million b/d in the early 2030s before beginning its long-term decline.

Fuel efficiency, spurred by regulation, will creep ever upward, new vehicles will be better than those they replace. The unfolding transition will gradually see oil displaced by electric vehicles, fuel cell vehicles, natural gas substitution and, eventually, synthetic fuels (e-fuels).

But this will take time. Only by the late 2020s will internal combustion engines account for less than half of global new vehicle sales. And another decade will pass before they fall below half of the total vehicle stock, which, by then, will be 50% larger than it is today. Oil will prove even stickier in shipping, aviation and haulage, sectors in which equipment has long in-service lives. As a consequence, oil demand is set to remain above 90 million b/d out to 2050.

What about a Paris-aligned 1.5 °C scenario?

Wood Mackenzie's base-case Energy Transition Outlook (ETO) is equivalent to a 2.5 °C pathway, but there are alternative demand scenarios, each with vastly different implications for future upstream investment.

Our accelerated energy transition scenario, describing a 1.5 °C pathway (AET-1.5), projects demand falling by around 10 million b/d by the early 2030s. However, such a steep fall would require an investment boost of unlikely speed and scale in electric vehicles and charging infrastructure, low-carbon power supply and battery raw materials.

Figure 1: Base-case ETO liquids demand outlook to 2050

Oil supply growth has matched demand

Global liquids supply has kept up with rising demand over the last decade, despite structurally lower prices than in the early 2010s. The industry has tapped into new supply sources including the Middle East and the US, which have displaced higher-cost oil from Europe and Africa.

Low-cost conventional, tight oil and deepwater sources have outcompeted the more complex projects and higher-cost resource themes that were the focus of much exploration and production investment earlier in the century.

The cost of new supply has fallen dramatically

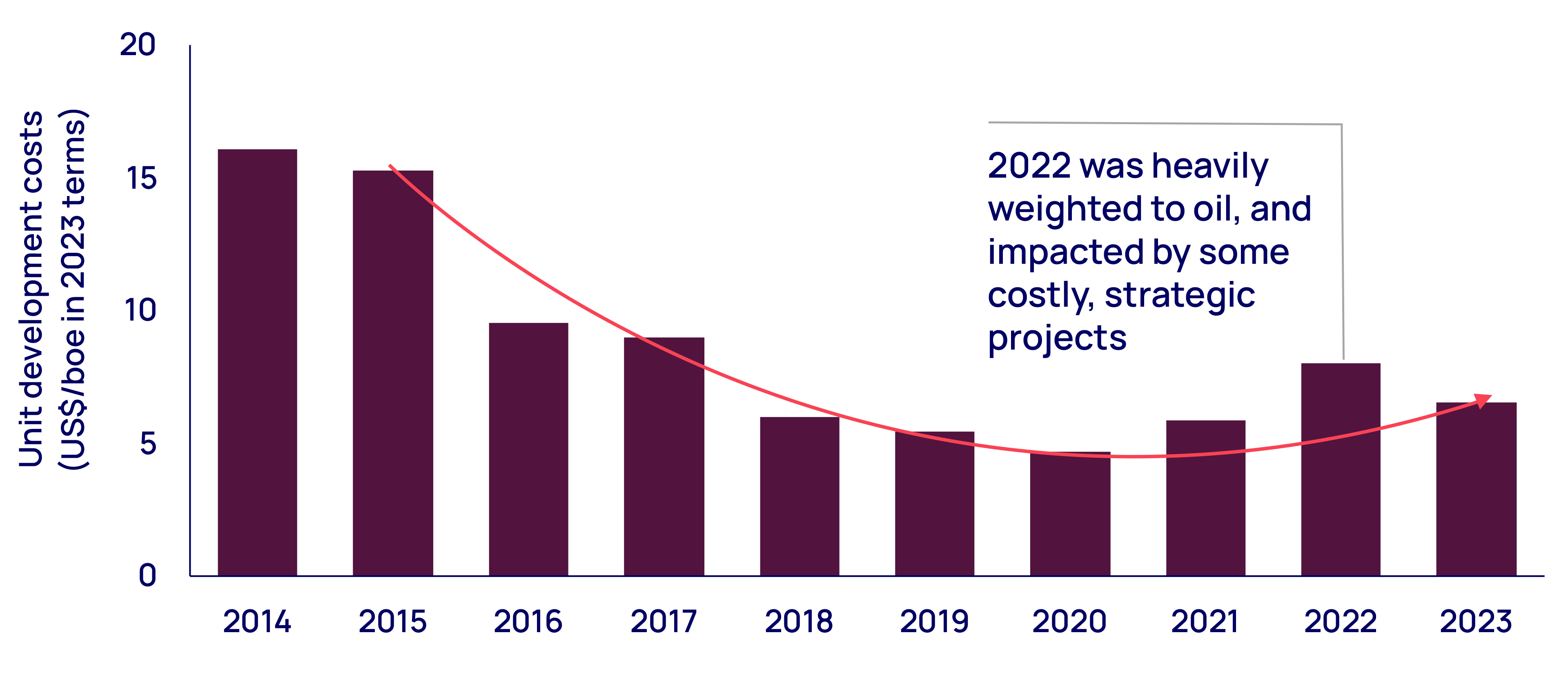

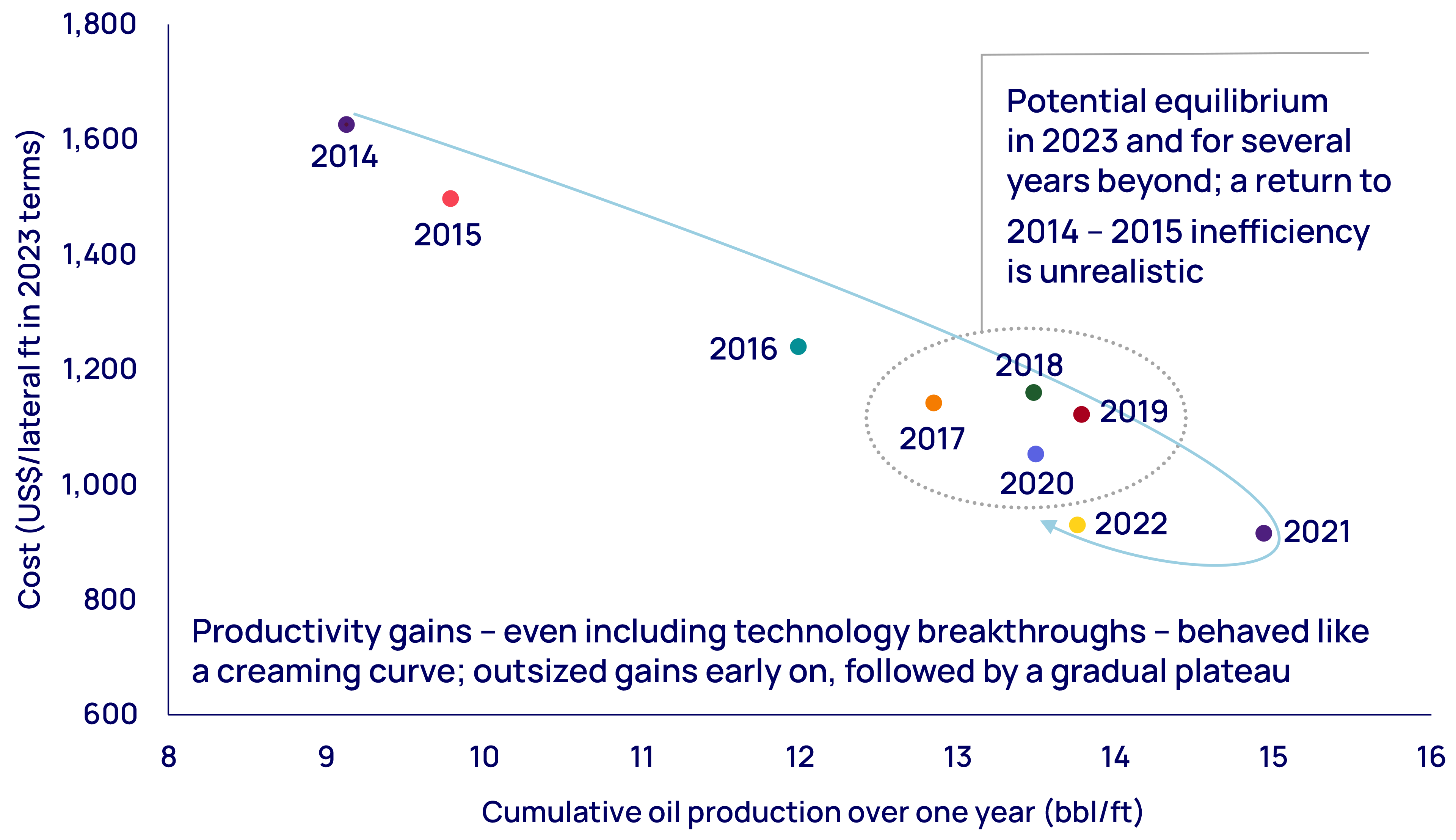

Adversity was the primary catalyst for a structural change in supply efficiency. The price shocks of 2015-2016 and 2020-2021 forced the industry to become far more disciplined with its capital. Portfolios have been high-graded, to ensure only the best projects proceed. Project delivery has been transformed. Upstream investment today is far more effective than it was in the ignominious years of ‘peak inefficiency’ during the early 2010s.

Conventional greenfield unit development costs (development cost divided by the reserves developed) have been slashed by 60% in 2023 terms, from US$16.1/boe in 2014 to US$6.5/boe today, briefly dipping to a low of just US$4.7/boe in 2020. Today, US tight oil wells generate nearly three times more production for the same unit of capital than in 2014. New technology, capital efficiency and modularisation have been leveraged to powerful effect.

Figure 2: Conventional unit cost efficiency improvements over time

Figure 3: US Lower 48: normalised costs versus oil well performance

Most of the industry’s oil and gas investment for the rest of this decade will target advantaged resources: those with the lowest cost, lowest emissions and least risk.

Non-OPEC supply growth is still dominated by the US Lower 48, which is now maturing and edging towards a plateau, augmented by deepwater Latin America (Brazil, Guyana, Suriname) and emerging giant plays such as Namibia. OPEC aims to add around 3 million b/d of oil primarily from Middle East expansion projects in Saudi Arabia, the United Arab Emirates (UAE) and Iraq.

Beyond this decade, the growth potential of these prime, existing advantaged opportunities will be exhausted. New supply will inevitably become more expensive to develop. To meet demand, the industry will depend increasingly on late-life reserves growth from legacy supply sources, higher-cost greenfield developments and as yet undiscovered volumes.

Beyond this decade, the growth potential of these prime, existing advantaged opportunities will be exhausted

OPEC’s market share will increase in the 2030s and beyond, buoyed by expansions in the UAE and Iraq. An eventual easing of sanctions could lead to a recovery of volumes from Iran and Venezuela.

Is the industry underinvesting?

The upstream industry’s raison d’etre has always been to deliver the supply required to meet demand. For the last century or more, ever-rising demand has de-risked investment. Today, the prospect of peak demand in a decade's time changes the risk equation.

Oil and gas are depleting resources – fields in production decline naturally, so constant investment is required to maintain supply. If investment stops, supply drops immediately. Calls for a complete halt to spending would result in oil supply from existing assets declining far faster than any credible energy transition scenario.

By the early 2030s, when we forecast demand peaks, today’s existing assets ‒ currently delivering supply of 102 million b/d ‒ might only be producing 43 million b/d, an effective supply gap of 65 million b/d to our base case. In our AET-1.5 scenario, the gap by that time would only be one-third less, meaning substantial investment in oil and gas would still be required.

Figure 4: Volume of liquid resource required to meet demand to 2033

US$500 billion a year, in 2023 terms, should be enough

There is much debate over whether there is systemic underinvestment in upstream. The common rhetoric – that the industry used to spend more, so is clearly underspending now – is overly simplistic.

The counterargument that Wood Mackenzie has made for some years is based on a quantitative approach – a granular assessment of the demand outlook and a view of supply using our global upstream database, which has provided independent, asset-by-asset production forecasts to the industry for the past 50 years.

In the depths of the pandemic downturn, we forecast that spending would recover over a three-year period. This is how it played out, but with the sting of higher cost inflation. From just US$370 billion in 2020 (in 2023 terms), spending has risen by one-third to around US$490 billion this year. And we expect increases over the next three years to bring spending incrementally to US$520 billion (in 2023 terms). This excludes spend on exploration and corporate overheads.

Our analysis indicates that the current investment rate of around US$500 billion a year (in 2023 terms) can deliver enough oil and gas supply to meet demand over the next 10 years, up to and including a forecast of peak oil demand of 108 million b/d the early 2030s (and peak gas demand of 440 bcfd in the late 2030s). Critically, this view assumes that the industry does not lose its grip on capital efficiency, which is not guaranteed.

After peak demand, the industry will face new challenges. Substantial investment will still be needed to offset a natural decline at a time when the most advantaged remaining oil resources are being exhausted. Less new supply will be required, but from higher-cost sources, while the gradual degradation of asset quality means that the half-a-trillion-dollar run-rate will need to be maintained.

Under our AET-1.5 scenario, spending of nearly US$400 billion per year would be required in the 2020s and nearly US$250 billion a year in the 2030s (all in 2023 terms).

Figure 5: Upstream spending levels required to meet our base-case ETO demand outlook

The story will not be this simple

For many reasons, the spending profile might not turn out as flat as this outlook describes. Demand and prices may deviate from our base-case ETO view. The industry may well overspend on supply capacity – it has often done so in the past and could do so again – either through choice (to build spare capacity) or because it buys into the underinvestment story.

But there is neither the will, the project types, nor the supply-chain capacity to return to previous levels of extravagance. And, put simply, there is also no need – spending, activity and supply recovery have already exceeded expectations.

Efficiency and inflation

Investment efficiency will evolve, and there are many parameters to consider. These include general and sector-specific inflationi. The oil and gas supply chain is approaching its limits, and service companies are more focused on expanding cash-flow margins than adding capacity.

iThis report references costs in 2023 terms. In nominal ‘money-of-the-day’ terms, capex will, of course, rise in line with macro inflation.

But even further inflation does not mean a return to previous absolute spending highs. The industry can continue to optimise asset development and improve execution. This includes artificial intelligence, but also the further embedding of structural improvements achieved to date.

Other factors will affect spending, including domestic exchange rates versus US dollar-denominated costs and decarbonisation costs that continue to ramp up.

CCS, an emerging upstream investment opportunity

Even if spending on upstream does plateau, it’s not the end of the road for upstream businesses. The potential in carbon capture (utilisation) and storage (CCS/CCUS) is enormous, and the oil and gas sector has unique skills that make it ideally placed to lead in the CO2 transport and storage sectors.

The investment run-rate for transport and storage CCUS projects could reach US$10 billion a year over the coming decade in our ETO base-case scenario. Under a more rapid net zero pathway, with far greater reliance on carbon sequestration, investment would need to reach US$50 billion per year in the same timeframe.

The investment run-rate for transport and storage CCUS projects could reach US$10 billion a year

What will happen if the sector gets investment levels wrong?

The oil market is balanced by just three levers: price, OPEC spare capacity and demand. Companies monitor signposts to assess supply, demand and the speed of the transition, and shift their investment strategies accordingly.

Given the inherent demand uncertainty, accurately interpreting these volatile signals is somewhere between difficult and impossible. Meanwhile, there is increasing and irrevocable pressure from many of the sector’s stakeholders to reduce spending.

The impact of sustained underinvestment

Sustained underinvestment would have far-reaching consequences. We modelled an investment scenario 15% below our base case in our global Oil Supply Model to determine the impact this would have on price. The result would be a US$20/bbl increment to our base-case forecast (which averages US$82/bbl out to 2040 in 2023 terms).

This would have a substantial impact on the global economy. Consumers’ purchasing power would be eroded through higher costs for energy, heating, transportation, food, goods and services. Low-income households and emerging economies would be hit the hardest, as they spend a greater share of income on necessities.

The flipside is that higher prices would lead to an increased focus on fuel efficiency and fuel switching and would accelerate investment in low-carbon energy – a positive for efforts to limit global warming.

Sustained investment imbalances are hard to quantify, but unlikely to persist

Despite the headwinds, and contrary to the consensus view of industry underinvestment, we think the industry risks overinvesting in the near term if budget increases exceed wider inflation by more than a few percentage points each year to 2026.

But sustained oil and gas investment imbalances are usually a result of externalities such as exogenous price shocks rather than operator investment strategies. The oil market is literally and metaphorically liquid, and price signals and the actions of OPEC+ eventually bring demand and supply back into equilibrium.

For example, reduced spending in Europe due to a lack of finance, regulatory and fiscal actions may simply result in investment shifting to other parts of the world where investment in oil and gas is actively encouraged.

Will the required investment show up?

This cycle is different because the uncertainty around the pace of the energy transition adds a new layer of complexity and risk. Moreover, operators will change capital allocation decisions the closer they perceive peak demand to be.

The availability of capital is another risk ‒ certainly in Europe, and increasingly in other regions, too. But the most viable projects and companies remain funded today. And if that changes, host governments may intervene to ensure that assets are in the hands of those with access to capital, such as national oil companies.

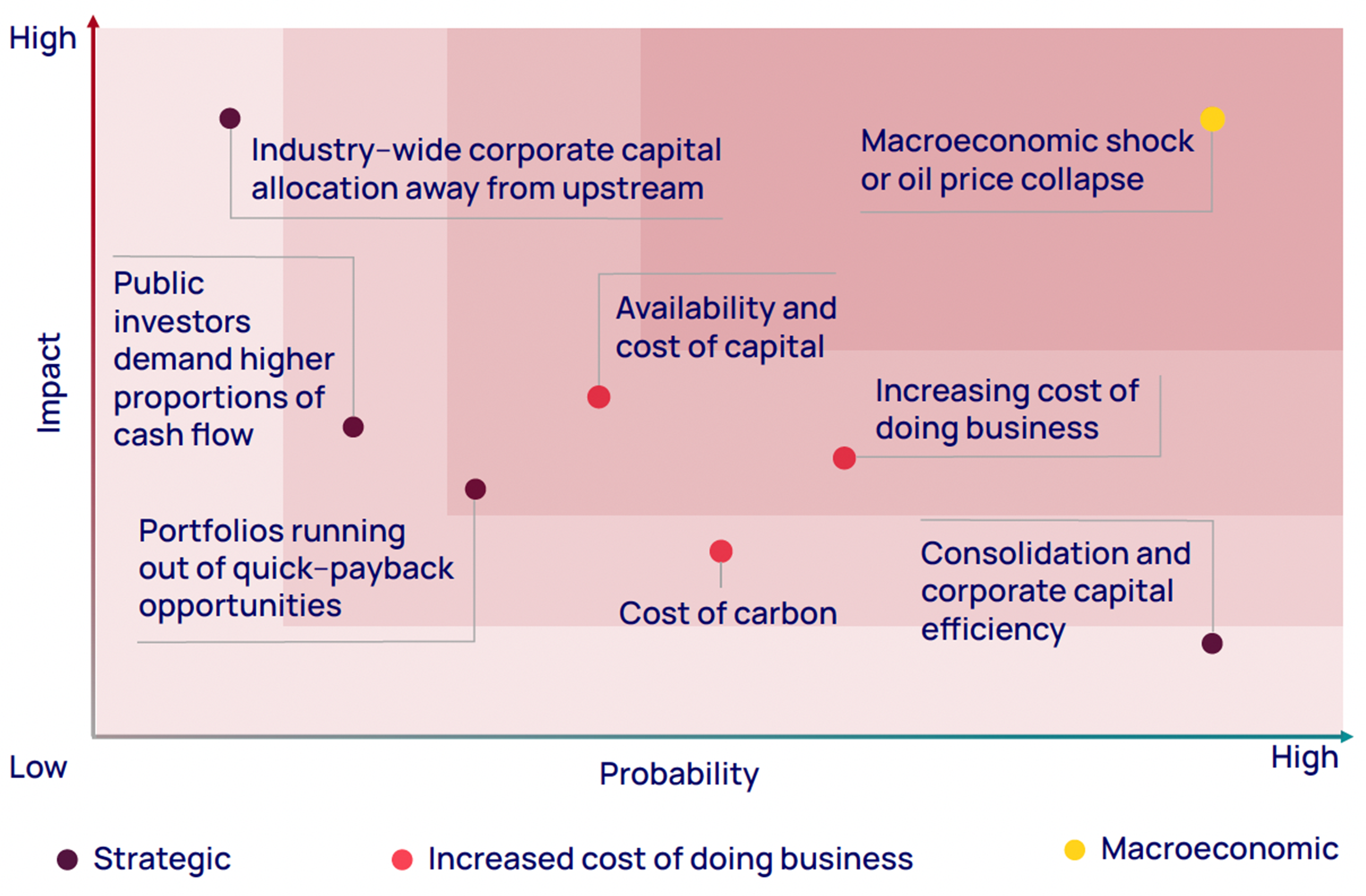

Figure 6: Upstream underinvestment risk matrix

Explore our latest thinking in Horizons

Loading...