Sign up today to get the best of our expert insight in your inbox.

What a future Ukraine peace deal means for energy (part 1)

Three scenarios for gas and LNG markets

5 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Tariffs - implications for the oil and gas sector

-

The Edge

Big Mining pivots to copper for growth

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

How gas could displace renewables in meeting surging US data centre demand

-

The Edge

Majors' capital allocation in a stuttering energy transition

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

What next for East Med gas?

-

The Edge

Battery energy storage comes of age

-

The Edge

CCUS’s breakthrough year

-

The Edge

Five themes shaping the energy world in 2025

-

The Edge

Renewable developers change tack

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo Di Odoardo

Vice President, Gas and LNG Research

Massimo brings extensive knowledge of the entire gas industry value chain to his role leading gas and LNG consulting.

Latest articles by Massimo

-

Opinion

Video | Lens Gas & LNG: Will Russian gas and LNG come back?

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

Featured

Gas and LNG 2025 outlook

-

Opinion

Preparing for ADIPEC 2024: 3 crucial questions answered

-

Opinion

What the Middle East conflict means for oil, LNG and the global economy

-

The Edge

What the Middle East conflict means for oil and LNG

In 1917, former US president Theodore Roosevelt criticised America’s refusal to enter the first world war, arguing that “peace at any price” was no guarantee of peace at all. More than a century later, Roosevelt’s message still rings true. For Ukraine’s beleaguered people, the prospect of peace on the terms of others provides little grounds for optimism.

Whatever the outcome of current negotiations, the consequences will reverberate for decades to come. In the first of two editions of The Edge on the impact of a potential Ukraine peace deal on energy, Gavin Thompson and Massimo Di-Odoardo discuss three scenarios for gas and LNG markets.

How Europe detached from Russian gas dependency

The geopolitical landscape of the Ukraine conflict has entered a new and highly uncertain phase with the Trump administration determined to broker a peace deal. The implications for European and global gas and LNG markets are profound.

Prior to the invasion of Ukraine, Russian piped gas met around 40% of European gas demand. Volumes have since collapsed from almost 150 bcm a year in 2021 to only 15 bcm a year as flows ended via Ukraine and Nord Stream, the Yamal-Europe pipeline was sanctioned and legal disputes led to the termination of most legacy contracts. Both the US and the EU have also aggressively sanctioned Russia’s Arctic LNG-2 project, halting output before it had even begun. Russia’s Yamal LNG project continues to export around 20 Mt a year, mostly bound for Europe.

European LNG imports from elsewhere soared in response, with US LNG filling much of the gap. Weaponising energy bolstered European support for Ukraine, but the rocketing gas and power prices that have ensued left it poorer as a result.

What comes next?

President Trump’s return to the White House has dramatically changed the picture. The terms of any future deal will not only define Ukraine’s future but also determine the willingness of both the US and Europe to re-establish political and economic ties with Russia.

Ukraine’s territorial boundaries and its political and military alignment will dominate negotiations, but energy is also high on the agenda. We expect that the removal of sanctions on its LNG projects will be the very least of Russian demands as it looks to reaffirm its position as a global player. Over the weekend, President Putin also dangled the carrot of Russian piped gas returning to Europe. This would be a difficult pill for much of Europe to swallow, but the prospect of lower gas prices may prove difficult for some to resist.

Three scenarios for how a peace deal could impact gas and LNG markets

WoodMac’s Gas and LNG team have developed three distinct peace agreement scenarios and used our Lens Gas Market Model to examine the implications for trade flows and prices in each scenario.

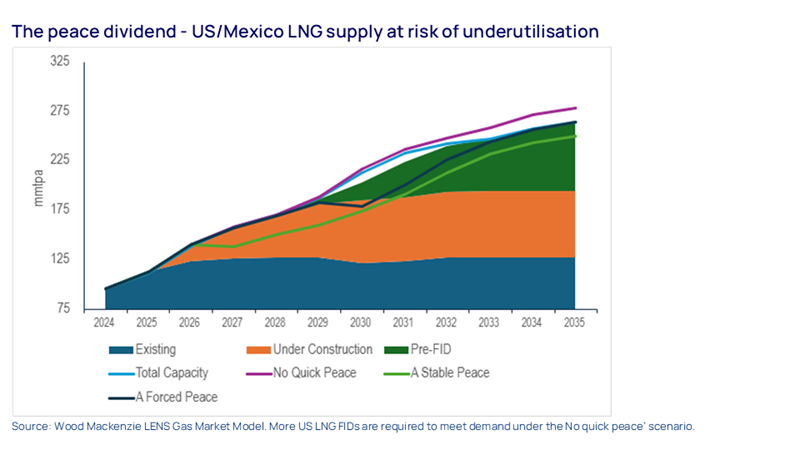

Scenario 1: No quick peace

A failure to reach any agreement cannot be ruled out and results in "stronger for longer" gas prices as even less Russian supply comes into Europe.

A continuation of the war, with Russia pursuing its strategic goals regardless of the consequences, would see the US and Europe double down on military support for Ukraine and rachet up sanctions on Moscow. These would likely include additional restrictions on Russia's ability to export gas and LNG.

The EU would push even harder to achieve its ambition of independence from Russian energy, banning LNG imports from the Yamal LNG project and the 15 bcm a year TurkStream pipeline. Good news for LNG developers but more pain for European gas consumers.

Scenario 2:

A forced peace. Based on the dynamics of negotiations at this early stage, a peace deal effectively forced on Ukraine by the US and Russia looks the likely outcome. This widens the rift between the US and Europe and allows for only a limited return of Russian piped gas and LNG into the market.

A disenfranchised EU would maintain its position on Russian pipeline imports, but horse trading is required to ensure unity. Allowing some additional flows into Hungary and Slovakia via Ukraine might be the price of keeping the bloc’s Moscow-leaning members from vetoing an extension of EU sanctions on Russia. An easing of US sanctions would see Russian LNG exports grow but an EU ban on Arctic LNG-2 limits winter exports and curbs annual output at 6 Mtpa.

This limited return of Russian gas and LNG helps the market rebalance more quickly from 2026, lowering prices and supporting additional European gas demand. Some US LNG projects in line for FID could face delay, but the overall impact is modest.

Scenario 3: A stable peace

A scenario where all parties sign up to a comprehensive and mutually acceptable peace agreement looks the least likely at this stage in the proceedings. If achieved, it would open the door to material volumes of Russian gas into Europe. A Europe willing to embrace – or unable to resist - a degree of economic rapprochement with Russia could lead to pipeline imports increasing by up to 50 bcm a year by 2027. The lifting of sanctions on Russian LNG raises exports to 12 Mtpa.

In this scenario, European (TTF) gas prices would collapse well below the US$8-9/mmbtu we already anticipate in 2028/29, leading to years of US LNG capacity underutilisation and delays to several expected LNG FIDs. Henry Hub prices in the US soften in turn due to lower than expected LNG exports, supporting more gas into domestic power generation and helping deliver the Trump administration’s central goal of lowering prices for US consumers. But with an average of 25 Mtpa of capacity at risk of underutilisation over the next five years, US LNG is the collateral damage.

Read more: For full analysis of the implications of a future Ukraine peace agreement on global gas and LNG markets please click here.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.