Ready, steady, store: delivering on the EU’s CO₂ storage obligation

What will the European Union’s Net-Zero Industry Act (NZIA) mean for Europe’s upstream oil and gas industry?

3 minute read

Anastasia (Tasie) Cooper

Research Analyst, CCUS

Anastasia (Tasie) Cooper

Research Analyst, CCUS

Latest articles by Anastasia (Tasie)

View Anastasia (Tasie) Cooper's full profileJohn Ferrier

Senior Research Analyst, Carbon Management

John Ferrier

Senior Research Analyst, Carbon Management

John works to provide expert insight and strategic analysis on developments in CCUS across EMEA to support his clients.

Latest articles by John

-

Opinion

Ready, steady, store: delivering on the EU’s CO₂ storage obligation

-

Opinion

Video | Three FIDs, one day: a turning point for CCUS in the UK and Denmark

In June 2024, the European Union’s Net-Zero Industry Act (NZIA) came into force, establishing a series of measures aimed at creating a single market for carbon capture, utilisation and storage (CCUS) within the bloc.

In a recent report, we delved into the specifics of the NZIA and explored what it will mean for Europe’s upstream oil and gas industry. Fill in the form to receive a complimentary extract and read on for an introduction.

What is the NZIA?

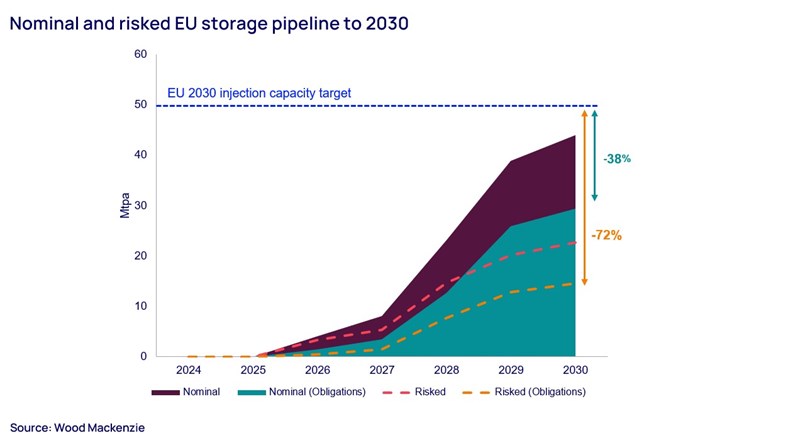

Most notably, the NZIA targets the development of 50 Mtpa of CO2 storage capacity across the EU by 2030 and obliges European oil and gas producers to make a pro rata contribution to this target based on their 2020-23 oil and gas output. In the coming months, the European Commission will adjust this target to incorporate storage in the European Economic Area (EEA).

The act also establishes the Net Zero Europe Platform to coordinate financing and accelerate permitting. By the end of June 2027, the European Commission will assess the CO2 market to ensure fair and open access to relevant infrastructure across the CCUS value chain. It will then review the target and adjust it, if needed, in 2028, depending on supply and demand. The Commission also intends to introduce guidance on CO2 purity for storage projects.

Consequences for European upstream

By our calculations, the net pipeline owned by companies with an obligation to contribute to the 50 Mtpa target currently shows a significant shortfall – 38% and 72% off target on a nominal and risked basis, respectively. Consequently, we expect to see a rapid campaign of storage development, acquisition and investment over the next five years as obligated producers seek to comply with the act.

We estimate that the EU’s top 10 oil and gas producers account for more than 70% of the 50 Mtpa target, while the top 15 will be on the hook for more than 85%. Majors, national oil companies, mid-caps and Europe-focused producers will be responsible for meeting most of the target, and have varying degrees of expertise and readiness to execute. Some are ahead of the game, with surplus planned capacity; others have yet to get out of the starting blocks.

According to the NZIA, production licence holders will be responsible for fulfilling CO2 storage obligations (with the Netherlands and Romania accounting for almost 50%). Those with a commercial interest only will have no obligation.

Obligated companies will have three options: 1) invest in or develop CO2 storage projects alone or with others; 2) enter into deals with other producers; or 3) strike agreements with third-party storage project developers or investors. There are almost 20 pre-2030 storage projects planned in the EU (excluding projects associated with enhanced oil recovery, which is not classed as dedicated storage under the NZIA).

Whichever way you cut it, though, timelines are tight. Oil and gas companies will need to act fast if they are to have a chance of meeting their obligations by 2030. Obligated firms are required to submit their storage plans by June 2025, but the European Commission will not specify who is obliged to do precisely what and how until Q1 2025. This gives producers very little time to investigate their options, especially if their only route to compliance is acquisition and/or negotiating agreements with third-party storage providers.

What’s next?

In the coming months, the European Commission should clarify the key unknowns, including the final methodology for calculating obligations, how mergers and acquisitions will be treated, the thresholds for exemption and the status of EEA storage. These key decisions will significantly shape how the policy is implemented.

The potential application of the NZIA to the wider EEA raises the question of whether Norwegian storage will be able to contribute towards the 2030 target. Recognising Norwegian storage could either prove advantageous or place a significant burden on Norwegian operators. The outcome will depend on the specifics of the adjustment and how the obligations are extended to EEA (Norwegian) producers.

Subscribe to Lens Carbon for full access to our detailed report on the NZIA’s impact on Europe’s producers. Or, fill out the form at the top of the page for a complimentary extract from the report, including:

- An executive summary of the report

- Our analysis of the top 15 O&G producers affected by NZIA CO₂ storage obligations

- A timeline of how storage obligations are evolving

We’ll publish further analysis following the official announcement of obligations in late Q1 2025.