Sign up today to get the best of our expert insight in your inbox.

What the Middle East conflict means for oil and LNG

And the mystery of the modest geopolitical price premium

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

View Simon Flowers's full profileAnn-Louise Hittle

Vice President, Oil Markets

Ann-Louise Hittle

Vice President, Oil Markets

Ann-Louise directs our Macro Oils Service and is a frequent contributor to numerous industry publications.

Latest articles by Ann-Louise

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

Opinion

Price swings ripple through North American oil markets

-

Opinion

Oil and refining market implications of Israel’s strike on Iran

-

Opinion

What is the impact of US tariffs on oil and refining?

-

Opinion

What the Middle East conflict means for oil, LNG and the global economy

-

The Edge

What the Middle East conflict means for oil and LNG

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo brings extensive knowledge of the entire gas industry value chain to his role leading gas and LNG consulting.

Latest articles by Massimo

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

The Edge

Gastech 2025: when will the music stop for US LNG?

-

Opinion

Asia’s LNG affordability challenge amid surging supply

-

The Edge

Could US LNG become a victim of its own success?

-

Opinion

Dynamics shaping the European natural gas market

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

The Edge

Five key takeaways from COP30

-

The Edge

Can copper supply keep up with surging demand?

-

The Edge

ADIPEC 2025: six key takeaways

-

The Edge

Slipping climate targets and the “energy addition”

-

The Edge

China renewables investment powers on

Heightened geopolitical tension in the Middle East has become a disturbingly recurrent theme this century, just as it did in the last. The locus of conflict might shift each time and so, too, the implications for energy markets. So far, the oil, gas and LNG markets seem largely unfazed by this week’s escalation in Lebanon and Iran’s direct engagement with Israel.

I asked Ann-Louise Hittle, Head of Macro Oils, and Massimo Di-Odoardo, Head of Global Gas and LNG Research, why markets have stayed relatively calm and what the risks to supply and prices might be.

What is the threat to oil supply?

Potentially large, depending on whether infrastructure is targeted. We expect security around key production and processing facilities and ports to be redoubled. To reassure the market, producing countries in the region will seek to ensure production, refining and exports are maintained

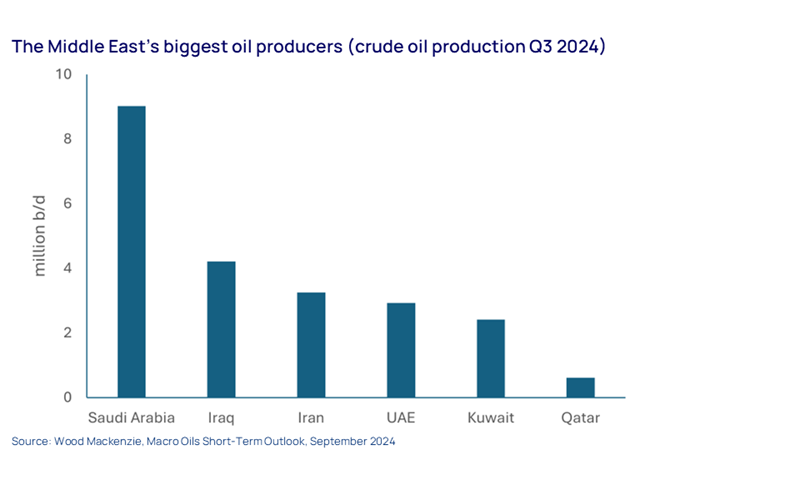

Of the big producing countries in the region, Iran – which produces 3.2 million b/d of crude oil of which about 1.4 million b/d is exported – is the most vulnerable to disruption. Israel has reportedly threatened to attack its energy infrastructure. In a wider or prolonged conflict, Iraq – 4.2 million b/d crude and 3.3 million b/d of crude exports – could also be at risk since it is home to Iran-based proxy groups. Iranian retaliation on US energy operations in the region adds to the potential risks to supply disruption.

Finally, if a supply outage were to occur, we estimate OPEC has roughly 6 million b/d of spare productive capacity readily available to come to market should it be required. However, a further risk for the oil market would be if the Strait of Hormuz were to become inaccessible. Around 20% of global crude trade passes through the Strait, as would much of the spare capacity.

Why has the oil price remained relatively subdued?

Brent has jumped US$5/bbl this week as the conflict escalated. But at US$75/bbl, that is well below the year’s peak of US$91/bbl back in April, when tensions between Israel and Iran ramped up. Since then, prices have weakened as the market focus turned to China’s slowing economy and the prospect of disappointing oil demand growth.

Even so, our fundamental analysis shows a tight balance between global supply and demand for the rest of 2024. What’s puzzling is why prices aren’t firmer, especially given that there’s even more justification for a strong geopolitical premium.

How could the gas and LNG markets be affected?

The LNG market faces similar risks to supply as oil, but unlike oil, there is little or no spare capacity should there be a disruption, and neither Iran nor Iraq exports LNG.

Iran does export gas via pipeline to Turkey for an equivalent of 4 Mt per annum of LNG, however intentional disruptions of the pipeline carry substantial political risk and there is sufficient spare capacity to import more Russian gas in Turkey. Risks to global LNG markets seem limited. (mostly Qatari). All these volumes pass through the Strait of Hormuz. The threat to either country’s ability to deliver cargoes is limited in our view. However, higher security to protect cargoes, perhaps including military escorts for LNG carriers, could slow down deliveries to the market.

Any shutdown of Israel’s piped gas exports from Israel to Egypt could also impact LNG supply, albeit indirectly. Israel took pre-emptive action to cut gas exports in case infrastructure sited close to the conflict zone became a missile target. In the event, there was no strike and flows resumed promptly. Now, with Hezbollah’s military capabilities seriously damaged, it seems unlikely it has the capability to inflict damage.

Should gas flows be disrupted for an extended period, Egypt would need to secure the equivalent of up to 6.5 Mt per annum of LNG from an already tight global market (although regas capacity might be a constraint). With winter approaching, this would occur just as the northern hemisphere enters peak demand.

The global LNG market was already pricing in some of these risks. Prices are currently trading upwards of US$13/mmbtu as the market grapples with resurgent Asian LNG demand and further risks to Russian pipeline disruption. Unlike oil, there has been no spike since the recent escalation and risks to supply disruptions remain modest.

Can we expect more price reaction?

It looks as if oil and gas traders are betting that supply disruptions can be avoided, in spite of the escalation of the conflict. But if military activity between Israel and Iran intensifies, the upside could be substantial.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.