Get Ed Crooks' Energy Pulse in your inbox every week

US low-carbon energy manufacturing booms

Tariffs and tax credits are leading to a surge in production capacity for solar equipment and batteries

10 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Keeping cleantech investment alive

-

Opinion

Can energy close US trade gaps?

-

Opinion

Tariff shockwaves shake the energy industry

-

Opinion

How can the power industry meet the challenge of rising demand?

-

Opinion

Is the US being left behind in the race to develop new clean energy technologies?

-

Opinion

US E&Ps look for international growth

Although the US elections on 5 November present voters with a choice between two starkly different visions of energy and climate policy, there are a few issues on which there is broad consensus across the political spectrum. One of those is the importance of rebuilding the US manufacturing base.

The US manufacturing workforce rebounded during the recovery from the pandemic, but has so far not been able to reverse its trend of long-term decline. In January 2000 there were about 17.3 million people employed in manufacturing in the US. Now it is about 12.9 million. Democrats and Republicans both want to turn that trend around.

Both President Joe Biden and former President Donald Trump have put job creation in manufacturing at the heart of their economic strategies. “Under my leadership we’re going to take other countries’ jobs,” former president Trump said in a speech in September, promising a manufacturing renaissance if he is returned to the White House. “We’re going to take their factories.”

On the Democratic side, US Secretary of Commerce Gina Raimondo said this week: “There is no one who cares more about revitalizing American manufacturing than President Biden...He believes that America is a place where we should make things.”

A stronger manufacturing sector is seen as a priority in Washington for both economic and strategic reasons. The US Department of Defense said last year that advanced manufacturing capabilities were critical to national security, and its 2023 National Defense Science and Technology Strategy identified 14 key strategic sectors for geopolitical competition, including renewable energy generation and storage.

One of the Biden administration’s most important initiatives for making progress towards those goals has been the 2022 Inflation Reduction Act (IRA), which included a series of incentives for domestic production of renewable energy equipment.

The US Treasury last week issued its final guidance on eligibility for the 45X Advanced Manufacturing Tax Credit, available for renewable energy equipment, batteries, and 50 critical minerals. The final rules are not enormously different from the proposed guidance published in December last year, but help provide certainty to manufacturers and developers.

The most significant change from the initial proposals is that extraction costs for critical minerals can now be eligible for the credit under certain conditions, helping mining companies that also refine their materials. The change was welcomed by Senator Joe Manchin, an independent from West Virginia whose vote was critical for getting the IRA passed.

Another announcement from the Treasury last month also clarified an area of uncertainty in a way that will help US producers of solar components. The government said that the 48D 25% investment tax credit for semiconductor manufacturing, included in the 2022 CHIPS and Science Act, would be available to producers of the silicon wafers used for solar modules.

The government statement added that the Treasury and Internal Revenue Service (IRS), along with the Department of Energy and other agencies, “continue to evaluate additional options to further the administration’s goal of incentivizing domestic production of the full solar supply chain.”

The tax credits for domestic manufacturing are being reinforced by tariffs and duties on imports of low-carbon energy equipment. The US Department of Commerce last month issued a preliminary decision that some solar cells and modules from Cambodia, Malaysia, Thailand and Vietnam were being unfairly subsidised, a step forward in a process that could lead to additional duties being imposed on imports from those countries.

While many aspects of US energy policy have swung sharply from one presidency to the next over the past couple of decades, tariffs and duties on solar equipment have been a consistent theme through the Obama, Trump and Biden administrations. They are likely to remain relevant through the next administration, too, whoever is in the White House.

The big question is over how effective these measures are going to be in building a low-carbon energy manufacturing supply chain in the US, where the industry has in the past been vulnerable to lower-cost foreign competition.

Wood Mackenzie view

The early evidence on the effectiveness of the Biden administration’s industrial strategy shows clear signs of success. Spending on construction in the manufacturing sector, indicating factories being built and expanded, has rocketed in the US in past three years. In 2015-21, that spending was running at about US$80 billion per year. In 2024, it has been running at a rate almost three times that: about US$230 billion a year.

For the energy industry specifically, there is evidence that at least parts of the administration’s strategy have been effective. Wood Mackenzie tracks projects for energy equipment manufacturing facilities, and has detailed data on the outlook for US production in sectors including solar and battery storage. In both of those sectors, manufacturing capacity is soaring.

In solar, US module manufacturing capacity has quadrupled in less than two years, rising from about 9 gigawatts per year at the end of 2022 to more than 30 GW /year by the middle of 2024. We project that next year, US solar module manufacturing capacity will be greater than US installations.

Wood Mackenzie analysts say the position of US solar manufacturing is still “precarious” because of the huge growth in Chinese production capacity that has created a global plunge in module prices. But the US framework of import barriers and incentives for domestic solar equipment manufacturing has already supported rapid growth in the industry. It is quite possible that restrictions on imports will be tightened further, boosting the growth of domestic manufacturing.

The story is similar for battery storage. US manufacturing capacity for batteries is set to grow rapidly over the next few years, again supported by tax incentives and import barriers, including new Section 301 tariffs first announced in May. Wood Mackenzie is forecasting that US battery production for energy storage systems, rather than electric vehicles, will rise to over 50 GW hours per year by the early 2030s.

That will still not be enough to cover all of US demand, which is also growing rapidly. But it does mean that every US stationary storage project should be able to source enough home-produced equipment to meet domestic content requirements to qualify for bonus tax credits.

The downside of success in building domestic manufacturing is that it raises costs in the supply chain. For battery storage, the impact so far has been relatively small. We estimate that the Section 301 tariffs announced in May will increase energy storage system costs in the US by 6%-16%, starting in 2026, and will have only a small impact on deployments. We are forecasting that by 2026, US-manufactured energy storage systems will become cost-competitive with Chinese systems, once tariffs and tax credits are taken into account.

For solar, the cost premium for domestic production is larger. “A future with more domestic solar module procurement will be more expensive, particularly in the near term,” Michelle Davis, Wood Mackenzie’s head of global solar, wrote in a recent report. “Our analysis shows that domestic modules with US-made cells will be priced around $0.41/watt in 2025, and decline to $0.35/watt by 2032 compared to typical module import pricing today in the mid-twenties.”

It is one of the central policy dilemmas of the energy transition. Tariffs and tax credits have become popular with politicians as tools to build manufacturing capacity. But if those policies did not exist, and US developers were free to source equipment from the most competitive suppliers, anywhere in the world, costs would be lower and the deployment of low-carbon technologies would be faster.

In brief

The European oil and gas Majors have been reporting third quarter earnings this week. Shell’s results delivered the most positive news, with quarterly profit of US$6 billion coming in well ahead of analysts’ consensus estimates. The result was particularly noteworthy in that it largely reflected underlying operating performance, rather than trading or commodity prices. BP reported underlying profits of US$2.3 billion for the quarter, which was also above expectations, but its lowest quarterly figure since the onset of the pandemic in 2020. TotalEnergies’ net income fell 66% year-on-year to US$2.3 billion, hit by factors including lower European refining margins.

Skydio, a US drone manufacturer, is looking for alternative suppliers for critical components after China’s government prevented it sourcing from Chinese companies. The sanctions, which were first reported in the Financial Times, have highlighted concerns about Western companies’ reliance on China for strategically important supply chains.

China’s largest offshore wind project has been completed and came into operation last weekend, China Daily reported. State Power Investment Corporation’s U1 offshore wind project has a total capacity of about 900 megawatts from 106 8.5 MW turbines.

The first production model of the world’s largest wind turbine, with a capacity of 26 MW, has just been completed in China. The turbine is intended for use offshore.

The first phase of what will be Australia’s largest battery installation has come on line ahead of schedule. Neoen’s Collie battery in Western Australia is starting up with a power capacity of 219 MW, and energy storage capacity of 877 MWh in stage one. When complete, it will have a maximum power output of 560 MW and 2,240 MWh of storage.

Other views

AI and data centres will transform US power market dynamics – Simon Flowers and Chris Seiple

Making the connection: the electric T&D supply chain challenge – Xizhou Zhou and Devin Thomas

US residential solar market turmoil reached new heights this year – Zoe Gaston

Global upstream update: oil supply questions and portfolio resets – Fraser McKay and Robert Clarke

Infographic: The future of the copper market

The battery revolution is finally here – Peter Holderith

Quote of the week

“We, the undersigned, are scientists working in the field of climate research and feel it is urgent to draw the attention of the Nordic Council of Ministers to the serious risk of a major ocean circulation change in the Atlantic. A string of scientific studies in the past few years suggests that this risk has so far been greatly underestimated. Such an ocean circulation change would have devastating and irreversible impacts especially for Nordic countries, but also for other parts of the world.”

A group of 44 climate scientists signed a letter to the Nordic Council of Ministers, the official body for inter-governmental co-operation among the Scandinavian countries, Iceland and Greenland, raising the alarm over the potentially severe impacts from climate change.

The Atlantic Meridional Overturning Circulation (AMOC), the main mechanism transporting heat northwards in the North Atlantic, “determines life conditions for all people in the Arctic region and beyond and is increasingly at risk of passing a tipping point,” the scientists warned. If the AMOC does collapse, the impact on Scandinavia would be “catastrophic”, potentially threatening the viability of agriculture in northwestern Europe, they added. Other impacts could include “major additional sea-level rise particularly along the American Atlantic coast.”

Chart of the week

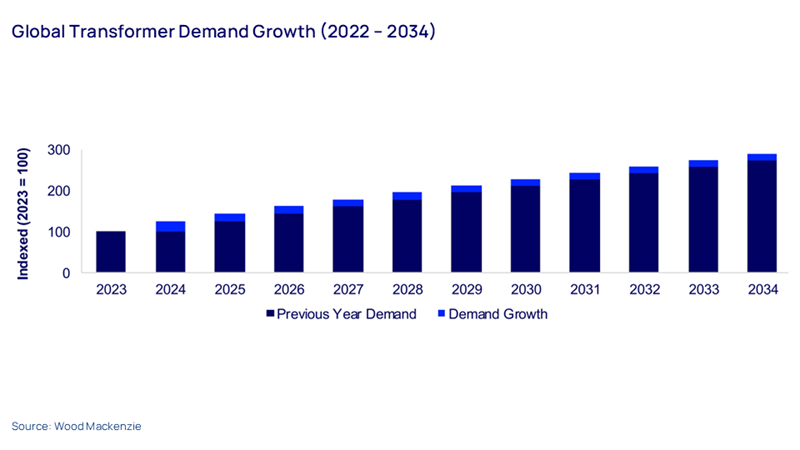

This comes from the slide deck for Wood Mackenzie’s latest study of the supply chain in the power and renewables industry: Making the connection: meeting the electric T&D supply chain challenge. It shows expected growth in worldwide demand for transformers out to 2034. Transformers are essential for the operation of the power grid, and demand is growing strongly, creating strains in the supply chain. Prices are rising and buyers are being forced to wait for product to be available. We project that global sales of transformers will approximately double by the end of the decade.

Take a look at the study page and download the full set of slides for more details.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.