Get Ed Crooks' Energy Pulse in your inbox every week

OPEC+ strikes a deal to avoid oil glut

After disagreements delayed the OPEC+ meeting, ministers managed to compromise on a cautious production increase of just 500,000 b/d in January

1 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Keeping cleantech investment alive

-

Opinion

Can energy close US trade gaps?

-

Opinion

Tariff shockwaves shake the energy industry

-

Opinion

How can the power industry meet the challenge of rising demand?

-

Opinion

Is the US being left behind in the race to develop new clean energy technologies?

-

Opinion

US E&Ps look for international growth

When the Persian emperor Xerxes I led his enormous army into Greece in 481 BCE, some of the leading Greek city-states set aside their rivalries to resist him. They agreed, wrote the historian Herodotus, “that the absolute priority should be to make good their differences, of which there were a whole number rumbling on.” It was an example that the members of the OPEC+ group of oil producers just about managed to follow at their meeting on Thursday.

Before the meeting, there were some bad omens for hopes of a constructive agreement to defend oil prices. The online meeting of ministers of the OPEC+ group, including OPEC and its allies such as Russia and Kazakhstan, had been originally scheduled for Tuesday, but was put back when it became clear that the differences between members would take more time to resolve.

Although everyone expects a much better year in 2021, the severity of the Covid-19 pandemic in many countries means there are still some bumpy months ahead for the oil market. Against that backdrop, Russia and Saudi Arabia, the group’s de facto leaders, had wanted to keep its production limits at their current level of 7.7 million barrels a day below the pre-pandemic baseline.

Under the agreement the group reached in April, when the plunge in oil demand was at its worst, the curbs were scheduled to ease off to a 5.8 million b/d reduction at the start of 2021. Some OPEC+ members, led by the United Arab Emirates, wanted to keep to that schedule. The UAE has been increasing its production capacity, and has made the steepest cuts in its output relative to its potential.

The problem is that the demand is not yet there for the increased OPEC+ production envisaged in April. Allowing almost 2 million b/d of additional output in January would have led to a significantly oversupplied market in the first quarter, Wood Mackenzie analysts calculated, putting strong downward pressure on prices.

Faced by that threat, the OPEC+ producers agreed to make good their differences. The compromise agreement sealed on Thursday allows only an extra 500,000 b/d on to the market in January, with subsequent increases trickled out only as demand recovers. The OPEC+ countries will hold monthly ministerial meetings, starting in January 2021, “to assess market conditions and decide on further production adjustments for the following month”. The largest possible production increase in any one month will be 500,000 b/d.

Ann-Louise Hittle, the head of Wood Mackenzie’s Macro Oils service, commented that the compromise reflected a determination to avoid a repeat of the price war that broke out after the OPEC+ countries failed to reach an agreement on production cuts in March. “The group is clearly signaling its intent to avoid an all-out push for market share regardless of prices,” she said.

ExxonMobil writes down American gas assets

Over the past decade, while many companies have written down the value of their North American gas assets, ExxonMobil has held back. Until now. This week, ExxonMobil announced that it would be taking a non-cash after tax charge of US$17 to US$20 billion in its fourth quarter earnings, for writedowns on the value of dry gas assets in the US, Canada and Argentina.

The company said it “no longer plans to develop a significant portion of its dry gas portfolio,” including some of its resources in Appalachia, the Rocky Mountains, Oklahoma, Texas, Louisiana, Arkansas, western Canada and Argentina. Expected capital and exploration spending for 2022-25 has been cut to US$20 to US$25 billion a year, one-third less than the US$30 to US$35 billion guidance given at the company’s 2020 Analyst Day in March.

Darren Woods, chief executive, said in a statement, “Continued emphasis on high-grading the asset base — through exploration, divestment and prioritisation of advantaged development opportunities — will improve earnings power and cash generation, and rebuild balance sheet capacity to manage future commodity price cycles while working to maintain a reliable dividend.” The company also said it planned an “increased focus on monetisation of less strategic assets to grow the portfolio of potential divestments,” subject to achieving satisfactory valuations.

Tom Ellacott, Wood Mackenzie’s senior vice president for corporate analysis, said: “Cutting costs, managing for margin and improving business resilience will be a priority to ensure the dividend is sustainable medium term.”

The impairment charge shows how the outlook for gas in North America has changed since ExxonMobil agreed to buy XTO Energy for $41 billion in December 2009. At that point the average price of Henry Hub gas in the futures market for the next five years was $6.53 per thousand cubic feet. As it turned out, the average price in the spot market over that period was just $3.84. Today the month-ahead price is about $2.50, and the December 2033 contract is trading at about $3.10.

“The days of $6 gas are long gone,” said Dulles Wang, a director with Wood Mackenzie’s Americas Gas and LNG team. “We still expect gas demand to grow, but the market is facing headwinds with energy transition and decarbonisation. We just don’t have much growth in some of those regions where ExxonMobil holds XTO legacy assets.”

In brief

Companies that are members of the Oil and Gas Climate Initiative increased their spending on low-carbon energy by 14% last year to $6.4 billion for the 10 companies that disclosed data, according to the group’s latest progress report. Members of the OGCI, which include companies such as Royal Dutch Shell, BP, ExxonMobil and Saudi Aramco, cut the total greenhouse gas emissions from their operations by 1%, to 678 million tonnes of carbon dioxide equivalent. The emissions intensity of their oil and production dropped by 5%, to an average of 21.1 kilogrammes per barrel of oil equivalent produced. The progress made so far suggests the group’s members are well on course to hit their target of reducing that to 20 kg / boe by 2025.

Investment in energy storage in the US has soared this year, despite the pandemic. The latest quarterly monitor from Wood Mackenzie and the US Energy Storage Association found that a record 476 megawatts of capacity was deployed in the US in the third quarter. That is up 240% from the previous high, set in the second quarter. The great majority of the new storage was added “in front of the meter”, on transmission and distribution networks, which is the fastest-growing market segment. The boom in installations was described as “a sign of things to come”, with storage procurements, particularly in California, growing fast. Dan Finn-Foley, Wood Mackenzie’s head of energy storage, said he expected the quarterly record for installations would soon be broken again.

The US government has announced an auction on January 6 for oil and gas leases in sections of the Arctic National Wildlife Refuge in Alaska. Much of the industry is expected to be wary of attempting to operate in an area that has been the subject of fierce controversy over energy development for decades.

A study supported by China’s environment ministry has proposed that projects backed under the country’s Belt and Road initiative should be graded based on their impacts on the climate, pollution and biodiversity, with the aim of discouraging banks from supporting the worst most damaging investments. Coal, oil and gas developments would be classed as “red” projects that require strict safeguards to minimise their impacts on the environment.

New shared air transport services could be available in just a few years in Dallas and Los Angeles, but Uber has apparently decided that the flying car business is no longer central to its strategy. Axios reported that the company is in talks to sell its fledgling air taxi business Uber Elevate to electric aircraft company Joby Aviation, which is backed by Toyota.

And finally: what’s in a name? “Natural gas” has been used since at least the 1820s, to distinguish it from “coal gas” or “town gas”, made from coal. Given the general popularity of anything labelled “natural”, it is a helpful bit of branding for the industry. A recent poll found that the American public has a much more positive view of natural gas (76% favourable) than it does of oil (51% favourable) or coal (39% favourable), and environmental campaigners argue that the name helps reinforce that good impression.

The word “methane”, on the other hand, is viewed much less favourably by the public, according to research from the Yale Program on Climate Change Communication. Environmental campaigners often use the term “fracked gas” instead of natural gas, but the Yale study suggests the words “methane gas” may start to be used more often. Quibbles about natural gas also including some ethane and other hydrocarbons, as well as various impurities, are unlikely to make much headway with the public.

Other views

Simon Flowers — Who will fund the energy transition?

Julian Kettle — Will we need to mine metals in the future?

Rory McCarthy, Ben Gallagher and Simon Morris — Five challenges on the path to net zero

Gail Anderson et al — Harvest or grow? What is the future of upstream oil and gas investment?

Tyler Cowen — Warp Speed for clean energy? That won't work

Ted Nordhaus and Alex Trembath — To fight climate change, get real

Jamie Smyth and Robin Harding — Will Australia’s ‘hydrogen road’ to Japan cut emissions?

Quote of the week

“When looking at our actual profitability, it is very low at around 1% for the past year. Investors are giving us a lot of credit for future profits, but if, at any point, they conclude that’s not going to happen, our stock will immediately get crushed like a soufflé under a sledgehammer!” — In an email to Tesla employees, chief executive Elon Musk warned about the need to control costs to make the company’s cars both affordable and profitable. He added: “In order to make the electric revolution happen we must make electric cars, stationary batteries and solar affordable to all.”

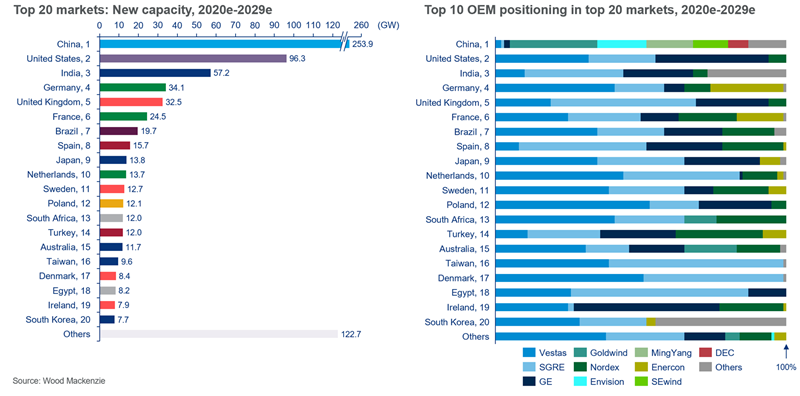

Chart of the week

These charts come from a new Wood Mackenzie release on the outlook for global wind power out to 2029. On the left, there is a breakdown of expected installations by country, showing how China is expected to be by far the world’s largest market for wind turbines over the coming decade, accounting for almost a third of total global new capacity. On the right, the chart shows the implications for manufacturers. Although the “big three” — Vestas, Siemens Gamesa Renewable Energy and General Electric — have only small shares of the Chinese market, they are strong in every other major economy, and they are expected to consolidate their positions. The big three had a combined global market share of 43% in 2019. By 2029, that will have risen to 60%, Wood Mackenzie analysts project.