Get Ed Crooks' Energy Pulse in your inbox every week

Energy appointments signal Trump administration goals

Nominees aim to boost US investment and production, in all sectors

11 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Solar import duties highlight the challenges in building up US manufacturing

-

Opinion

What do the tariff wars mean for low-carbon energy?

-

Opinion

Keeping cleantech investment alive

-

Opinion

Can energy close US trade gaps?

-

Opinion

Tariff shockwaves shake the energy industry

-

Opinion

How can the power industry meet the challenge of rising demand?

“Personnel is policy.” That aphorism about the realities of US presidential government was coined by Scot Faulkner, who was director of personnel for Ronald Reagan’s triumphant election campaign in 1980. What he meant was that, while US presidents can do almost anything, they can’t do everything. The day-to-day business of the administration is carried on by appointed officials. And if presidents want to make real progress towards their policy objectives, they need to make sure that their officials are as committed to those goals as they are.

That is why President-elect Donald Trump’s first two picks to be his senior energy officials are particularly significant. There is still a great deal of uncertainty around exactly how energy policy will play out in his second administration. But the announcements he has made give a clear sense of the direction he wants to set and the objectives he wants to achieve during his four-year term.

Last week, President-elect Trump named Chris Wright, the chief executive of oilfield services company Liberty Energy, to be his energy secretary, and Doug Burgum, governor of North Dakota, to be the interior secretary and head of a new National Energy Council at the White House.

The common thread in the thinking on energy expressed by both Wright and Burgum is that they want to boost production of all types of energy, including fossil fuels. They do not deny that human-caused climate change is a real threat that needs to be addressed. But they argue that there are other priorities for policy that are more important and more urgent, and that oil and gas can continue to play the central role in the global energy system into the indefinite future.

If they get to take the reins of energy policy-making under the Trump administration, they will undoubtedly aim to help the oil and gas industry in every way possible. But several low-carbon sectors could also benefit, or at least not be hit as hard as they might have feared.

Meet Chris Wright and Governor Doug Burgum

Announcing their nominations, President-elect Trump said that Wright and Burgum would be working on cutting red tape, enhancing private sector investment and focusing on innovation, with the aim of boosting energy production to cut prices and “win the AI arms race with China (and others)”.

Chris Wright has become one of the highest-profile CEOs in the industry thanks to his tireless advocacy for American energy in general, and oil and gas in particular. He has made his case in a variety of public forums, including YouTube videos and in a 180-page report titled ‘Bettering human lives’.

That report makes its argument in 10 key points, which include: “Global demand for oil, natural gas, and coal are all at record levels and rising — no energy transition has begun” and “Zero Energy Poverty by 2050 is a superior goal compared to Net Zero [emissions] 2050.”

Wright summarises his position on climate change like this:

“Climate change is a real and global challenge that we should and can address. However, representing it as the most urgent threat to humanity today displaces concerns about more pressing threats of malnutrition, access to clean water, air pollution, endemic diseases, and human rights, among others.”

Tackling those other more pressing problems, he argues, would be helped by the strongest possible growth in US oil and gas production. This would displace supplies from authoritarian regimes and geopolitical rivals of the US and substitute for dirtier fuels, including coal and traditional biomass.

On policy, Wright warns that the 2022 Inflation Reduction Act (IRA), which extended and expanded tax credits for a range of low-carbon energy technologies, “appears poised to drive the U.S. electricity grid along the European path [to] higher prices and more grid stability problems”.

He is not opposed to all forms of low-carbon energy, but says the world needs a massive increase in research and innovation, as opposed to subsidies for existing technologies. His company has worked on low-carbon energy sources, including advanced geothermal, small modular nuclear reactors (SMRs) and sodium-ion batteries. The world needs more and better energy, which means contributions from “all viable energy technologies,” Wright says.

One of the peculiarities of the US system of government is that the energy secretary – the job that Chris Wright is being proposed for – does not have primary responsibility for many of the decisions most relevant to the energy industry. A US energy secretary does have responsibility for overseeing energy policy, but the most vital part of the job relates to nuclear weapons. The secretary is tasked with “maintaining a safe, secure and effective nuclear deterrent” for the US, and reducing the threat of nuclear proliferation.

Many of the key decisions related to energy, such as oil and gas leasing programmes, lie with the Department of the Interior. So the proposal that Governor Burgum of North Dakota should head that department, as well as the new White House energy council, is also highly significant for the industry.

Governor Burgum, like Wright, has a record of recognising the need to act on climate change while also aiming to boost oil and gas production. In 2021, he set a goal of reaching net zero emissions for North Dakota – described as “carbon neutral status” – by 2030. That is a much more ambitious schedule than California’s – the Golden State is aiming for net zero by 2045.

Another crucial difference is that Governor Burgum has envisaged his state reaching net zero largely through carbon capture and storage (CCS). As he has pointed out, North Dakota hit the “geologic jackpot” in its potential for sub-surface storage of carbon dioxide. Its estimated capacity of 250 billion tons could take all of the US’s carbon dioxide emissions from energy for almost 50 years.

In a sign of North Dakota’s enthusiasm for CCS, the state’s Public Service Commission last week voted unanimously to approve the route permit for Summit Carbon Solutions’ proposed US$8 billion carbon dioxide pipeline system, which would take captured emissions from ethanol plants for storage.

But despite his support for decarbonisation, Governor Burgum has also been a strong critic of the Biden administration’s energy policies. He signed up to a joint statement with other Republican governors in June, arguing that the president’s “rhetorical and regulatory hostility towards traditional energy” was holding back US oil and gas production.

One sector that could be particularly favoured under the new administration is gas-fired power generation. President-elect Trump said in the statement announcing Governor Burgum’s nomination that he wanted to “undo the damage done by the Democrats to our Nation's Electrical Grid, by dramatically increasing baseload power”. That will certainly mean acting on his pledge to scrap President Biden’s emissions rules for power plants, which could potentially have ended up forcing gas-fired generation to shut down. But he could go further. A national version of the Texas system that subsidises gas-fired power plants is possible.

Wood Mackenzie view

Some of the critical issues for energy policy under the second Trump administration remain highly uncertain. The future of the IRA tax credits for low-carbon energy is likely to be decided by a tight vote in the House of Representatives, given the Republicans’ slender majority there. Energy industry leaders – including Darren Woods, chief executive of ExxonMobil, who last week attended the COP29 climate talks in Azerbaijan – have urged President-elect Trump not to sweep away all of President Biden’s energy policies.

“I don’t think the stops and starts are the right thing for businesses,” Woods told the Wall Street Journal. “It is extremely inefficient.”

But while the prospect of a sharp reversal in policy is a concern, the appointment of two senior officials who have been champions for investment in energy, with a brief to continue that work in the federal government, will be welcomed by many in the industry.

The power and renewables sector is threatened by the potential curtailment or elimination of the production and investment tax credits (PTC and ITC) for wind, solar and storage. But it could benefit from other changes under a Trump administration, including permitting reform and regulatory changes that could make it easier to add new transmission capacity.

Wood Mackenzie’s “severe downside scenario” represents a worst-case outlook, with total installations of wind, solar and storage over the next decade about 30% lower than in our previous base case forecast. But for that to play out, several factors have to turn against the industry, including not only a phase-out of the PTC and ITC, but also increased permitting challenges. If the new administration lives up to its rhetoric about supporting investment in all kinds of energy, permitting and regulation could become easier, not harder.

However, the new administration’s plans raise important questions about the balance of supply and demand for energy, and especially for natural gas. President-elect Trump has promised to end immediately the “pause” on approvals for new LNG export projects, which will add to demand for US gas over time. A surge in gas-fired power generation, which the new administration sees as important for supplying new data centres for AI, would add additional demand pressure.

On the supply side, Wood Mackenzie analysts think government regulations and access to acreage are not the most important issues. US oil and gas production is determined principally by commodity prices, cash flows and corporate capital allocation strategies. The federal government can take actions that will help, including expediting investment in new pipeline infrastructure. But it cannot guarantee that additional production will flow.

Those conditions, with stronger demand but a limited supply response, would be bullish for energy prices. Although President-elect Trump’s stated goal is to drive down energy costs for American consumers, it is possible that his policies could have the opposite effect.

COP29 makes little progress in its first week

The election victory for President-elect Trump, who plans to take the US out of the Paris climate agreement for a second time, cast a shadow over the first week of the COP29 climate talks in Baku, Azerbaijan. There were more signs of disharmony among the assembled nations, with Argentina withdrawing its official delegation, and France’s environment minister choosing not to attend after a diplomatic spat with the hosts Azerbaijan.

Meanwhile, behind the scenes, negotiators are attempting to secure a global agreement on climate finance, which could pledge more than US$1 trillion a year in investment, loans and grants to low- and middle-income countries to support emissions reductions and adaptation to the impacts of climate change. So far, there appears to have been little movement on agreeing a deal.

The conference began with an announcement of significant progress towards finalising the rules for international carbon markets under Article 6 of the Paris agreement. But on that issue, too, much work remains before the market can start working as intended.

One group of leading figures in international climate policy has argued that the entire process of COP negotiations is “no longer fit for purpose”.

In brief

Renewable generation in Europe has been hit by “dunkelflaute” – “dark doldrums” – conditions, with both low wind and low solar power production. From 4 to 10 November, 70% of Germany’s electricity supply came from fossil fuels. European natural gas prices surged last week after Gazprom said it would cut off supplies of Russian gas to Austria.

Albemarle, the world’s largest lithium producer, plans to cut its capital spending sharply next year, following a steep decline in prices. The company is preparing for lithium prices to remain low for the foreseeable future. Its chief executive Kent Masters told the Financial Times that the “returns are not there” to enable a shift in supply chains away from China. “We were trying to pivot to the west,” he said. “The prices we see in the market don’t really allow us to do that.”

Other views

Africa’s energy future, on Africa’s terms – Simon Flowers and Gavin Thompson

Navigating uncertainty in the solar industry: maximising IRA benefits – Sylvia Leyva Martinez

Everything about climate change may seem grim. It isn’t

California’s rooftop solar is a benefit, not a cost, to the state – Jeff St. John

Quote of the week

“Every natural resource, whether it's oil, gas, wind, sun, gold, silver, copper, they are all natural resources. Countries should not be blamed for having them, and should not be blamed for bringing these resources to the market because the market needs them. The people need them.”

President Ilham Aliyev of Azerbaijan, which is hosting the COP29 climate talks, said in his opening speech that while his people were “strong advocates for the green transition”, it was important to be realistic. He also noted that after Russia’s invasion of Ukraine, the EU sought a strategic partnership with Azerbaijan to help with its gas supplies. Since that agreement was signed in 2022, the number of EU countries buying gas from Azerbaijan has risen from two to eight.

Chart of the week

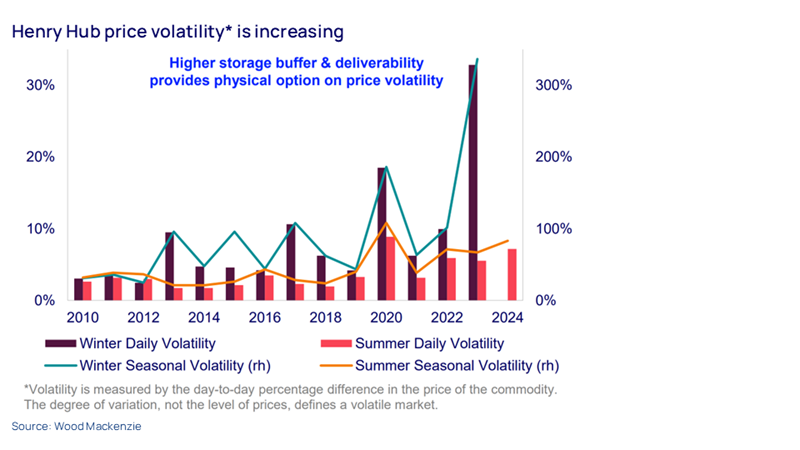

This comes from our new report on the winter outlook for natural gas in North America. It shows price volatility for the Henry Hub benchmark, which has been on a clear upward trend over the past decade. The increase in both daily and seasonal volatility in winter is particularly striking.

The key explanation for this trend is a lack of storage, which enables arbitrage to smooth out peaks and troughs in prices. Gas storage capacity relative to demand in North America is shrinking, and volatility is the result. I wrote about the issue back in February, and these are the data that support that intuition.

Download the full report for much more on what we expect from gas in North America over the winter.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.