Sign up today to get the best of our expert insight in your inbox.

Battery energy storage comes of age

Technology to expand zero carbon power generation

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Tariffs - implications for the oil and gas sector

-

The Edge

Big Mining pivots to copper for growth

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

How gas could displace renewables in meeting surging US data centre demand

-

The Edge

Majors' capital allocation in a stuttering energy transition

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

What a future Ukraine peace deal means for energy (part 1)

-

The Edge

What next for East Med gas?

-

The Edge

Battery energy storage comes of age

-

The Edge

CCUS’s breakthrough year

-

The Edge

Five themes shaping the energy world in 2025

-

The Edge

Renewable developers change tack

Anna Darmani

Principal Analyst, Energy Storage EMEA

Anna Darmani

Principal Analyst, Energy Storage EMEA

Anna is a principal analyst focused on the European, Middle East and African storage markets.

View Anna Darmani's full profileCecilie Kristiansen

Research Associate, Energy Storage EMEA

Cecilie Kristiansen

Research Associate, Energy Storage EMEA

Cecile works on research for the power and renewables team, focusing on European storage markets.

View Cecilie Kristiansen's full profileWind and solar dominate new power capacity additions worldwide but struggle to supply grids 24/7. Battery energy storage systems (BESS) can help, allowing more renewable power to be dispatched, reducing curtailment and enhancing grid stability.

Today’s dominant energy storage technology, lithium-ion phosphate (LFP) batteries, still has limitations, not least duration and supply chain. Despite these hurdles, investment in BESS is now surging.

Gavin Thompson, Vice Chair EMEA, spoke to Anna Darmani and Cecilie Kristiansen from our energy storage team to get the lowdown on the fastest-growing market in the sector.

First, energy storage is essential to expanding zero-carbon power generation

In many markets, grid constraints mean wind and solar capacity is often curtailed during high availability, pushing wholesale prices to zero or below. Conversely, grid operators largely rely on gas plants when intermittent wind and solar are unavailable, ramping these assets quickly and driving prices to extreme highs.

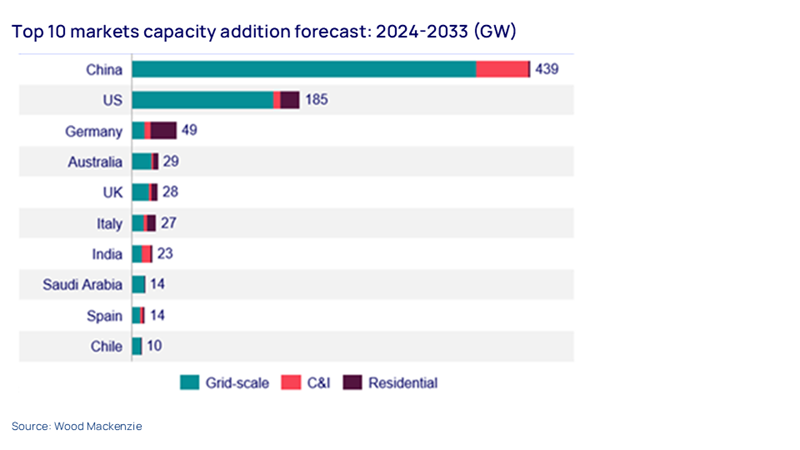

These economics are driving the rapid growth in energy storage to expand renewable generation and optimise grids. The BESS market expanded by 44% in 2024, installing 69 GW/161 GWh of capacity and discharge output, with 80% coming from the grid-scale segment. We expect the global energy storage market to surpass 1 TW/3 TWh over the next decade, nearly seven times the current installed capacity.

Second, governments worldwide are stepping up as massive wind and solar build-out struggles to be fully dispatched due to insufficient grid infrastructure

In November 2024, COP29 agreed to a global energy storage target of 1,500 GW by 2030, up from 340 GW today, covering all technologies, including BESS and pumped hydro. China has been quick to identify storage as a critical technology to maximise renewable generation. Through its low-cost LFP battery manufacturing and renewables coupling policies, China now accounts for around half of global installed storage capacity. It will broadly maintain market dominance with plans to commission 45% of total new capacity additions over the next 10 years.

BESS growth is not limited to mature renewable energy markets. Saudi Arabia is projected to install 14 GW/53 GWh of energy storage capacity and output by 2033, driven by giga-projects like Neom and large-scale government tenders designed to integrate renewable energy. This positions Saudi Arabia among the top 10 global markets for energy storage, aligning with its goal of achieving a 50% renewable energy share by 2030.

Third, advances in battery technology offer the prospect of longer duration storage

Current LFP batteries typically only deliver full output for up to eight hours. This is useful for net-load smoothing and alleviating the ‘duck curve’ – batteries are charged during daytime solar oversupply and discharged to meet evening peak demand and prices. But it’s when they can provide full-day duration and enable renewables to provide baseload power that batteries will have taken a giant leap. Today, advanced cell chemistry batteries hold promise in increasing storage capacity and duration, such as flow or iron-air batteries that can boost battery duration up to 100 hours. But further technological advancement is needed before full commercialisation.

Fourth, costs continue to fall

Battery storage costs dropped by nearly 20% in 2024, amid oversupply and an ongoing price war. Increasing cell sizes and energy density will further push down prices. Battery container costs could potentially fall by almost 40% from US$160/kWh to below US$100/kWh by 2030, further driving demand. Combined with solar PV, which already offers the lowest levelised cost of electricity, declining battery costs mean hybrid applications such as solar-plus-storage systems will become one of the lowest cost and reliable forms of electricity by 2035.

Corporate activity is also increasing competitiveness. Experienced Asian battery manufacturers – including CATL, Panasonic and BYD – with mature technology, mass production experience and robust supply chains are expanding investment overseas to access markets in North America and Europe. Several US and European automakers have also established joint ventures with Asian companies for battery production.

Rising trade protectionism poses a threat to the pace and cost of energy storage deployment. In the US, President Donald Trump could move to impose higher tariffs on BESS cells that rely on China’s near-monopoly on LFP production. This would give US operators little choice other than to pay tariffs, increasing storage costs until local LFP lines are built. Similarly, federal support for BESS is far from guaranteed. The new administration could introduce sweeping cuts to the Inflation Reduction Act, impacting the pace of clean electricity growth.

Protectionism isn’t just a US playbook. Beijing’s proposed ban on exports of cathode technology poses a threat to energy storage growth outside of China. Currently, many companies license cathode technology from Chinese manufacturers to benefit from the country’s advanced cathode and precursor industry without the need to import physical materials. This option may now be at risk.

Finally, BESS alone can’t do all the heavy lifting

All forms of power will be needed – including gas paired with carbon capture and storage, nuclear, green hydrogen and renewables – to meet future demand for clean power and ensure energy security. But with rising investment, BESS is now coming of age.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.