Sign up today to get the best of our expert insight in your inbox.

The coming low carbon energy system disruptors

Emerging technologies present a huge investment opportunity

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Tariffs - implications for the oil and gas sector

-

The Edge

Big Mining pivots to copper for growth

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

How gas could displace renewables in meeting surging US data centre demand

-

The Edge

Majors' capital allocation in a stuttering energy transition

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash leads a team of analysts designing research for the energy transition.

Latest articles by Prakash

-

Opinion

Energy transition outlook: Asia Pacific

-

Opinion

Energy transition outlook: Africa

-

The Edge

COP29 key takeaways

-

The Edge

Is it time for a global climate bank?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

The coming low carbon energy system disruptors

Lindsey Entwistle

Senior Research Analyst, Energy Transition

Lindsey Entwistle

Senior Research Analyst, Energy Transition

Lindsey provides analysis and insights into global policy, regulations and disruptive technologies.

Latest articles by Lindsey

-

Opinion

Energy transition outlook: UK

-

Opinion

Energy transition outlook: EU

-

Opinion

Our key takeaways from the Lisbon Energy Summit 2024

-

The Edge

The coming low carbon energy system disruptors

-

The Edge

How the world gets onto a 1.5 °C pathway

-

The Edge

Breakthrough technologies for the energy transition

Jom Madan

Senior Research Analyst, Scenarios & Technologies

Jom Madan

Senior Research Analyst, Scenarios & Technologies

Jom works on scenario modelling for country and global-level energy mixes across all major energy commodities

Latest articles by Jom

-

Opinion

Energy transition outlook: Middle East

-

Opinion

Energy transition outlook: Asia Pacific

-

The Edge

The coming low carbon energy system disruptors

-

Opinion

How the MENA region and its NOCs are diversifying into new energies

-

Opinion

Bioenergy: a US$500 billion market opportunity

-

The Edge

How the world gets onto a 1.5 °C pathway

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

What next for East Med gas?

-

The Edge

Battery energy storage comes of age

-

The Edge

CCUS’s breakthrough year

-

The Edge

Five themes shaping the energy world in 2025

-

The Edge

Renewable developers change tack

Momentum towards the 1.5˚C goal of the Paris Agreement may be faltering but while the pursuit of net zero is slowing, it won’t stop. Multiple low carbon technologies will be needed at scale to achieve a 2˚C or lower pathway to complement those such as renewables already on the front line of decarbonisation.

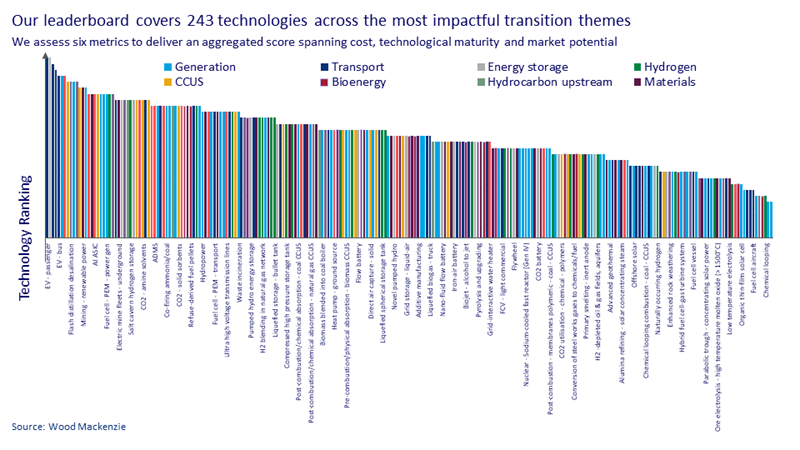

Our 4th New Technologies Outlook reveals there is no shortage of contenders to be the next big thing in low carbon. The analysis ranks 243 technologies across ten transition themes that are currently at various stages of development. All could, in time, make an impact by accelerating the transition. We’ve scored each technology on six metrics: maturity, pace of change, cost of carbon abatement, carbon offset potential, policy support and dependency (the potential for other nascent technologies to piggy-back).

Prakash Sharma, Head of our Energy Transition Service, helped me focus on the top quartile - the sixty that we reckon will be the earliest to break through to mass adoption, as well as one or two that may be longer-dated.

1. Technologies fast closing in on global deployment:

Three themes top the rankings with technologies that are already disrupting the market. In transport these include passenger and light commercial EVs, electric buses and fast charging infrastructure; in power generation fixed offshore wind, and the crystalline silicon p-type cells (as well as the newer n-type) set to underpin solar’s future dominance; while lithium-ion batteries are streets ahead of rivals for short duration energy storage.

2. Bubbling under:

Grid Edge and End Use is a big focus of innovation and investment with ten technologies in the Top 60. Highest ranked, but still in the development stage, is dynamic line rating (DLR). It’s a technology designed to boost grid capacity, which is increasingly important as variable renewables begin to dominate power systems. DLR uses sensors to determine in real time the carrying capacity of the transmission line instead of relying on static assumptions that typically assume worst case conditions.

3. High-profile technologies progressing at different speeds:

Carbon capture continues to make steady progress up the ladder supported by strong policy support and keen interest from Big Oil. Planned CCUS project capacity reached 1.6 Bt at the end of Q1 2024 and we estimate nearly 50% of the pipeline is in early stage of development.

Hydrogen in contrast has slipped down the rankings from last year. The reality of project execution against a backdrop of rising costs, midstream transportation challenges, and the slow development of consumption have led to project cancellations. We have tempered our expectations of a hydrogen economy in the near-term but believe this is a blip. Hydrogen is destined to play an important part in decarbonising multiple industries.

4. Proven in demonstration but held back by dependencies:

Multiple designs of small modular nuclear reactors (SMRs) are emerging, each with maximum capacity of 300 MW per unit. High capital intensity, tight supply of fuel (high-assay, low-enriched uranium) and the social licence to operate (including the tough permitting process) are among SMRs’ challenges.

Sodium-ion and solid-state batteries are emerging as a promising alternative to lithium-ion batteries but will take years before widespread adoption. The challenge is managing the trade-off between the technical performance and costs. While lithium-ion batteries score high in energy density compared to sodium-ion and solid-state, the latter two are considered safe and can achieve lower costs longer-term.

Big efficiency gains have put heat pumps at the forefront of decarbonising space heating in buildings. The main barrier is consumer appetite given the cost and disruption caused by reconfiguring heating layouts required for most existing homes.

Sustainable fuels for aviation (SAF) and maritime are gaining momentum – sixty companies have committed to reach 10% SAF in aviation by 2030. Feedstock supply for biofuels is the major constraint, potentially opening the door for synthetic or e-fuels.

5. Policy support to incentivise investment is critical:

Low carbon technologies present a sustained investment opportunity - we estimate between US$34 trillion (Wood Mackenzie base case) and US$63 trillion (our net zero scenario) through to 2050. Many of the technologies in the analysis will be needed at industrial scale and all are capital intensive. Higher prevailing interest rates are compounding the specific challenges each faces to become competitive.

If the world is to get close to net zero, policy makers mustn’t stint on support for the development of new technologies from the concept phase in R&D through to commercialisation and global deployment.

6. AI could be a gamechanger:

The application of AI could unlock innovation by analysing vast amounts of data, running complex simulations to develop new designs and configurations. The result? New technologies with lower costs that are more scalable – and no doubt a shake-up of WoodMac’s rankings.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.