Storage, the energy transition’s flexible friend

Storage’s emerging role in balancing intermittent renewables

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Tariffs - implications for the oil and gas sector

-

The Edge

Big Mining pivots to copper for growth

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

How gas could displace renewables in meeting surging US data centre demand

-

The Edge

Majors' capital allocation in a stuttering energy transition

Is storage the Holy Grail of the energy transition? Maybe. Certainly, a critical missing link in the quest for decarbonisation. If intermittent solar and wind generation can be complemented by competitively priced storage, the power sector can rid itself of its dependency on fossil fuels. Investors, among them utilities, oil majors and private equity, have started to place bets on storage technology playing a big part in future energy markets.

How realistic is that vision? Our Global Energy Storage team – Ravi Manghani, (Director, Americas), Rory McCarthy (Senior Analyst, Europe) and Le Xu (Senior Analyst, Asia Pacific) – has just released its Global Energy Storage Outlook. I went to the team for the answer.

What's the technology?

Batteries, where the technology is evolving rapidly. Storage for power predominantly uses NMC (nickel, manganese and cobalt) batteries, the same chemistry as in most electric vehicles. The attraction is their efficiency – the ability to release power quickly – and falling costs. The big difference between the two is that EVs need lightweight batteries, and NMCs’ high-energy density fits the bill. Weight isn’t an issue for power storage.

How does storage fit into the power system?

The biggest segment is front-of-the-meter (55% of energy storage). Utilities or private investors build storage for frequency response to help short-term system balancing (second-by-second response), to provide energy capacity availability (up to four hours) and to deal with intermittency as more renewables come onto the grid. Residential (23%) has been mainly state-subsidised solar-plus-storage packages. Falling costs should help continue to drive growth as subsidies are phased out. For non-residential (22%), businesses install storage systems to reduce their reliance on high retail prices at peak times and improve power resilience.

Does storage make money?

The secret is to access multiple revenue streams. Even in the most advanced markets the revenue stack may be just one or two services – say, frequency response for system balancing and energy capacity. These can reward developers with double-digit returns. IRRs in the US range from 7% to 14%, reducing as frequency markets saturate. As intermittent renewables come to dominate power markets, we expect the value of flexibility will increase and so, too, should returns.

Where has storage taken off?

The first markets to foster investment in a big way share similar characteristics: an overarching decarbonisation policy, liberalised, unbundled markets and an independent regulator. Of these, the US offered tax credits for renewable-paired storage to spur investment and Germany solar-plus-storage subsidies while the UK has allowed investors into potentially lucrative system-balancing services. New markets are now proliferating, including Australia where Tesla has installed the biggest lithium-ion battery in the world, at 129 MWh. In the last two years, South Korea – home to the big battery manufacturers Samsung, LG Chem and SK Innovation – has emerged as a boom market.

The first markets to foster investment in a big way share similar characteristics: an overarching decarbonisation policy, liberalised, unbundled markets and an independent regulator. Of these, the US offered tax credits for renewable-paired storage to spur investment and Germany solar-plus-storage subsidies while the UK has allowed investors into potentially lucrative system-balancing services. New markets are now proliferating, including Australia where Tesla has installed the biggest lithium-ion battery in the world, at 129 MWh. In the last two years, South Korea – home to the big battery manufacturers Samsung, LG Chem and SK Innovation – has emerged as a boom market.

What’s the global growth potential?

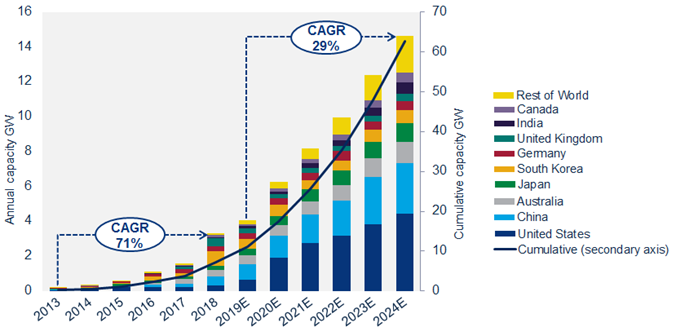

Today, battery storage is a tiny part of the power market. Last year was a record for new capacity, when the global storage ‘park’ effectively doubled to 7 GW. Compare that with 6776 GW of power generation capacity. We forecast storage growth of 29% a year through 2024, which takes capacity to 63 GW. That growth is related to the roll-out of intermittent renewables, which will account for 66% of annual new power capacity by the early 2020s. We estimate annual investment in solar and wind of US$191 billion by 2024, which fuels a tripling of spend on storage capacity to US$14 billion a year.

Will storage become central to power markets?

It’s coming. Our rule of thumb is that once renewables reaches 40% to 50% of any power market, the need for storage takes off exponentially. The EU’s roadmap for zero carbon emissions from all sectors by 2050 would depend on a huge roll-out of renewable capacity. Spain is proposing 100% renewables by 2050 and others will follow suit. That, in turn, will need a massive scale-up of system flexibility to balance markets. Energy storage will be part of the solution. To attract investment and win a big slug of the flexibility market a lot needs to happen. We’ll need sustained policy, market liberalisation and fair access to all value streams. Battery costs must continue to fall – innovation will bring new battery and non-battery technologies into play. The story for energy storage is only just beginning.