Sign up today to get the best of our expert insight in your inbox.

The narrowing trans-Atlantic divide on the energy transition

Resilient oil and gas demand across the board

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

Opinion

The narrowing trans-Atlantic divide on the energy transition

-

The Edge

Tariffs - implications for the oil and gas sector

-

The Edge

Big Mining pivots to copper for growth

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

How gas could displace renewables in meeting surging US data centre demand

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash leads a team of analysts designing research for the energy transition.

Latest articles by Prakash

-

Opinion

The narrowing trans-Atlantic divide on the energy transition

-

Opinion

Energy transition outlook: Asia Pacific

-

Opinion

Energy transition outlook: Africa

-

The Edge

COP29 key takeaways

-

The Edge

Is it time for a global climate bank?

-

The Edge

Artificial intelligence and the future of energy

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

Opinion

The narrowing trans-Atlantic divide on the energy transition

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

What next for East Med gas?

-

The Edge

Battery energy storage comes of age

-

The Edge

CCUS’s breakthrough year

-

The Edge

Five themes shaping the energy world in 2025

David Brown

Director, Energy Transition Practice

David Brown

Director, Energy Transition Practice

David is a key author of our Energy Transition Outlook and Accelerated Energy Transition Scenarios.

Latest articles by David

-

Opinion

The narrowing trans-Atlantic divide on the energy transition

-

Opinion

Energy transition outlook: Americas

-

Opinion

The federal government steps up support for nuclear power

-

Opinion

The impact of Republican control on US energy policy and the IRA

-

The Edge

Nuclear’s massive net zero growth opportunity

-

The Edge

COP28 key takeaways

For much of the past decade, Big Oil had divergent views of the future. US Majors’ confidence that oil and gas demand would be resilient spurred their continued investment in upstream and ultimately led to the bold M&A deals that will underpin production growth for years to come. In contrast, the Euro Majors pinned their future on an energy transition closer to the goals of the Paris Agreement, deprioritising oil and gas to invest in multiple low-carbon technologies.

As the pace of the transition has slowed, the Euro Majors have changed tack. While low-carbon investments remain important to their portfolios, most now recognise that they can create more value for shareholders by leaning back into upstream.

How do the Majors now see the energy system evolving? Are companies’ outlooks converging? What does this mean for investment? Prakash Sharma and David Brown from our Energy Transition team shared their analysis of the Majors’ 2024 outlooks with Gavin Thompson.

How do the Majors now see the energy system evolving?

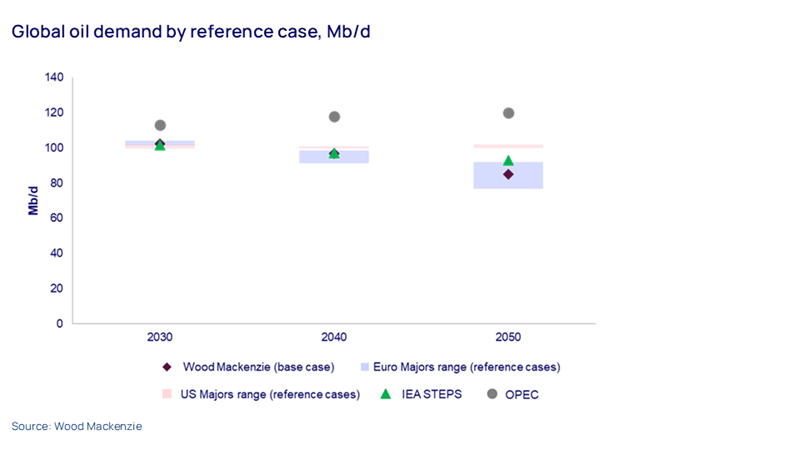

Almost all the Majors publish global energy outlooks, their view of the world’s future energy needs. Each expects oil and gas demand to be resilient, but with notable differences in volumes, timing of peak demand and the decline profile.

The US Majors remain the most bullish, with no peak in oil demand envisaged in their ‘reference’ cases. Volumes plateau at around 100 mb/d by 2050, as much as 15 mb/d higher compared to WoodMac's base case and closer to that of our Delayed Energy Transition scenario. For the Euro Majors, oil demand peaks earlier and declines faster – mainly from more aggressive EV penetration – but is still pretty material at 77 mb/d by 2050, exactly the same level as it was in 2000.

For the US Majors, energy markets expand around natural gas rather than transition away from it. Wood Mackenzie is bullish on gas demand, yet the US Majors’ reference cases are 34% higher in 2050 than our base case – with one company scenario having gas demand almost doubling to over 7,000 bcm (680 bcfd) from today’s level. Euro Majors similarly expect strong growth, but volumes are lower and the timing of peak gas demand expectations ranges between 2030 and 2048.

What’s been behind the strategic divergence?

Geography and good fortune played a part. The shale revolution on their home patch was a gift from above for US Majors, providing access to abundant, low-cost fossil fuel resources that drove oil and gas production growth. At the same time, the lack of a national carbon price in the US and fluctuating regulatory policies dampened the comparative attractiveness of investing in low carbon. That changed to a degree after President Joe Biden’s Inflation Reduction Act of 2022. But US Majors have remained highly selective, mainly on CCUS and blue hydrogen. President Donald Trump’s pursuit of “energy dominance” is essentially an energy policy aimed at doubling down on oil and gas.

The Euro Majors, in contrast, lacked exposure at scale to the US Lower 48. Instead, they aligned strategically with Europe’s decarbonisation policy, which included carbon trading and incentives for renewables and emerging low-carbon technologies. Capital allocation tilted in that direction.

What’s shaping Big Oil’s varying outlooks?

Three major themes support forecasts for higher oil and gas demand. First, the prioritisation of energy security after Russia’s invasion of Ukraine in 2022. This was the moment the industry realised that the shift to a low-carbon system would be gradual and oil and gas would play a sizeable role for years.

Second, governments' finances are stretched by other priorities, not least defence, blunting capacity for indefinite subsidies need to develop low-carbon technologies.

A third factor is that tariffs and the potential removal of the Inflation Reduction Act tax credits will dent renewables and energy storage capacity growth, significantly increasing the call on natural gas in the domestic power sector.

The Euro Majors’ strategies are already pivoting back towards upstream. With the impact of a potential weakening of government subsidies and lower renewables in the US not fully baked into 2024 outlooks, it remains to be seen if their future oil and gas demand forecasts catch up with those of their US peers.

Will the Euro Majors embrace upstream M&A?

Very likely. Five years of lower upstream investment have weakened the medium-term outlook for production and cash flow relative to their US peers. A more positive outlook for oil and gas demand points to higher organic upstream investment and M&A. Relatively modest equity market valuations remain a constraint on financing, but the current downturn could bring forward deal-making, perhaps even a transformational acquisition.

What is the future of low carbon for the Majors?

The scale and direction of the Majors’ investment in low-carbon energy is already changing – the Euro Majors’ share of low-carbon budgets is expected to fall from 24% to 18% over the next three to five years.

This doesn’t indicate a shift away from all low-carbon investments but rather a refocusing on where, on what and how much money is spent. TotalEnergies recent acquisition of Talos Low Carbon Solutions to expand its CCUS expertise suggests the Majors are still open to building low-carbon portfolios.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.